To Our DeFi Community,

DeFi is coming to CeFi. It’s too good for them to resist.

We mentioned this last week but DeFi tokens have been on an absolute tear over the past few months. Now, centralized exchanges are looking to capitalize on the new wave of tokens that are booming in the Ethereum economy. This trend was marked with Coinbase announcing their exploration on a range of new crypto assets back in early June, half of which were DeFi tokens. This week, Binance announced their listing of SNX, a massive win for the Synthetix Spartans as Binance continues to aggregate billions in volume on a daily basis.

Graphic via Coinbase blog

But listing DeFi assets is just the start.

We’re building something much bigger. Remember back in 2017 when DEXs sucked? Well now, they provide a significantly better user experience than their centralized counterparts. If you custody your own assets (i.e. use MetaMask) on Ethereum, it doesn’t take hours or days to onboard to a new DEX – it takes seconds. You connect your MetaMask and you’re off to the races. No KYC, no paperwork, and minimal trust required. It’s seamless onboarding for anyone in the world. More importantly, DeFi protocols operate at a substantially lower (and more efficient) cost basis than anything centralized exchanges can build. Rather than centralized exchanges setting up their own infrastructure, eventually, they’ll be forced to leverage the existing, permissionless financial infrastructure available on Ethereum. This is highlighted in detail with David Hoffman’s Protocol Sink Thesis.

Want to offer your users attractive interest rates? Integrate Compound, Aave, or the Dai Savings Rate (which is still at 0% btw). Good luck offering similar rates without taking significant risks. Want to offer frictionless swaps for any Ethereum asset? Integrate Uniswap or Kyber. Want to offer fun savings games? PoolTogether. Worried that these protocols are too risky for the average user? Well…you can automatically insure their deposits with Nexus Mutual or a hedge with Opyn. And when one domino falls, the rest will follow.

Imagine a scenario when Coinbase integrates Compound directly into their consumer application. Any Coinbase user will be able to earn a nice interest rate directly in the application. Do you think Binance or Gemini will sit back and let that happen? Not a chance. They’ll all scramble to offer the best products and services available in crypto. All of which are being built on DeFi.

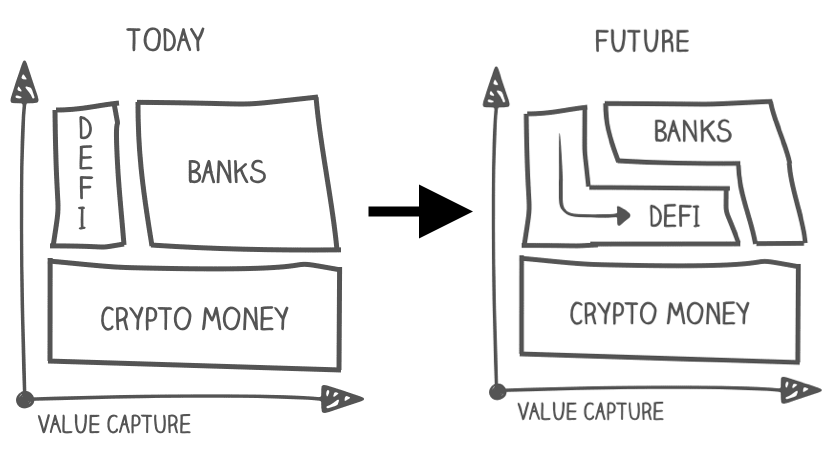

The value and benefits of DeFi protocols will become too dense. They’ll sink to the bottom of the technology stack and centralized exchanges will eventually have no choice but to build on top of them.

It’s only a matter of time.

Till next week!

Interest Rates

DAI

USDC

The leading DeFi liquidity protocol launched its highly anticipated Katalyst upgrade

The protocol for money market creation teased the details for credit delegation

The stablecoin liquidity aggregator will launch its native token MTA on June 15th

One of crypto’s leading exchanges listed SNX, a good indication for what’s to come!

Thanks for subscribing to This Week in DeFi. All of our content is free and publicly available, so feel free to share it!

Analyst at Bankless – one of the leading resources for open finance. Lucas is an active contributor to the DeFi ecosystem with appearances in other notable DeFi outlets including The Defiant and Our Network. He has years of experience working with dozens blockchain and token startups where he focused on token economics, marketing, and growth.