Ethereum price (ETHUSD) has been under siege. The price is down by more than 4.35%, extending the losses that started last week when the price approached a high of $500. Today, the second-most valuable crypto is trading at $337, a few points above last week’s low of $310. Bitcoin, on the other hand, is trading at $10,000, which is lower than its YTD high of more than $12,000.

Ethereum price has been relatively volatile in the past few day. This is in line with the overall sell-off in technology stocks in the United States and a relatively stronger US dollar. ETH has been more vulnerable because of its remarkable strength this year. Like I had written before, the price had climbed from below $100 in March to almost $500 this month.

The US dollar strength is a likely cause of the current volatility of Ethereum price. Today, the dollar index is up by more than 0.30%, extending the gains that happened last week. This performance is mostly because of the strong economic data from the United States. For example, the unemployment rate has fallen to 8.4% while the manufacturing and services sectors are doing well. Since Ethereum is usually priced in dollars, its price tends to fall when the dollar rises.

At the same time, the decline of Ethereum price is because of the overall sell-off that happened in the stock market last week. In fact, the major indices like the Dow Jones and S&P 500 had their worst week since June last week. Whenever there is such sell-off, no asset is spared. Indeed, the price of crude oil, gold, and silver also declined last week.

However, some market participants believe that the correction is a good thing and that the price will ultimately bounce back. Indeed, the number of Ethereum whales increased. For starters, whales are investors who buy a significant number of options hoping that the price will rise. The number of these whales increased by 68 in the previous week, according to data by Santinent.

Ethereum price forecast

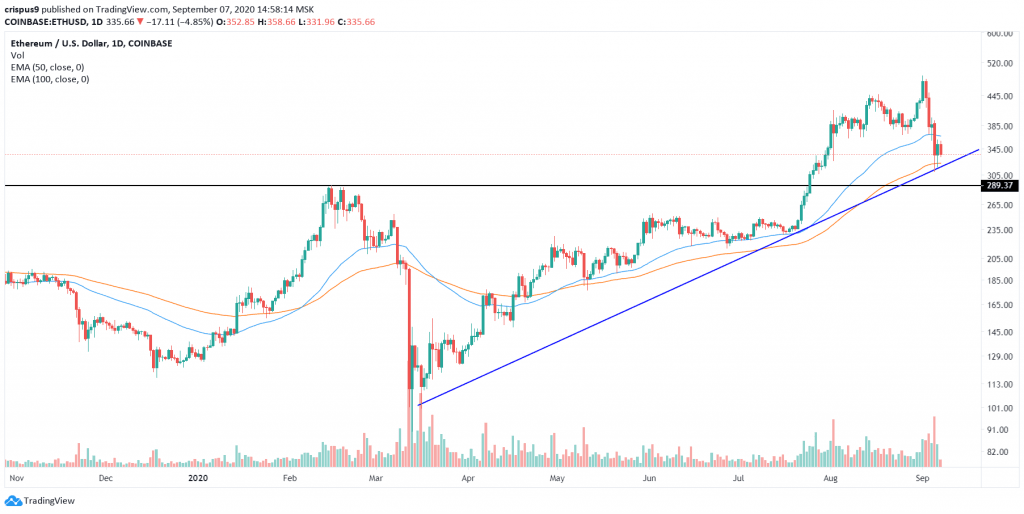

The daily chart below shows that Ethereum price dropped sharply last week. An interesting thing is where the price dropped to. As you can see, the price fell to $310, which is along the ascending trendline that connects the lowest levels on March 16 and July 20. That level was also along the 100-day exponential moving average.

We also see that volume spiked during the decline as more traders rushed to the exit. Therefore, I suspect that the bullish trend will remain so long as the price is above this ascending trendline.

Don’t miss a beat! Follow us on Telegram and Twitter.

Ethereum Price Forecast

More content

.png)