Source: Roman Bodnarchuk – Shutterstock

- The resistance level at $11,100 is the next target for Bitcoin bulls.

- A rejection at this resistance level could push Bitcoin below $10,000 again.

Bitcoin has managed to break an important mark again. At the time of publication, Bitcoin is trading at $11,023 with a sideways movement (-0.01%) in the last 24 hours. In the last week, the number one cryptocurrency by market cap has recorded a 6% gain. Thus, its current price puts BTC at the same level as it was at the beginning of the month.

Analysts have shared a bullish sentiment over the past few days, pointing out the key levels Bitcoin will have to break soon to resume the upward trend. According to analyst and trader Josh Rager, the Bitcoin price is close to its old support level of $11,100 before the market collapse at the end of August which now turned into resistance. This level is the new target that Bitcoin has break before exploring new highs seems possible.

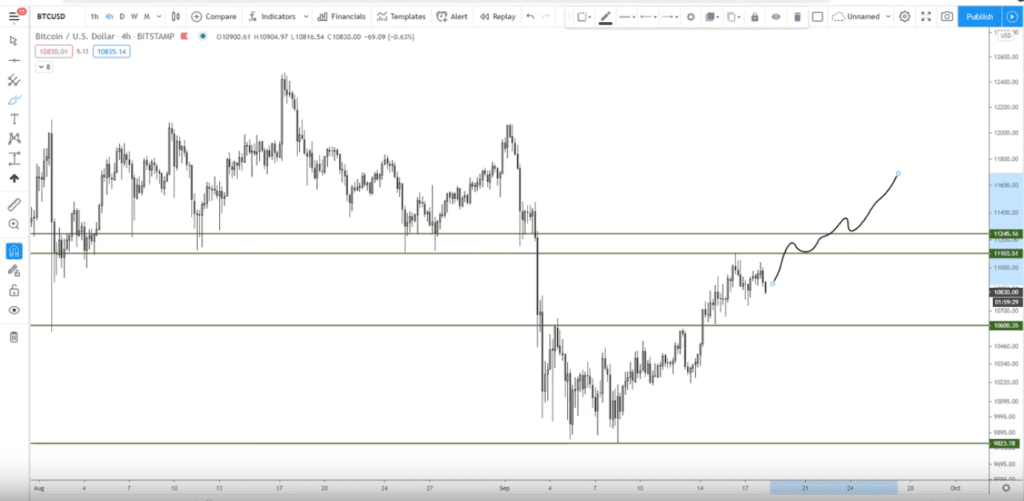

As shown in the chart below, Rager expects Bitcoin to break the local resistance level at $11,100 and then move up to $11,200 and approach $12,000. This level has been the strongest resistance Bitcoin has faced during the year. The analyst believes that breaking this level could take Bitcoin to the $14,000 mark and then to new all-time highs.

Source: https://youtu.be/tYJEsj1DA1A

In addition, Rager stated that a return to levels below $10,500 could cause Bitcoin to continue to fall toward $9,000. Once there, Bitcoin could again explore the price set by the futures gap on the Chicago Mercantile Exchange (CME), located at $9,600. The analyst noted that the price tends to fill these gaps in 90% of the cases. Furthermore, Rager added the following:

When we go above $11,100, $11,245 (…) that will decide whether (the price of Bitcoin) will be bullish or bearish overall.

Source: https://www.youtube.com/watch?v=tYJEsj1DA1A

Other analysts share similar bullish Bitcoin price predictions

Analyst Michael Van De Poppe known as Crypto Michaël agrees with Rager. In a recent publication, the analyst stated that the continuation of the upward trend for the price of Bitcoin will largely depend on its ability to overcome the resistance in the $11,100 to $11,300 range. The analyst expects that a rise above this range will push Bitcoin back towards $12,000.

Source: https://twitter.com/CryptoMichNL/status/1306910084811943937/photo/1

In that line, the trader Teddy commented that the price of Bitcoin will become bullish again after exceeding $11,000. Then, Teddy “will call his Lambo dealer”. Byzantine General has stated that it is impossible to make him feel bearish about the price of Bitcoin. In addition, the analyst believes that the performance of Ethereum and the growth of the DeFi sector have been important for the performance of the ecosystem today. Byzantine General explained that “the entire market is being carried by ETH”.

While the launch of the governance token of the Uniswap protocol, UNI, has caused a stir in the crypto community, so have the statements of MicroStrategy CEO Michael Saylor. While revealing details of the strategy on how the Wall Street company acquired 21,454 BTC, he said that Bitcoin meets the requirements to be a store of value. Data analysis firm Messari stated the following about MicroStrategy’s strategy:

Only time will tell if history looks back on this move as a brilliant strategic decision or a massive corporate mistake. In the short term, a big win is scored for Bitcoin’s digital gold investment thesis.