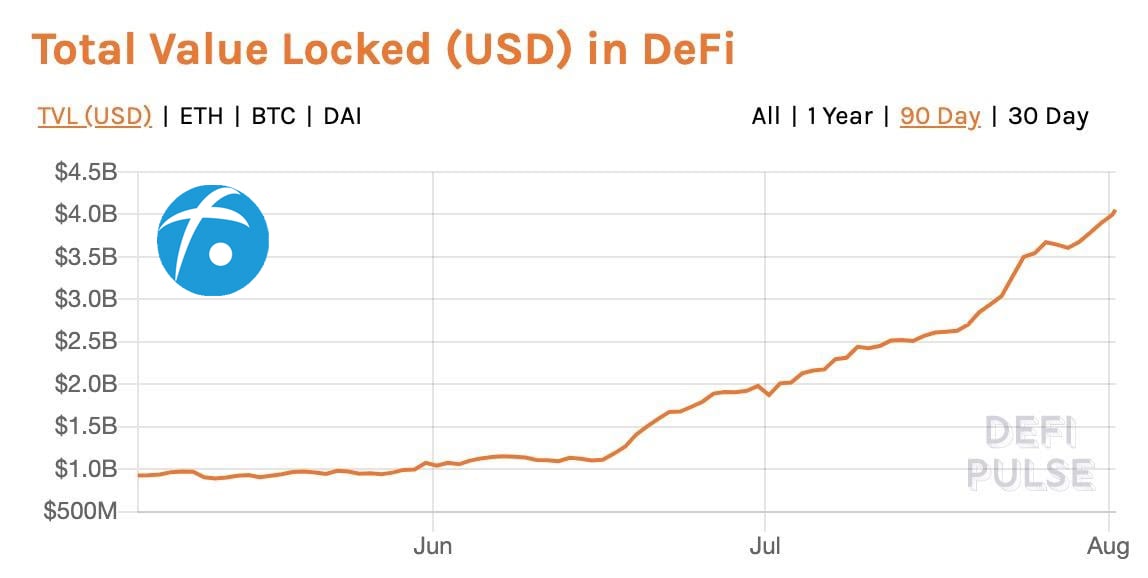

Four billion dollars.

This is the total amount of funds locked in “Defi”, growing from just one billion USD in 6 weeks. “Defi” has had a tortuous path ever since its inception, but now the concept of “Defi” is gaining more attention.

So, what exactly is “Defi”? Is it just another blockchain hype, or could it really be an epoch-making innovation?

“Defi” stands for “decentralized finance”. Fusion (fusion.org) proposed the concept of “crypto finance” in its official white paper at the end of 2017 and began to focus on constructing digital financial technologies. “Defi” has gradually evolved over the years as more projects have started to focus on this field.

“Defi”, in short, is the use of blockchain technologies (including smart contracts, decentralized asset custody, etc.) to replace all “intermediaries” with program codes, therefore maximizing the efficiency of financial services and minimizing costs.

Every major technological revolution in human society has brought about a significant increase in production efficiency and a reduction in cost (of production, labor, etc.).. During the industrial revolution, machines replaced human labor; during the information revolution, emails replaced postal services; and in the upcoming blockchain revolution, smart contract codes will replace loan officers.

Judging from its current development, “Defi” can be classified into four categories.

The first category: Decentralized loan

The advancement of the Internet is so rapid, that nowadays you can easily use apps on your phone – such as Alipay – to manage your assets. However, you may be surprised by the fact that if you have 10,000 dollars to spare and put it in a fixed deposit, the yield you gain is 240 dollars in a year, and yet, if someone needs to borrow 10,000 dollars, they need to pay around 1,460 dollars of interest in a year.

Why is there such a huge discrepancy?

This is because the “intermediary” takes an enormous cut.

Understandably, we cannot deny the role of intermediaries. They need to match the supply and demand for loans and bear the risk of overdue debts. There is also a risk of deposit oversupply, where many people deposit money but no one borrows. They also need to review the borrowers’ credit and chase debtors before the due date. The cost of these services is not low, but is it worth the difference between 240 and 1,460 dollars? Is there a better way?

Perhaps what came to mind for you is the infamous “P2P” lending. Whilst peer-to-peer loaning is well-intentioned, with the aim to simplify the lending ecosystem and thus reduce the intermediary cost, it should be noted that “P2P” lending still relies on centralized intermediaries and is susceptible to risks associated with centralization in a market that lacks regulation.

Using “Defi” technology, we can build smart contracts with codes that execute the actions of intermediaries, including: accepting and managing deposits, handling collateralized loans, and liquidating collateral assets as per the terms of the contracts should their values fluctuate. Thanks to blockchain technology, the contract codes cannot be manipulated or terminated by any individuals or organizations, and are executed with pre-defined terms.

