Cryptocurrencies have been gaining more popularity since Bitcoin’s (BTC-USD) parabolic bull run in 2017 where it reached $19,140.80 per coin on 12/11/17. From 12/12/16 to 12/11/17 BTC-USD rose from $790.53 to $19,140.80 then retraced into the mid $3,000’s in early 2019. At one-point, BTC-USD had its own slot on CNBC next to the Dow and Nasdaq. Over the years many analysts have discussed Cryptocurrencies on CNBC and on other news outlets. BTC-USD will remain my biggest investing mistake as in 2012 I was seriously considering building a computer with four graphics cards or (GPUs) to mine bitcoin or just taking that money and buying BTC-USD. I ended up talking myself out of it because at the time Crypto was such a grey area I couldn’t get comfortable with the options of buying it, storing it, selling it, and actually getting your money back into USD currency.

I have been following the Crypto market for years and finally started investing in it XRP (XRP-USD) to mine represents the largest opportunity in the crypto space. This is such an interesting market because not many people understand it or are invested in it yet the amount of money going into it can’t be overlooked. Currently, BTC-USD has a market cap that is larger than many US companies as it exceeds $200 billion. XRP is the third-largest cryptocurrency by market cap and as it currently trades at roughly $0.25 it presents a possible explosive opportunity. I have no idea if cryptocurrencies will ever be adopted the way some are envisioning and I currently can’t walk into a store and purchase items with crypto but it’s hard to dismiss that this is a real market with real buyers and real money going into it. I have been creating a position in XRP-USD because of its real-world utility through the Ripple network. Crypto is certainly a gamble and isn’t for everyone but if you have some money to speculate with XRP-USD could be an opportunity of a lifetime. XRP-USD could also be a huge disappointment, only time will tell.

(Source: coinmarketcap.com)

XRP and Ripple, What the heck are they and why they are important

I am going to do my best to explain what both Ripple and XRP are without getting to technical. Each year CNBC publishes their disrupter 50 list for private companies whose breakthroughs are influencing the business landscape. Ripple was #28 on the 2020 list which was published on 6/16/20. RippleNet is a global decentralized network that brings together a diverse ecosystem of payments players. RippleNet utilizes advanced blockchain technology for global payments and has a network of over 300 providers across 40+ countries on 6 continents. With RippleNEt banks and payment providers can process payments more efficiently through pre-validation of every transaction to eliminate failure and through rich data attachments for every payment. It also provides payment certainty through the pre-disclosure of information prior to settlement to eliminate failures and through atomic settlement that provides pass-fail processing across all intermediaries to avoid settlement like risk. Users of RippleNet can utilize the network to send payments on-demand in real-time, can attach rich data such as invoices to any payment and they can gain complete visibility into payment status and payment time.

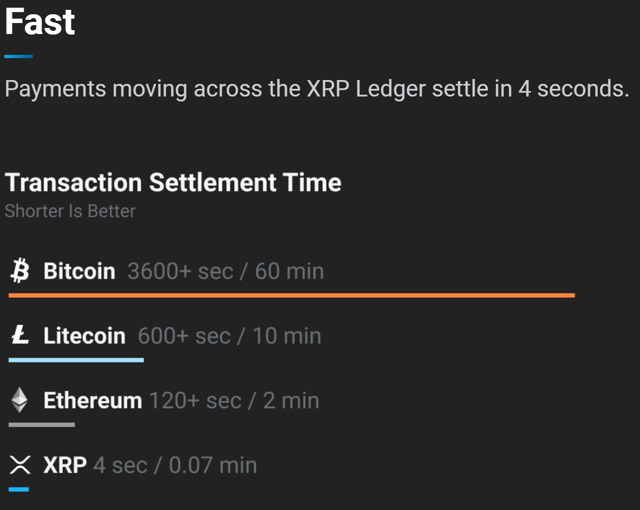

XRP-USD is a digital asset that is built for real-world utility in the form of payments. It is the native digital asset on the XRP Ledger which is an opensource, decentralized blockchain technology. The real-world utility of XRP-USD is that it can be sent directly and transactions can settle between 3-5 seconds. XRP handles 1,500 transactions per second and operates continuously. It was created as a scalable utility to handle the same throughput as Visa (V). In comparison to the two biggest digital assets BTC-USD and Ethereum (ETH-USD) XRP is handling 1500 transactions per second while ETH-USD handles 15 transactions per second and BTC-USD handle between 3-6 transactions per second. When looking at settlement time BTC-USD takes an hour to settle a transaction while ETH-USD takes two minutes and XRP-USD takes four seconds.

