Cryptocurrencies were hit on Monday as the U.S. dollar rally picked up. LTC goes into RPG, THETA continues to grow and China seeks first CBDC.

BTC

Bitcoin crashed over $500 on Monday as the U.S. dollar rally picked up steam. I’ve warned in recent articles that BTC is following the dollar swings closely and today saw the USD rally around 0.8% to test key resistance levels.

Markets were rocked with the Dow Jones down almost 800 points. This was driven by the potential for further virus lockdowns, a potentially bitter battle in the U.S. over the freed up Supreme Court Justice Seat, and a news report which saw banks implicated in a trillion-dollar money laundering scandal. President Trump said he would announce a new Supreme Court nominee on Friday or Saturday, but Democrats insist the winner of the Nov. 3 election should choose the nominee after the Republican-led Senate used the same rationale to block a nomination by Barack Obama in 2016 following the death of Associate Justice Antonin Scalia. The plunge in the dollar today highlights again how Bitcoin is now an asset that is driven by politics and other assets.

Bitcoin now eyes the familiar $10,000 support level as a line of defense for the 2020 rally that began after the panic-selling in markets in mid-March.

LTC

Litecoin was dragged lower by the negative sentiment in crypto markets but the platform has seen a new role-playing game (RPG) launched on the network. The Litecoin Foundation did an official release of the LiteBringer game, with Founder Charlie Lee saying it was, “It’s the first major game that utilizes the Litecoin blockchain for all of its interactions”.

CipSoft created the game and its founder said the game is fully decentralized, so all users have to be running a Litecoin node to play. All original weapons, characters, and items in LiteBringer are stored on LTC’s blockchain.

The price of Litecoin took a hit today with a drop of around 8%, which saw it trade just above the $43.00 level.

THETA

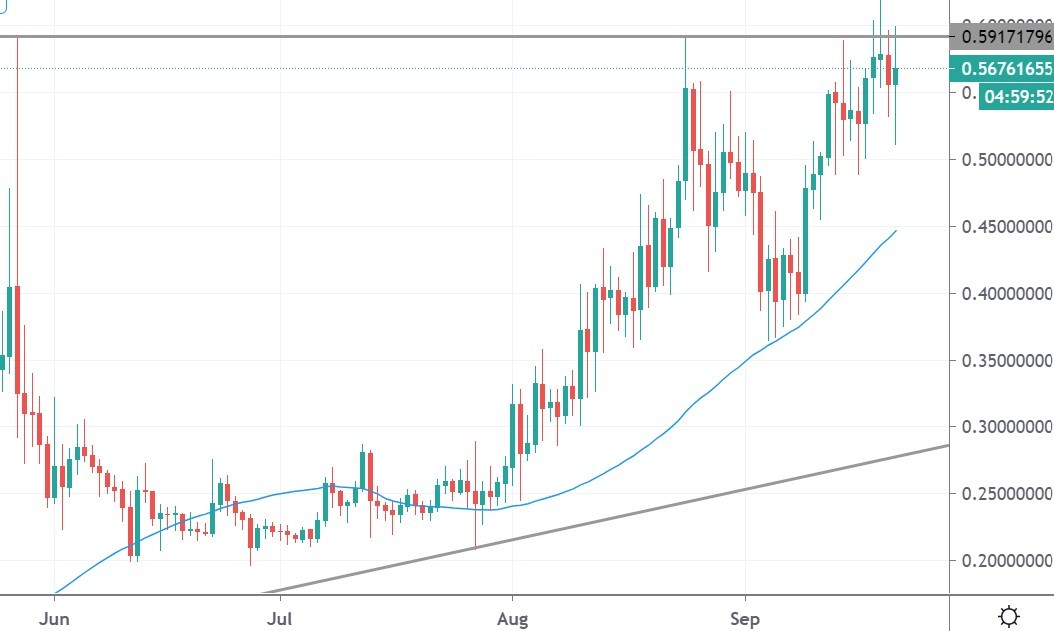

Theta Token was a rare standout with a gain of a few percent on the week. The coin bounced from a recent pullback from strong gains earlier in the year. The coin rallied from March lows near $0.0500 to trade at highs near $0.6000.

The coin is currently ranked at number 35 in the list of coins by market cap with a market cap of nearly $500 million. The project announced in May that Google Cloud was to become an Enterprise Validator and launch partner for the Theta Mainnet 2.0. The news was announced at the same time as MGM Studios release some classic films to THETA.TV. Last week saw Nasdaq-listed company Cinedigm launching a free ad-supported CONTV Anime on Theta Network. Theta was launched in 2016 with the support of companies such as Samsung. The company received patent approval in the U.S. for decentralized finance streaming this month.

The coin is now trading at highs near $0.60 and this has created initial resistance. The level will determine whether we see new highs or a retracement.

CHINA

A commentary published by the Chinese central bank said the country needs first-mover advantage with the release of its digital currency in order to reduce the country’s dependence on the global dollar payment system.

An article published in China Finance, which is a magazine run by the PBOC, said the right to issue and regulate a digital currency would become a “new battlefield” of competition between sovereign nations.

The article stated: “China has many advantages and opportunities in issuing fiat digital currencies, so it should accelerate the pace to seize the first track”.

The article confirms what many already knew with China’s early efforts to create a digital version of the Yuan. We have since seen countries such as the U.S. talk about a central bank digital currency but China has the lead in the development of such a payment system. The situation with the global financial crisis created by the Coronavirus also gives China an advantage as they are one of the only countries expected to see growth this year and this could lead them to overtake the U.S. as the largest global economy in the near future.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.