- Cameron Winklevoss labels BTC and ETH as organic forms of money.

- Ethereum dApps witness a massive surge in user activity thanks to DeFi.

Bitcoin

Researcher discloses details of a bug in the BTC network after two years

Back in 2018, Braydon Fuller, a security researcher, discovered a vulnerability in Bitcoin Core and chose to keep the technical details a secret to prevent hackers from exploiting the issue. The same vulnerability was independently discovered in another cryptocurrency a few days back.

The vulnerability, dubbed INVDoS, is a classic denial-of-service (DoS) attack. While DoS attacks are largely harmless, they are not for internet-reachable systems, which need to have stable uptime to process transactions. Two years back, Fuller found that a hacker could create malformed BTC transactions that would lead to uncontrolled consumption of the server’s memory resources when processed by Bitcoin blockchain nodes. This would eventually crash impacted systems. In a recent paper, Fuller said:

At the time of the discovery, this represented more than 50% of publicly-advertised Bitcoin nodes with inbound traffic, and likely a majority of miners and exchanges.

INVDoS impacted more than Bitcoin nodes (servers) running the Bitcoin Core software. The same bug also impacted Bitcoin nodes running Bcoin and Btcd. Other cryptocurrencies built on the original Bitcoin protocol such as Litecoin and Namecoin were also impacted. Fuller said the bug was harmful because it could “contribute to a loss of funds or revenue.”

This could be through a loss of mining time or expenditure of electricity by shutting down nodes and delaying blocks or causing the network to temporarily partition. It could also be through disruption and delay of time-sensitive contracts or prohibiting economic activity. That could affect commerce, exchanges, atomic swaps, escrows and lightning network HTLC payment channels.

The same bug was recently discovered by Javed Khan, a Bitcoin protocol engineer, while he was looking for bugs in the Decred cryptocurrency. Khan reported the bug to the Decred bug bounty program. According to a joint article published by Fuller and Khan, they said:

There has not been a known exploitation of this vulnerability in the wild. Not as far as we know.

Cameron Winklevoss explains why BTC and ETH are organic forms of money

Cameron Winklevoss, the co-founder of the Gemini cryptocurrency exchange, recently took to Twitter to say that BTC and ETH are emerging forms of currency and are perfect examples of organic technological and financial growth.

#Bitcoin and Ether are emergent money. They haven’t been forced upon anyone, their adoption is peaceful and organic. Fiat money is violent money, its adoption always requires force.

— Cameron Winklevoss (@winklevoss) September 9, 2020

Cameron added that many countries such as Turkey, Lebanon, and Venezuela had suffered economic disasters and currency collapses in recent times. In these nations, citizens have turned to assets like Bitcoin. After being forced into using a dead-end store of value or currency, the public in these countries eventually became more inclined to turn to BTC as a safe haven.

Bitcoin may not be used as a common means of exchange at the moment. However, institutions and regulators have started to soften their stances on the usage of digital assets. Even major payment processing firms like Visa are becoming increasingly interested in offering cryptocurrency services to their customers.

Majority of cryptocurrency investors believe BTC will end 2020 above $10K

The majority of the cryptocurrency investors believe that Bitcoin will end 2020 above $10,000, according to a recent poll conducted by digital asset analyst Chris Burniske. Only 11.6% of the total 1,400 respondents said that Bitcoin will end 2020 under $10,000. The rest believe that the coin could end up anywhere from $10,000 to $17,500 and beyond.

According to Vinny Lingham, the chief executive of crypto startup Civic, Bitcoin could hit $15,000 in the near future.

It looks to me that #Bitcoin is poised for another leg up, with an overshoot above $15k, but then a retrace and heavy consolidation around $14k for a few weeks at least. I doubt this sub-$12k price holds for much longer and $10k represents strong support right now.

— Vinny Lingham (@VinnyLingham) August 28, 2020

In a separate comment, he noted that once Bitcoin turns $12,000 into support, the coin will be bullish on a macro scale.

I’m not a permabear or a permabull – I called the bubble and I called the bear market. The bear market is almost over, if/when we break and hold $12k. So yes, I’m turning bullish.

Mike McGlone, a senior commodity analyst at Bloomberg, is also optimistic. He said that BTC will reach $20,000 by the end of 2020, citing the block reward halving and other factors.

Bitcoin is mirroring the 2016 return to its previous peak. That was the last time supply was halved, and the third year after a significant peak… Fast forward four years and the second year after the almost 75% decline in 2018, Bitcoin will approach the record high of about $20,000 this year, in our view, if it follows 2016’s trend.