Just those two short paragraphs are a lot to digest but the reason it’s important is because over 300 financial institutions utilize the Ripple network including companies such as American Express, MoneyGram, PNC, Santander, etc. I have no idea how much the Ripple Network and XRP will be adopted in the future as many of the large institutions utilize the SWIFT network but its certainly interesting and real-world utility can be associated with XRP due to its ledger, the Ripple network and 3-5 second settlement times. The world continues to advance technologically and I believe digital assets are here to stay. I am investing in XRP-USD not because it’s the most popular or the most valuable but because it has real-world utility and can settle cross border payments instantly.

(Source: Ripple.com)

Playing connect the dots with the recent news

Last week was huge for the cryptocurrency world. In previous years well-respected people including Jamie Dimon called BTC-USD a fraud and indicated that it had zero real-world value. Warren Buffett also said that he believes cryptocurrencies will have a bad ending. Sediment has been mixed where either you were a believer in crypto or you hated the idea. I am going to speculate and say because banks weren’t allowed to hold cryptocurrencies for their customers they had no incentive to be bullish on the idea.

So before I go over the news which really shook up the crypto world let me introduce Brian Brooks. He is the acting comptroller of the currency which means that Mr. Brooks is the administrator of the federal banking system and the chief officer of the Comptroller of the Currency better known as the OCC. The OCC has oversight of 1,200 national banks, federal savings associations, and foreign banks which conduct roughly 70% of all banking business in the United States. Here is the first point in connecting the dots. Before Mr. Brooks joined the OCC he was the Chief Legal Officer for Coinbase Global, INC. Coinbase is one of the largest cryptocurrency exchanges which has over 35 million users in over 100 countries with over $7 billion in assets in crypto in their custody. While at Coinbase Mr. Brooks was the head of legal and compliance while being in charge of government relations. So the first point is that Mr. Brooks with a big background in crypto is now the head of the OCC and 70% of the banking in the U.S.

The second point in my string on connecting the dots is that on 7/22/20 the OCC issued a letter stating that the OCC is letting all nationally chartered banks in the U.S provide custody services for cryptocurrencies. On pages 7-8 of the letter, it states “Providing custody services for cryptocurrency falls within these longstanding authorities to engage in safekeeping and custody activities. As discussed below, this is a permissible form of traditional banking activity that national banks are authorized to perform via electronic means. 36 Providing such services is permissible in both non-fiduciary and fiduciary capacities. A bank that provides custody for cryptocurrency in a non-fiduciary capacity would essentially provide safekeeping for the cryptographic key that allows for control and transfer of the customer’s cryptocurrency. In most, if not all, circumstances, providing custody for cryptocurrency will not entail any physical possession of the cryptocurrency. Rather, a bank “holding” digital currencies on behalf of a customer is actually taking possession of the cryptographic access keys to that unit of cryptocurrency.”

The third point in connecting the dots is that Visa published a roadmap that will facilitate the creation of a bridge between cryptocurrencies and its payment network. This is huge because Visa has access to over 61 million merchants and is one of the largest payment networks. When reading the publication from Visa it indicates that Visa has been working closely with Coinbase and around the world more than 25 digital currency wallets have linked their services to Visa. This provides users an option to purchase goods through Visa cards with their cryptocurrency.

