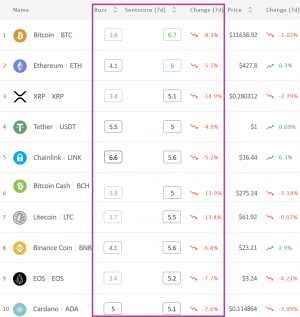

Over the course of the past week, the combined moving 7-day average crypto market sentiment score (sentscore) for the top 10 coins by market capitalization did not recover to its previous positive zone status, but dropped deeper into the neutral zone instead – from 5.96 seen last week to today’s 5.48, according to crypto market sentiment analysis service Omenics.

It wasn’t a good week for the top 10 coins overall, with every single one of them seeing a drop in their respective scores. Bitcoin (BTC) and ethereum (ETH) are the only two remaining coins in the positive zone, with XRP seeing a sharp fall since last week, all the way down to 5.1. That said, no coin is below the score of 5 either, though several are on the verge.

Among the redness of today, XRP, litecoin (LTC), and bitcoin cash (BCH) dropped the most, all three seeing tripple-digit decreases. Meanwhile, tether (USDT), chainlink (LINK), and ETH dropped the least in the past seven days.

Sentiment change among the top 10 coins*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive

Meanwhile, the combined moving average sentscore for the top 10 coins in the last 24 hours has seen some improvement compared to the 24-hour situation last Monday. It went up from 5.49 to 5.93, once again nearing the positive zone. What’s more, four coins are already there, compared to only BTC and ETH from last week. These two have seen a rise in their respective scores, with BTC now boasting a score of 7.2 and ETH of 6.8. They’ve been joined by chainlink and binance coin (BNB), with 6.4 and 6.1 respectively.

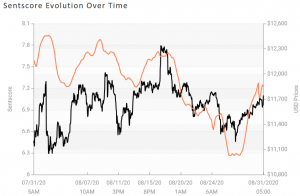

Daily Bitcoin sentscore change in the past month:

Looking into the 29 coins outside the top 10 list, also rated by Omenics, over the course of the past week all but two have turned red. The only two coins whose scores went up are WAVES and trueUSD (TUSD). While no coin is in the negative zone, or even particularly near it, only NANO is in the positive zone.

___

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 39 cryptocurrencies.