MakerDAO and Compound are two examples of “decentralized loans”: they establish capital pools that can lend out assets via smart contracts. In today’s world, where US bank interest rates for savings are nearly zero, if you deposit 10,000 SEC-approved digital USD tokens into these “decentralized loan” platforms, you can generate up to 11.26% yield annually. When the amount of the deposit increases, the yield decreases dynamically; and when the amount loaned out increases, the lenders’ income increases dynamically.

Interestingly, once a smart contract is up and running, even the project developers cannot take funds away from the capital pool. Everything will be executed in accordance with the codes, including their commission rates, which are specified in the contract and taken as profit.

At present, this category of “Defi” is growing the fastest and constitutes a majority of the “Defi” space, accounting for 80% of the 1 billion USD. On the one hand, this reflects the underlying demand for lending. On the other hand, this implies that lending is the most acceptable financial service in the world. But if we think more about it, we realize that the scale of a loan market of 800 million USD is negligible compared to the scale of the traditional financial market.

The central bank of China has begun experimenting with digital Renminbi DECP (digital currency electronic payment). If this is fruitful, you may be able to sit at home and use your phone to lend out your idle digital Renminbi to someone in another corner of the world in the foreseeable future. You would not have to worry about a chain of intermediaries that would take a huge commission, or a possibility that the DECP you have lent cannot be recovered. The program codes take care of everything for you, and it cannot cheat you out of money.

The second category: Decentralized exchange

As we all know, almost all financial transactions today need to go through centralized custodial service providers because of counterparty risk; it is a risk that you may not receive assets or funds from the other party in a trade when you have already paid in advance.

The same thing happens in stock trades, real estate transactions, and any OTC (over the counter) exchanges. You and your counterparty both need to transfer assets or funds in escrow to a third party to mitigate counterparty risk when making an exchange. Those institutions that provide centralized custodial services charge a custodial and transaction fee, and the fee can be up to 3-5% for OTC transactions.

“Defi” brought us non-custodial exchanges, where codes (smart contracts or decentralized key management systems such as Fusion’s DCRM) hold assets from both parties in escrow. Those codes from decentralized blockchains guarantee the asset swap is atomic. That means when you make a transaction with a party, assets are guaranteed to be transferred to each other and the cost of making such “non-custodial transactions” is nearly zero.

This category of “Defi” is still in its infancy. There was a wave of establishing decentralized exchanges with smart contracts in 2017, but almost none of them were successful. This is because the technology was not mature enough at the time, and the market acceptance was slow. Another obstacle was that decentralized transactions could only be made on the same blockchain, as cross-chain exchanges were not possible at the time. As the advantages of decentralized exchanges were overshadowed by the advantages of centralized exchanges such as services and UI, we know how it turned out.

We believe that decentralized exchanges should focus on cross-chain, non-custodial,decentralized transactions, such as the use of Fusion’s solution to decentralized custody to achieve high efficiency and low cost. This piece of the market is incredibly large, especially the OTC market because there is huge counterparty risk and the market intrinsically has a much higher volume than other trading markets. The development prospect here is extremely broad.

The third category: Programmable standardized decentralized derivatives

The financial derivatives we see today are designed and issued by centralized financial institutions, such as banker’s acceptance drafts, bonds, factoring, options, etc. The issuing cost is high, and derivatives with identical parameters but issued by different institutions cannot be homogenized.

For example, a bank acceptance draft of 1 million Chinese yuan due to mature on January 1st2021 and endorsed by the Bank of China and a draft of 1 million Chinese yuan due to mature on January 1st 2021 endorsed by a small local commercial bank are intrinsically different, as their discount rates are different.

This is because the risk levels of those derivative-issuing centralized institutions are different. But in reality, those two bills get you the same 1 million yuan on January 1st 2021. Do we have the technical competency to homogenize derivatives that share the same parameters by eliminating the risk factors of the issuers? The answer is yes.

Everyone can issue derivatives and set their parameters with “Defi”. Due to its decentralized characteristics, derivatives with identical parameters but with different issuers do not have any risk differences.

By setting the same parameters, different people can create homogenous derivatives. Fusion’s time-lock technology adds time attributes to all assets. Say you have an acceptance draft of 1 million yuan due to mature on January 1st 2021, you only need to specify the time attribute of that digital Renminbi as [January 1st 2021 ~ forever], et voilà! This way, derivatives created can be standardized and homogeneous, and they can form a financial ecosystem with smart contracts.

These kinds of digital acceptance bills no longer need to be redeemed from a centralized institution such as a bank; the blockchain consensus guarantees the bill will automatically become digital cash when it is due. It is equivalent to redeeming bills from the blockchain system. We do not need to worry about any form of contract breach given the decentralized characteristics of the system.

