Regional reports from China have highlighted that a number of major Chinese ASIC mining rig manufacturers have sold out of their next-generation model stock. The shrinking supply of high-performance machines may be due to the shortage of 7nm and 8nm chips from TSMC and Samsung.

Bitcoin miners are finding it difficult to obtain next-generation application-specific integrated circuit (ASIC) mining rigs after a number of firms have sold out. Semiconductor goliaths like Samsung and TSMC have been struggling to keep up with the demand that was sparked by the Covid-19 outbreak.

On September 10, financial columnist, Vincent He, detailed that mining manufacturers like Canaan, Whatsminer, and Ebang have “sold out most of their stocks this year.” Furthermore, the report highlights that Bitmain still has leadership issues and delays in delivery.

Rumor has it, Innosilicon might be releasing a next-generation ASIC mining device at the end of 2020 that leverages Samsung’s 8nm chip. Vincent He says that the difficulties right now straining the next-gen mining rig supply, stems from the shortage of 7nm and 8nm semiconductors.

A research paper covering the semiconductor production equipment market notes that the coronavirus pandemic made the industry see exponential growth, as there was “increased demand for semiconductors in diverse applications.” Additionally, the semiconductor industry has seen a transition from traditional wafer producers to those creating Kerfless wafers.

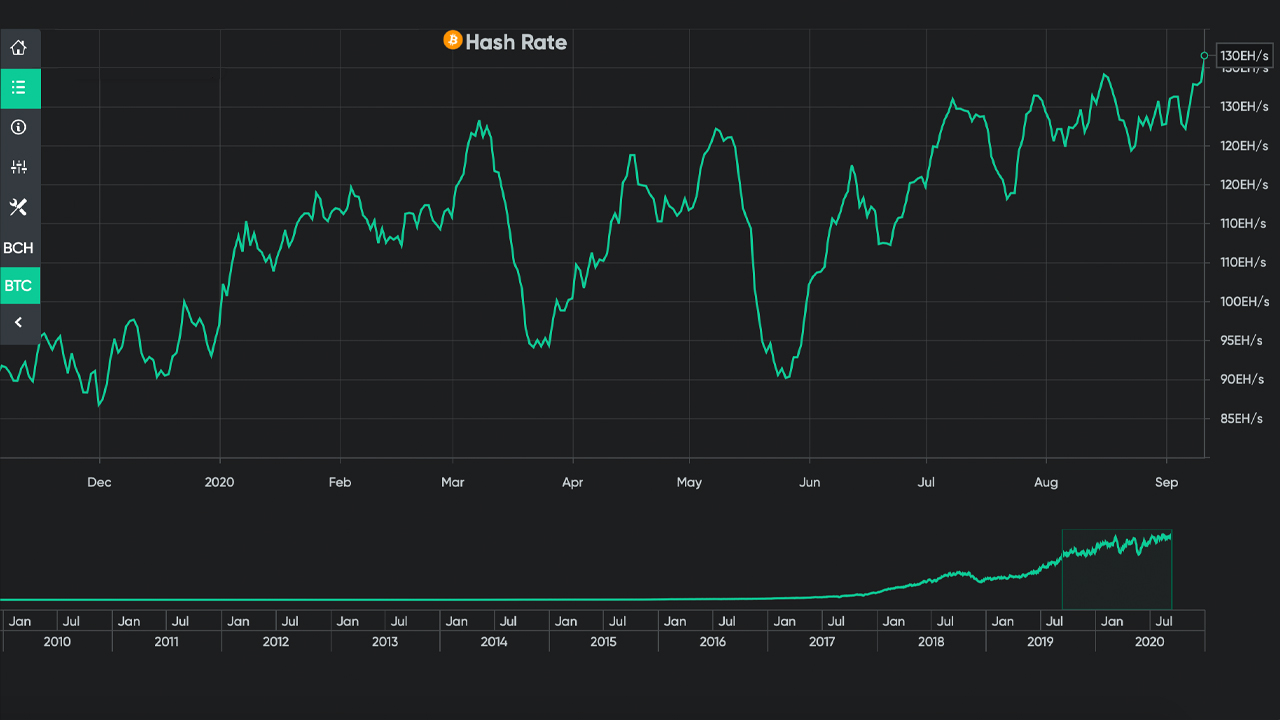

Meanwhile, the Bitcoin (BTC) network’s hashrate has been considerably higher than usual, as the seven-day average touched 131 exahash per second (EH/s) this week.

Some of the top machines that are seeing the most profits today include Bitmain’s Antminer S19 Pro, Microbt’s Whatsminer M30S++, Innosilicon’s T3+, and Canaan’s Avalonminer 1166 Pro. These high-powered ASIC machines are leveraging semiconductors between 10nm to 7nm.

The report from China also notes that Microbt and Bitmain have sold a bulk of their stock to mining operations overseas. News.Bitcoin.com has covered a number of publicly disclosed sales invoked by Marathon Patent Group, Hut8, and Riot Blockchain.

Vincent He stresses with the next-gen ASIC shortage, older machines are getting a second life by being sold on secondary markets.

“The second-hand mining machine market is very active,” the author concludes. “Some big miners [are] choosing to sell the previous generation of second-hand mining machines, such as M20S and T17, [and are] gaining a lot of profits.”

What do you think about the shortage of next-generation ASIC bitcoin miners? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.