BTC/USD daily chart

BTC/USD is currently trading around $10,675-level in the early hours of Tuesday. This follows a heavily bullish Monday, wherein the price jumped from $10,325.45 to $10,678.37. Since the RSI is hovering around the neutral zone, there is enough space for the buyers to boost the price up even more. As of now, BTC will need to go up to $10,780.25 to break above the SMA 20 curve.

Bitcoin IOMAP

As per the BTC IOMAP, there is enough space to go up to $11,316.13, provided they can break above the two strong resistance levels. On the downside, there is a moderate-strong support zone below $10,678,87.

Ethereum

Ethereum dApps are witnessing a massive surge in user activity, thanks to DeFi

The ongoing boom in the decentralized finance (DeFi) sector has led to a massive surge in the user activity in the Ethereum decentralized application (Dapp) ecosystem. The spiking demand for Dapps and DeFi enhances the overall bull case for Ethereum in the long run.

Even when ETH’s price hit an all-time high of $1,450 three years ago, the user activity of Dapps was nowhere close to current levels, as per U.Today report. John Todaro, the head of research at TradeBlock, said it was unthinkable three to four years ago to expect such large user activity.

3-4 years ago those of us in the crypto space thought it was a moon shot that Ethereum and other decentralized applications would see millions of dollars in fee based revenues per day. Today we are seeing the fruition of decentralized ecosystems.

On August 30, Uniswap processed more volume than Coinbase for the first time in history. Hayden Adams, the creator of Uniswap, noted:

Wow, Uniswap Protocol 24hr trading volume is higher than Coinbase for the first time ever. Uniswap: $426M, Coinbase: $348M. Hard to express with how crazy this is.

Dapps offer clear incentives and advantages that centralized platforms do not. For instance, Uniswap allows any trading pair to be listed in a decentralized manner at any given time. This allows cryptocurrencies that are not listed on exchanges to be traded in a peer-to-peer ecosystem.

On the other hand, DApps still have many disadvantages when compared to centralized applications. For example, the scalability of Ethereum is still a problem for Dapps as it results in high fees every time the blockchain network activity spikes. Nevertheless, Ethereum Dapps are witnessing sustainable high demand that levels centralized platforms.

ETH/USD daily chart

ETH/USD has dropped slightly from $377.27 to $376 following a heavily bullish Monday. Since September 9, the price has bounced up from the $337.80 support line and gone up to $375. The MACD shows decreasing bearish momentum after the recent bullish price action.

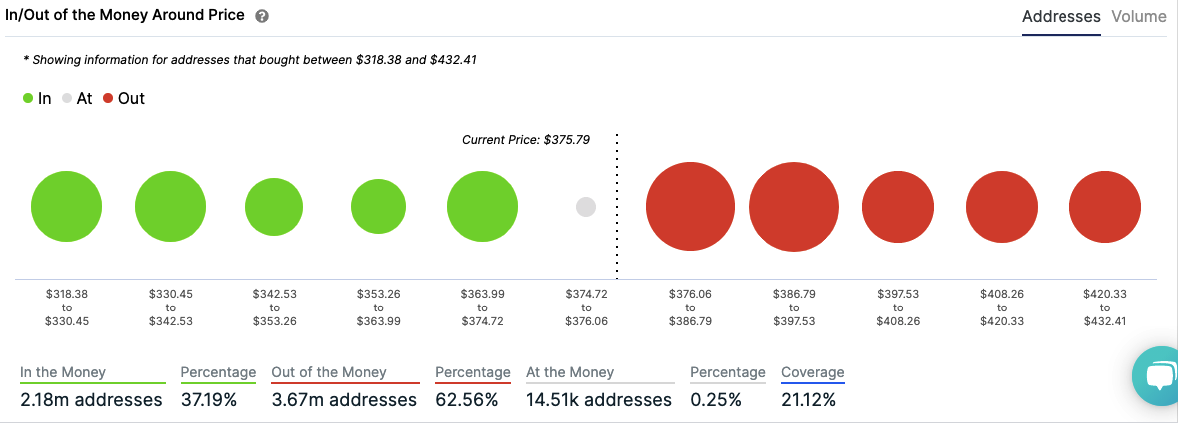

Ethereum IOMAP

ETH/USD has minimal upside potential due to the presence of strong resistance levels. The $364 healthy support level prevents downward movement.

Ripple

XRP/USD daily chart

XRP/USD has gone up from $0.241 to $0.246 over the last two days. The William’s %R is trending at the edge of the overbought zone, so further upward movement can be expected. Ideally, the price will want to reach the $0.258 resistance level.

-637357332709236145.png)

-637357333440334231.png)