This piece of the market has huge potential. We all know that the volume of derivatives is many times larger than that of the currency market. With the support of derivatives in the space of “Defi” decentralized technologies, not only does it make derivatives themselves interoperable, but it also greatly reduces the cost of issuance (the cost of issuing such acceptance drafts on a blockchain with underlying assets is almost zero), and greatly reduces the time required to issue such instruments (in the magnitude of seconds).

The fourth category: Financial process automation

Ever since the inception of computer technology, we have witnessed many processes being digitized and automated, such as office and supply chain automation. Nevertheless, finance has not been fully automated, and the root cause is trust. How can you accept the fact that your money is controlled by someone else and can be transferred away from your account automatically? Even in scenarios that require highly efficient automation, we still need a centralized entity to ensure the safety of funds.

For instance, many logistics companies outsource their last-mile delivery and bill collection to other companies, splitting the profits. In this scenario, these logistics companies require a financial service that allocates payments proportional to their profits to each outsourced service provider, as per some pre-agreed terms. There are also other business scenarios where income from subsidiaries needs to be collected and distributed proportionally to accounts with various functions, such as a tax account, a management cost account, etc.

Assisted by other fintech companies, banks currently offer some services that meet the above-mentioned demands. However, on the one hand, cross-bank operations are still unrealized. On the other hand, they need to persuade external service providers to count on banks to allocate payments under pre-agreed terms, and to sign agreements with the banks. The actual operations are very difficult and complex: when terms and conditions change, anyagreements that were made must be re-signed.

“Defi” has a strong advantage in this area. Smart contract templates can generate flexible smart contracts for payment distribution and bill collection based on the digital signature dynamics of various accounts. This type of to-B market has huge potential. In the foreseeable future, whether it is a conglomerate with multiple subsidiaries, or an organization with a convoluted co-operative business model, or even a startup with shareholders all over the world, they can all become customers of this kind of “Defi”. The cost is also close to zero.

Nonetheless, “Defi” also encounters many challenges in its development.

First, the challenge of digitizing cross-chain, cross-financial systems assets.

Most of the existing “Defi” products are developed on the Ethereum blockchain. It can only support decentralized finance related to Ethereum and ERC-20 tokens on this blockchain. When asset interoperability cannot be realized, this kind of “Defi” can only be regarded as an experiment, and we are still a long way from the real “Defi”. When our most-used assets and currencies still have not been digitized, let alone decentralized on interoperable platforms, “Defi” still has a long way to go.

Second, the challenge of code security.

We have heard of the security vulnerabilities of digital assets countless times before. Fixing these vulnerabilities when it comes to “Defi” smart contracts is notoriously difficult. There must be professional code-auditing teams in the market that have the capacity for providing financial insurance and reinsurance for the decentralized codes. A certain governance mechanism is also required when deploying decentralized codes for handling some extreme security issues, in order to instill the general public with confidence in “Defi”.

Third, the exploration of national laws and regulations.

Finance is a national security issue. “Defi”, in essence, will shorten the financial distance between people, and the world will be borderless from a financial perspective. However, how nations can legislate so that “Defi” does not erode national security remains a question. We need to consider how KYC and AML can integrate into “Defi” ecosystems such that this new technology improves our financial efficiency, and is not leveraged by criminals for illicit purposes.

Fourth, the challenge of the convenience of use and the compatibility with traditional finance.

Innovations are often hindered through a lack of user acceptance, a reluctance to try new systems. When it comes to finance, user experience and trust are incredibly important factors in the success of new systems and products. Driven by the widespread use of the Internet, finance becomes more within reach year on year, yet user experience is still a serious challenge for “Defi”. Financial service users are usually more conservative under the premise of safety, and thus providing an excellent user experience is necessary for “Defi” to become a part of people’s daily lives. At the same time, how “Defi” products embrace traditional finance is a key to transforming “Defi” into a “killer” application. It has to provide a seamless experience to users such that it is as smooth as using traditional financial products. This should be the goal of all “Defi” applications, and Wedefi (wedefi.com) and Anyswap (anyswap.exchange) have been playing a leading role in this regard.

The good news is that “Defi” technology is becoming more mature, and the above-mentioned challenges can be overcome without any technical obstacles. We believe “Defi” is more than a short-term trend and that it fundamentally innovates our financial system. This innovation is unstoppable, and the existing financial system will undergo major changes in the foreseeable future.

With the advancement of “Defi”, future financial institutions may become “coding factories”, accounting firms will lose their clients unless they start conducting on-chain data analysis and “Defi” smart contract code audit. There was a boom of “challenger banks” in Europe and North America 10 years ago. Similarly, the “Defi” trend will reach new heights in today’s society.

DJ Qian

This is a sponsored post. Learn more on how to reach our audience here. Read disclaimer below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.