By Philip Lawlor, head of Global Investment Research

Following a long rally, the US dollar slid 5% against a basket of other major currencies in July, marking its worst monthly decline in more than a decade. The causes and ripple effects of this drop have important implications for future market performance.

As the chart below illustrates, the dollar’s July pullback has almost solely been about the strength of other developed-market currencies, particularly those of northern Europe, the euro and the pound sterling.

FX moves vs. US dollar – Month ended July 31, 2020

Source: FTSE Russell / Refinitiv. Data as of July 31, 2020. Past performance is no guarantee to future results. Please see the end for important disclosures.

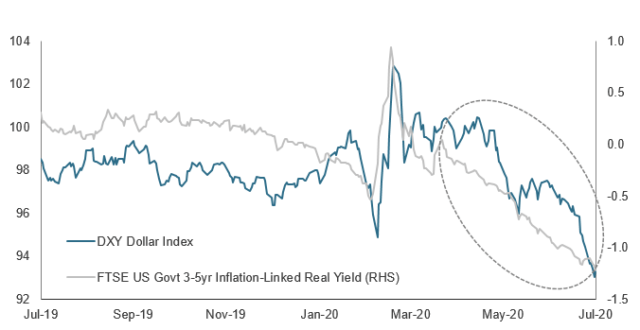

The culprit – negative US real yields

The US dollar’s weakness can be linked to the dramatic drop in US real (i.e., inflation-adjusted) yields. As shown below, yields on the FTSE US 3-5yr inflation-linked bonds have collapsed since May and are now deeply into negative territory. This has reduced the relative attractiveness of owning US dollars for investors.

Trade-weighted US dollar index vs. real US Treasury yields (rebased)

Source: FTSE Russell / Refinitiv. Data as of July 31, 2020. Past performance is no guarantee of future results. Please see the end for important legal disclosures.

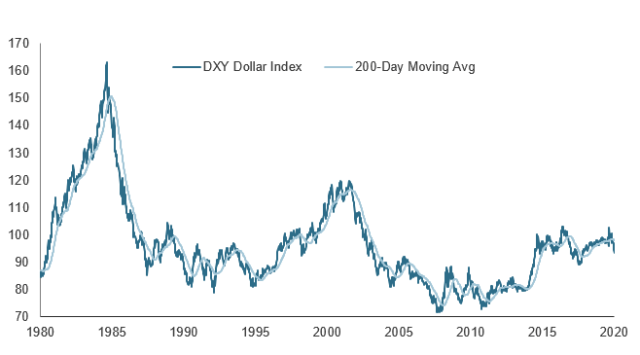

The longer-run view

When put into a longer-term perspective, however, last month’s downdraft doesn’t look so remarkable. Although the greenback has slipped below its 200-day moving average recently, the July pullback pales in comparison to the quantum declines of the mid-1980s and early 2000s. In trade-weighted terms, the US currency is still above its 10-year average.

Trade-weighted dollar index vs. 200-day moving average

Source: FTSE Russell / Refinitiv. Data as of July 31, 2020. Past performance is no guarantee of future results. Please see the end for important legal disclosures.

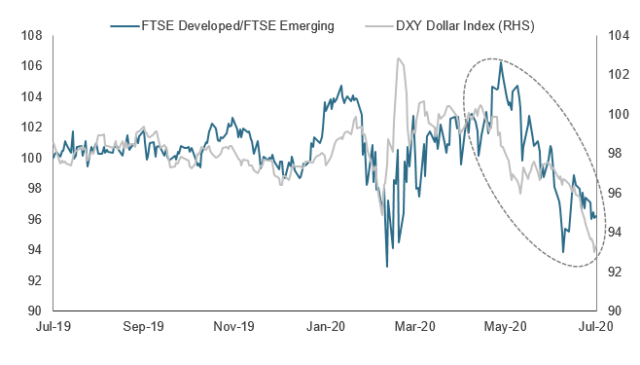

The falling USD has helped emerging markets…

One of the consequences of the recent dollar depreciation of the past few months has been the outperformance of emerging markets over their developed peers since May. Emerging currencies rebounded in the early stages of the post-lockdown pickup in risk appetite, though the rally has lost momentum more recently. The weaker US dollar has also relieved pressures on the developing nations that have taken on too much dollar-denominated debt.

FTSE Developed/FTSE Emerging Indexes (TR, local currency, rebased) vs trade-weighted US dollar index

Source: FTSE Russell / Refinitiv. Data as of July 31, 2020. Past performance is no guarantee of future results. Please see the end for important legal disclosures.

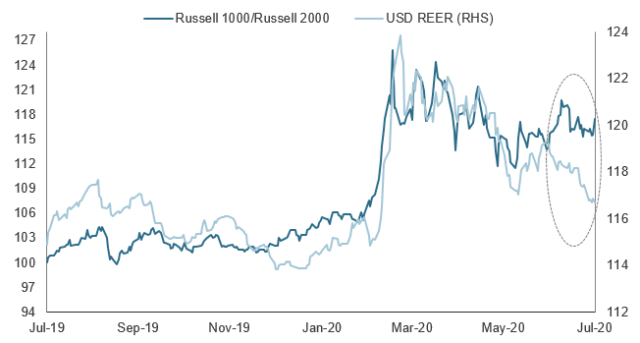

…but not Russell 2000 relative performance

The chart below shows the strong positive correlation between swings in the US dollar and the relative performance of US large-caps (Russell 1000) versus small-caps (Russell 2000) over the past year. However, this linkage appears to have broken down in July. Despite the fall in the dollar, typically a signal of waning risk aversion, the Russell 1000 has held its ground against the Russell 2000. This trend reversal likely reflects the increasingly uncertain US recovery backdrop, thus favoring the less domestically exposed large-cap index over its small-cap counterpart.

Russell 1000 relative to Russell 2000 (total return, rebased) vs. USD real effective exchange rate (REER)

Source: FTSE Russell / Refinitiv. Data as of July 31, 2020. Past performance is no guarantee of future results. Please see the end for important legal disclosures.

© 2020 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) MTSNext Limited (“MTSNext”), (5) Mergent, Inc. (“Mergent”), (6) FTSE Fixed Income LLC (“FTSE FI”), (7) The Yield Book Inc (“YB”) and (8) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products, including but not limited to indexes, data and analytics, or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing contained in this document or accessible through FTSE Russell Indexes, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back- tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This publication may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and/or their respective licensors.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.