The price of Bitcoin briefly drops below $10,000 for two consecutive days.

NurPhoto via Getty Images

The price of Bitcoin (BTC) dropped to as low as $3,596 on BitMEX in March. Over $1 billion in futures contracts were liquidated at the time, wreaking havoc in the market.

Bitcoin has sharply declined from around $12,050 to as low as $9,875 in a span of five days. The sudden drop caused the sentiment around the cryptocurrency market to turn cautious.

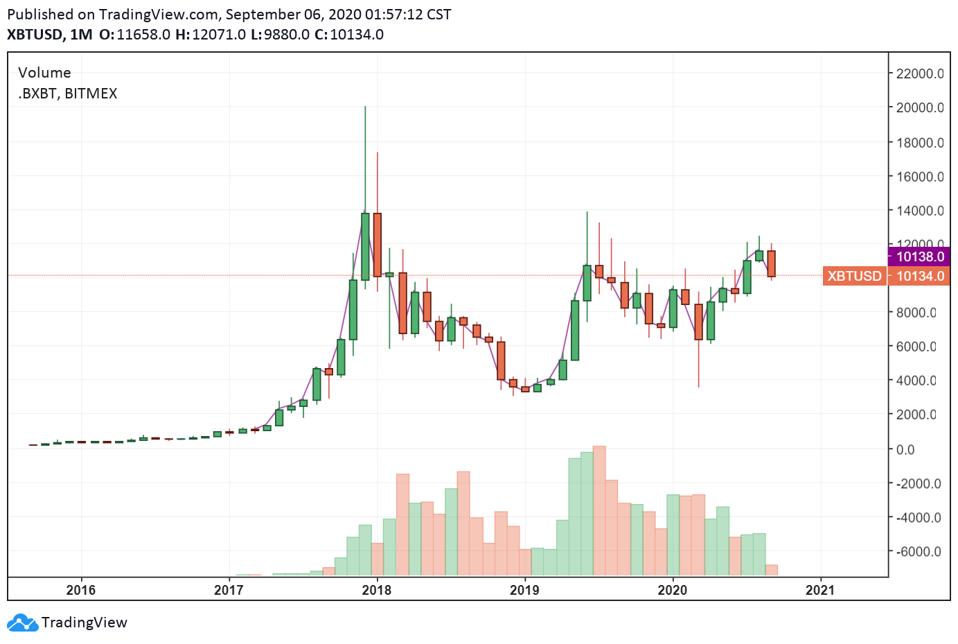

The monthly chart of Bitcoin.

TradingView.com

But the market is in a different position than where it was in March. Bitcoin’s market structure remains in a bullish state, especially considering that BTC traded above $10,000 for the longest period since 2017.

There are five fundamental factors that buoy the longer-term bull trend of Bitcoin, which differentiates it from March. The factors are the presence of whale orders, BTC’s resilience above $10,000, and an expected reaction to heavy resistance, March’s black swan event, and the market dynamic at the time of the crash.

Macro Trends Are Not So Bearish, Whale Orders at $8,800

According to market data, major whales are bidding Bitcoin at around $8,800. That level is technically important because it marked the start of a new bull run in June.

After five weeks of consolidation above $8,800, Bitcoin went on to surge to $12,468 at its yearly peak on Binance. Whales are eyeing the $8,800 macro support as a possible short-term target for BTC.

Large holders, also known as whales, tend to mark tops and bottoms because they seek significant liquidity. As an example, data from Whalemap showed that a whale who purchased nearly 9,000 BTC in 2018 took profit at $12,000.

The whale held onto the BTC and took profit after two years, marking a local top. Whether how much of the 9,000 BTC the whale sold remains unclear. The point is that whales have often marked local tops and bottoms for BTC.

Cole Garner, an on-chain analyst, shared a chart that showed Bitfinex traders are bidding $8,800.

“Smart money has their bids sitting at $8,800. I expect the bottom will likely be around there,” the analyst said.

Bitfinex Bitcoin whale buy orders.

Tradinglite, Cole Garner

Before $8,800, there is a CME gap at $9,650, which has been there since the end of July. There are key levels before $8,800, and even if BTC was to drop to $8,800, it would mark a 29% drop from the highs. Bitcoin historically declined by 20% to 40% during bull markets, resetting expectations before the next leg higher.

BTC Has Been Above $10,000 For The Longest Period Since 2017

Atop the technical catalysts, Bitcoin has been above $10,000 for the longest period since 2017. That suggests that the $10,000 level served as a strong support level for a long period.

The data also indicates that many buyers aggressively protected the $10,000 area, which in previous years acted as a heavy resistance area.

Bitcoin stays above $10,000 for the longest period since 2017.

Hsaka Twitter @HsakaTrades

Bitcoin dipped below $10,000, and even if BTC sees a bigger pullback, $10,000 would not likely remain a massive resistance level in the future.

$12,000 Was Multi-Year Resistance, Big Reaction Was Expected

The monthly candle of Bitcoin closed above $11,000 for the first time since 2017. There have been many first instances in terms of technical analysis throughout the past three months.

Less than two months ago, the high-$9,000 region acted as a huge resistance area that caused BTC to drop sharply at repeated retests. Now, it has turned into a strong support region, which technically could serve as a strong foundation for the medium term.

March Was A Black Swan Event

The drop of Bitcoin in March to sub-$3,600 was a black swan event that many investors did not expect.

Due to the pandemic, Bitcoin fell in tandem with stocks, gold, silver, and other legacy markets. Eventually, gold, stocks, and Bitcoin all recovered amid monetary stimulus.

Expecting a similar response in Bitcoin as a black swan event triggered by a once-in-a-generation crisis is premature.

Bitcoin Was Not Supposed To Drop As Low, Data Shows

The only reason Bitcoin dropped to $3,600 in March was due to an unprecedented cascade of liquidations. Over $1 billion in futures contracts, mostly on BitMEX, were liquidated. It caused BTC to drop by more than 50%, but not many traders were selling by choice.

“Cascading liquidations were most prominent on BitMEX, which offers highly leveraged products. Amidst the selloff, a Bitcoin on BitMEX was trading well below that of other exchanges. It wasn’t until BitMEX went down for maintenance at peak volatility (citing a DDoS attack) that the cascading liquidations were paused, and the price promptly rebounded. When the dust settled, Bitcoin had briefly spiked below $4000 and was trading around the mid $5000s,” Coinbase explained.