In looking at the news from the past two weeks the OCC has cleared the way for banks to hold Cryptocurrencies for their clients, Visa is setting up cards which holders can buy goods using crypto and Brian Brooks is the person in charge of the OCC which has oversight on 70% of the banking done in the U.S and he just so happened to have worked at Coinbase which is one of the biggest cryptocurrency exchanges as their Chief Legal Counsel. The decision from the OCC and the roadmap from Visa in my opinion give a lot of legitimacy to crypto. Now if I speculate based on this information I would think banks and bank officials will change their tune on crypto assets and become neutral to bullish rather than bearish. Prior to this banks had zero incentives to say anything good about cryptocurrencies because they weren’t authorized to participate in the space. I believe banks are going to change their tune out of necessity. Banks will want to offer the largest range of services to their clients especially younger clients. If bank A offers a service to hold your crypto and bank B doesn’t that could be a determining factor of where someone will do their banking. Also with further speculation maybe banks become a vehicle to purchase crypto as well and they can charge a fee the same way brokerage firms charged a fee before $0 trades became a thing. At the end of the day banks are just like every other business and they want to make money and if holding your crypto provides an opportunity for them you better believe they will welcome it with open arms. It’s not just about the small fees or holding it, it’s about adding customers. If holding crypto entices younger people to bank with a particular bank when they go to buy a house it could influence them to seek out a mortgage from that entity instead of going somewhere else. I think you will see banks warm up to crypto sooner than later since they can now participate.

(Source: occ.gov)

XRP New Projects

XRP-USD and Ripple have some new projects which include Xpring, P2P Payments and PAYID. The Xpring platform provides tools, services and programs to developers so they can integrate money into their apps. Utilizing XRP-USD Xpring can facilitate rapid and easy payments with use cases focusing around payments, media and gaming. The point that peaked my interest is their gaming idea. They want to enable a new gaming economy where players can own their in-game assets then trade them for either other items or currencies. It seems far fetched but if you have played video games it may not be that crazy as people spend hundreds on virtual currency or items in the games they play.

The other day Ripple announced that they developed a payment platform based on XRP-USD that will work with web browsers. Craig DeWitt who is Ripple’s Director of Product said that Playburner is a non-custodial XRP wallet that is designed to operate as a plugin within Chrome and Brave web browsers. This is in beta release and it will allow users to send and receive payments worldwide and instantly. He has claimed anyone can use it to purchase physical goods online using the XRP cryptocurrency.

The third project is Ripple’s backing of PAYID which if you read PAYID’s whitepaper on page 57 it says “Significant support for and development of PayID has been provided by Ripple and Xpring.” XRP is also mentioned 12 times through the whitepaper. The PAYID project is quite interesting and is something I never thought about. Today you can send a text or a photo to anyone regardless of their network via a text or email because its all on one single network. It doesn’t matter if your provider is AT&T (T) or Verizon (Z). All you do is type in the phone number or email and it just works. The world of payments is much different as its infrastructure consists of hundreds of isolated networks. PAYID is creating the network of tomorrow which will be an open, single global payment network. This will enable anyone to easily pay another person or business instantly. The premise is that instead of payments running over fragmented networks that PAYID will create a united network where all payment companies participate to simplify and reduce friction with payments.

(Source: Coindesk)

Conclusion

I have no idea what will happen with cryptocurrencies and they could become nonexistent in the future. What I do know is they haven’t disappeared yet and there is real money behind these digital assets. There could be many winners in the space or just a few. With banks getting the green light to hold crypto for clients and the other news which has come out I am going to speculate that crypto is here to stay. I like XRP-USD the most because of the instant settlement, the real-world utility of the Ripple network and the projects Ripple is creating. I plan on holding multiple coins for the next decade to see what pans out. Society continues to evolve and maybe crypto will be part of banking’s evolution. If you go back to 1985 and told someone what banking would be like in 2020 they would think your nuts. XRP-USD was in the high $3 range during the bull run of 2017. Since then a ton of progress has happened. BTC-USD went to almost $20,000. I wouldn’t think it’s crazy to see XRP at $5, $10, $100 or even $1,000 in the next decade if Ripples projects pan out and XRP-USD is adopted as a main vehicle of moving money across its network. This is all speculation but I missed BTC-USD parabolic rise and if XRP-USD has its day in the sun I will be apart of its bull run.

Disclosure: I am/we are long XRP-USD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fits into their portfolio parameters.