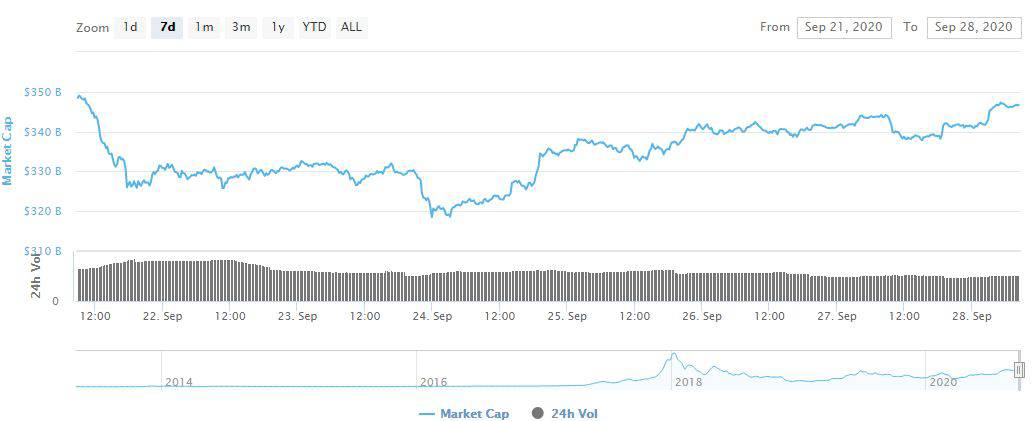

Bitcoin has continued to gradually increase in value and even came close to challenging $11,000 earlier today. Adding some impressive gains from altcoins and the total market cap has increased by $10 billion since yesterday’s dip.

Bitcoin Closing Down On $11K?

As reported yesterday, the primary cryptocurrency hovered mostly between $10,650 and $10,750. Shortly after, however, BTC dipped and marked an intraday low of below $10,600.

The price decrease was shortlived, and BTC started increasing. Firstly, the asset returned to its familiar ground of about $10,750 before exploding to its daily high of $10,950. Since then, Bitcoin has retraced slightly to where it trades as of writing these lines.

Moving on, $11,000 remains as the most critical resistance in BTC’s way up. If conquered successfully, the cryptocurrency could head towards $11,200, $11,360, and $11,530 as possible next resistance levels.

Bitcoin’s increase could be related once again to the events with the US stock futures. The futures contracts on the S&P 500, the Nasdaq Composite, and the Dow Jones Industrial Average show about 0.3% gains in overnight futures trading.

Chainlink And Cardano On The Move

Ethereum and Ripple have remained relatively stagnant on a 24-hour scale, as both of them are slightly in the red. ETH trades at about $357, while XRP is at $0.243.

By increasing its value with 3.3%, Bitcoin Cash has widened the gap with Binance Coin (-0.3%) for settling in the 5th spot.

The most impressive gains from the top 10 come from Chainlink and Cardano. LINK has increased by 4.5% to nearly $11. ADA has surged by 7% to above $0,10. As a result, Cardano has overtaken Crypto.com Coin (0.7%) for the 9th position.

Double-digit price jumps are evident from a few lower-cap altcoins. Arweave leads with a 33% surge, Swipe SXP (27%), CyberVein (15%), and OMG Network (10%) follow.

In contrast, ABBC Coin has lost the most value (-18%). The Midas Touch Gold (-10%), Yearn.Finance (-9%), and DFI.Money (-9%) are next.

Nevertheless, the cryptocurrency market cap has increased to almost $350 billion after bottoming at $340 billion yesterday.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.