DeFi token YFI launched this July and has risen more than 3,000% to hit $13,370, a price level that put it above Bitcoin’s $11,700 as of writing

The price of yearn.finance token, YFI, jumped to a high of $13,370 on Thursday morning, hitting a new all-time high as Bitcoin looked to rebound from yesterday’s rejection to retest $12,000.

For yearn.finance, which launched the “valueless” governance token in July, the jump to $13,000 is nothing short of meteoric. YFI’s value skyrocketed soon after launch — from around $31.65 to $1,000 — and it has not stopped.

Yesterday, YFI/USD rose more than 29% to add $2,889.90 to its value, reaching a daily high of $12,600.

According to crypto market data aggregating site CoinMarketCap, YFI/USD is up more than 115% over the past week and over 3,000% in the green since its debut.

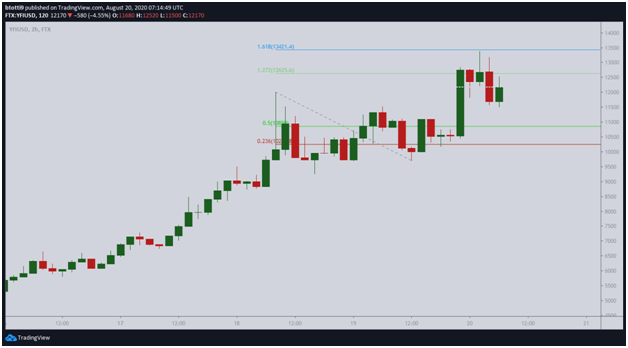

YFI/USD currently trades around $12,200, having retreated slightly. The technical picture shows that the token’s price could be in for a pullback likely to settle at lows of $11,000.

LunarCRUSH data suggests a bullish score of 72% on its social engagement metric, but sustained selling pressure could see it drop to lows of $10,000 (Fibonacci 23.6% of the downward move from highs of $12,600 to lows of $10,020).

Below this, the next major supply wall for YFI/USD is near $5,700.

On the upside, action could take prices to highs of $13,500, as suggested by the 61.8% Fibonacci retracement, while $14,000 provides the next psychological target.

DeFi craze part of YFI’s price action

According to a Medium post announcing the product, yInsure.finance is prototype decentralized insurance protocol targeted at tokenized assets within the DeFi ecosystem and the wider cryptocurrency market.

According to data from DeFi Pulse, the total value locked in the project is $669 million, up by 5.54% in the past 24 hours.

Interest in the decentralized finance token has also soared since Curve Finance launched its native governance token CRV, with TVL jumping from $131 million on August 14 to $511 million on August 15.

While yearn.finance provides for an ecosystem that uses DeFi tokens like Aave, Compound and Dydx to allow investors to extend lending for a fee, Curve Finance offers an Automated Market Maker aggregator of yTokens such as yUSDT, yDAI, yUSDC and yTUSD.