Bitcoin has been pushed back into the spotlight thanks to its recent rally and renewed interest from Wall Street and big-name day traders.

The bitcoin price, jumping over $12,000 per bitcoin late Sunday evening, has added 30% in the last month—though some smaller cryptocurrencies have made far bigger gains.

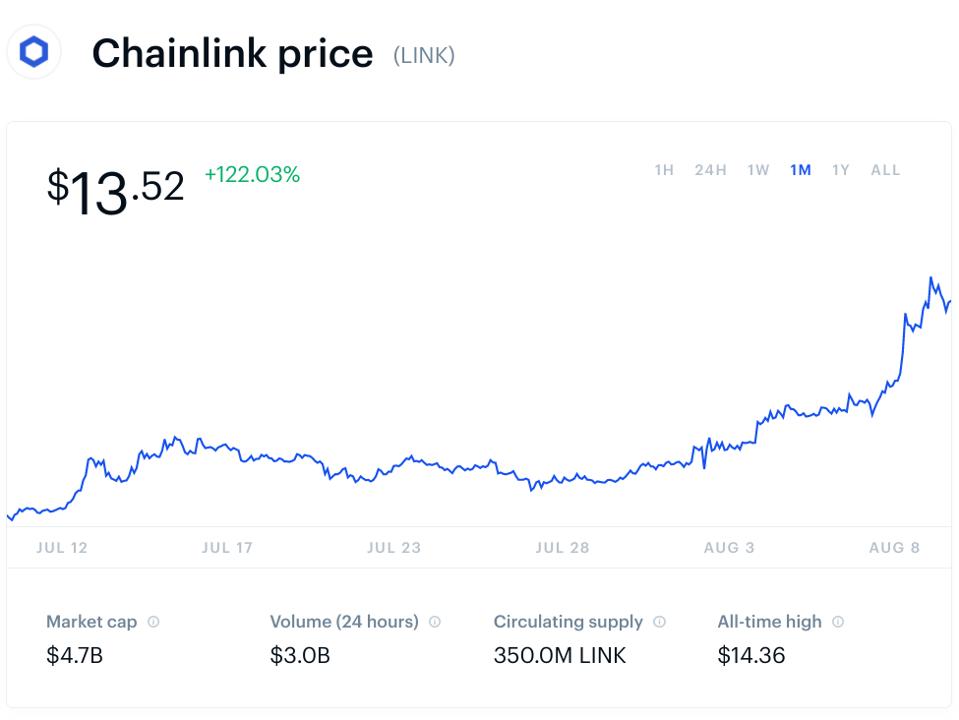

Chainlink’s link token has now added 120% to its price in the last month, climbing to over $13 per token, and building on gains of around 500% during the last year—with some investors saying link is still “wildly undervalued.”

Traders have sent the price of Chainlink’s link token sharply higher over recent months, dwarfing … [+]

BLOOMBERG NEWS

“Chainlink is on track to function as [the decentralized web3’s] defecto security layer for any and all transactions of meaningful value,” Michael Anderson, co-founder of Framework Ventures, the largest private holder of link tokens outside of the core team and bitcoin and crypto exchanges, said via email.

“We believe the value of link will track the value of the smart contract platform it is securing, meaning the long term market cap of link will eventually be larger than ethereum’s current market cap today.”

Chainlink, an ethereum-based token that powers a decentralized network designed to connect smart contracts to external data sources, currently has market capitalization of just under $5 billion compared to ethereum’s $45 billion.

Chainlink, up 65% in the last week alone, has has been boosted in recent months by a surge of interest in decentralized finance (DeFi)—the idea that blockchain entrepreneurs can use bitcoin and crypto technology to recreate traditional financial instruments such as loans and insurance.

“As it stands, blockchains are unable to speak in a trustless way with real world data, meaning they require some sort of blockchain abstraction layer that lies between the blockchain and the outside world,” said Anderson, adding Chainlink’s importance has “become more apparent as billions of dollars have been locked up in DeFi products reliant on smart contracts.”

Since early June, the total value locked in DeFi protocols has risen from around $1 billion to almost $5 billion, according to data from DiFi Pulse.

Meanwhile, the cryptocurrency token of a Chainlink competitor, band, the native token of Band Protocol, has also soared in recent weeks. Band, ranked 43rd on CoinMarketCap’s list of most valuable cryptocurrencies compared to link’s 6th, has added almost 5,000% since its rally began in early April.

Over the weekend, trading of Chainlink’s link token surged, knocking bitcoin off the top spot on the largest U.S. bitcoin and cryptocurrency exchange, Coinbase, to become the most traded cryptocurrency on the popular platform over a 24-hour period.

Link’s 24-hour trading volume on Coinbase Pro climbed to $163 million, some 70% higher than bitcoin’s trading volume of $96 million, according to data from bitcoin and crypto analysis firm Messari.

However, around the world, link’s 24-hour trading volume of just over $3 billion is still just a fraction of bitcoin’s $17 billion.

The price of Chainlink’s link token has more than doubled in value over the last month, far … [+]

Coinbase

Despite link’s massive rally and suggestions link’s price could be a swelling bubble about to pop, Anderson is confident the link price will continue to climb, pointing to Chainlink’s ambitions to work with smart contracts “for any transaction that requires real world data, events and payment” and plans to for so-called staking, meaning “users will be able to stake their link as collateral with Chainlink nodes, allowing them to earn a passive income stream when said nodes complete jobs by providing useful data to smart contracts.”

“A correction is possible in the short term, but even if the link price were to double tomorrow, we’d still think it’s wildly undervalued in light of the long term vision,” Anderson added.

“If they achieve even a fraction of what they’ve set out to do, the implications for enterprise, banking, derivatives, insurance and more will be enormous.”

Link’s surge over the last week has been put down to a massive short squeeze in the futures market, according to reports, leading some to warn its rally may not hold.

“Chainlink can be a very bubbly asset and it looks very bubbly now,” cautioned chartered alternative investment analyst and manager at Cane Island Alternative Advisors, Timothy Peterson, via Twitter.