Five years ago, Ethereum, Canada’s biggest contribution to the blockchain space, officially went live. Since then, the cryptocurrency platform has become the second largest in the world, next to Bitcoin.

Although it is now a global phenomenon, Ethereum’s roots are in Canada, where a significant portion of its early development took place. The decentralized peer-to-peer blockchain platform has come a long way since its launch, enduring a massive hack, an initial coin offering bubble, and now, the accelerated growth of decentralized finance.

“Ethereum’s growth over the last five years has been staggering.”

– Josh Stark, EthGlobal and L4 Ventures

Today, the crypto leader is on the verge of beginning its long-awaited shift to Ethereum 2.0.

Earlier this month, Ethereum released its “final” public testnet, a software separate from the cryptocurrency’s main blockchain, designed to test the ideas that underpin the platform’s next generation. The release is part of the first stage of Ethereum’s long-planned, multi-year rollout of Ethereum 2.0—its biggest series of updates to date.

“Ethereum’s growth over the last five years has been staggering,” Josh Stark, co-founder of two Toronto-based Ethereum companies, EthGlobal and L4 Ventures, told BetaKit.

Ethereum, which Stark said began as “an upstart project,” is currently used more than Bitcoin, and also recently passed Bitcoin on another metric—how much people pay each day to use the network.

Ethereum’s development to date has been “spectacular,” blockchain scholar JP Vergne said in an interview with BetaKit. “It started so well, in fact, that it’s raised people’s expectations.”

Vergne, an associate professor at University College London and the current director of Scotiabank’s Digital Banking Lab, noted that while Ethereum’s growth has been impressive, people are now “expecting even more” and feel general “disappointment” today with the blockchain industry as a whole.

Ethereum today

Vitalik Buterin, Ethereum’s co-founder, first described Ethereum publicly, back in early 2014, as “cryptocurrency 2.0.” The idea, he wrote, was about “using the Bitcoin blockchain for more than just money.”

Bitcoin was built to serve as an alternative monetary system. Ethereum was created as a platform to facilitate the construction and operation of a wide variety of decentralized applications (dapps) via its own currency. In other words, Ethereum aspires to compete with the internet itself, as a “more private,” open-source, decentralized, and “censorship resistant” alternative.

A July 2020 report from Coindesk called Ethereum “the world’s leading blockchain platform for dapps.” Ethereum’s dapps range in focus from financial services, to games, social media, and more.

Ethereum founder and inventor Vitalik Buterin.

The Ethereum Foundation, a Swiss non-profit dedicated to supporting Ethereum, is the closest thing the platform has to a central authority. The foundation, which manages the proceeds from the initial ether sale in 2014, notes that Ethereum is built, maintained, and governed by its community, which consists of “thousands of people, companies, organizations, and users all over the world.”

Despite Ethereum’s rapid rise to fame, the cryptocurrency platform still has some key technological limitations, including a lack of scalability, which some experts consider the biggest obstacle to mainstream adoption.

Ethereum’s blockchain can currently only process 10 to 20 transactions per second. As a result, it suffers from spikes in transaction fees as its network becomes congested. This cap comes in stark contrast to Visa, which claims it has the capacity to handle up 65,000 transactions per second. Although some argue the amount Visa actually processes per second is closer to 1,700, both figures represent a significant gap in terms of scale between the large, established financial services provider and its much younger counterpart, Ethereum.

“At times, Ethereum’s growth both in terms of the number of users and dapps has overwhelmed network capacity,” the Coindesk report found.

RELATED: Wealthsimple receives conditional approval from regulators to test crypto platform

Recently, the growth of decentralized finance (DeFi) has also exacerbated the network’s congestion issues, and in turn, contributed to higher transaction costs. Its growth has been so significant that some experts have cautioned that DeFi might result in another bubble, reminiscent of 2017’s ICO craze.

Decentralized finance is the most popular and fastest growing use of Ethereum.

DeFi is the most popular and fastest growing use of Ethereum. It refers to the notion that crypto entrepreneurs can recreate traditional financial instruments, like bonds, inside a decentralized structure, beyond the control of companies and governments.

A 2019 report on Canada’s blockchain ecosystem by the Information and Communications Technology Council (ICTC) highlighted that user-friendliness is also an issue. The report predicted that, until blockchain tech becomes more user-friendly, Canadian users will be slow to adopt it given their “high degree of existing trust in institutions of governance and finance.”

Ethereum 2.0

Ethereum 2.0 aims to address what is arguably the platform’s biggest issue: its lack of scale.

Its technological changes intend to allow Ethereum to process more transactions at a much lower cost, representing a significant step towards scalability.

The current shift to Ethereum 2.0 entails the move to a different type of ether mining called staking. Staking, experts say, will turn ether—Ethereum’s native cryptocurrency—into a financial asset resembling a bond. It also involves the implementation of sharding, a practice that will partition the Ethereum blockchain into 64 separate, smaller, and faster parallel chains.

These changes aim to ensure a cheaper, more energy-efficient transaction validation system, and could significantly increase transactions processed per second on the network.

Ethereum 2.0 changes intend to allow Ethereum to process more transactions at a much lower cost.

“It needs to do that to bring new use cases beyond DeFi,” said Vergne. “And it needs to do that to also up its game in the face of new competitors that are creating parallel ecosystems.”

Two risks associated with Ethereum’s transition to 2.0 include whether it might be more difficult to guarantee the security of Ethereum’s network under its new proof of stake mining model, and whether such an ecosystem would truly be less decentralized than the existing model, given the degree of concentration in ether ownership.

All transactions on Ethereum’s blockchain are verified and processed by users, or miners, who are incentivized by the ability to earn ether via transaction fees. Bitcoin and Ethereum miners currently operate under a process called proof of work, which requires huge amounts of energy, and forces miners to pay significant upfront costs to invest in mining hardware and infrastructure. To finance these purchases, miners often have to sell their ether to other users, which ultimately results in two separate groups with competing interests: miners and ether holders.

Under Ethereum 2.0, the platform will switch to proof of stake. One group—ether holders—will validate Ethereum transactions by “staking” some of the currency they hold, earning a return based on the percentage they stake, turning ether into a yield instrument.

RELATED: OSC finds Quadriga CEO ran Ponzi scheme leading up to crypto exchange’s downfall

According to Everett Muzzy of Consensys, proof of stake will lower barriers to entry for validators by decreasing energy and hardware costs, result in a more decentralized network, and allow for the implementation of sharding, a new scalability solution.

Shifting from proof of work to proof of stake has “never been done before,” according to Vergne, who called it “a massive transition for a large network.” He argued that the Ethereum platform needs to strike a balance between ensuring that its legacy applications and protocols continue to work on the proof of stake blockchain, while at the same time attracting new users and developers, stressing the need for it to maintain the support of its powerful developer community.

How Ethereum got here

As Bitcoin Magazine tells it, Buterin, a then 19-year-old programmer who was born in Moscow and raised in Toronto, conceived of the idea for Ethereum while he was working on a series of Bitcoin-related projects.

Buterin (who did not respond to interview requests for this article), first joined the Bitcoin community in March 2011, and started Bitcoin Magazine later that year. He began studying computer science at the University of Waterloo in 2012, but dropped out a year later to work on Bitcoin projects full-time.

The DAO, the first attempt to conduct DeFi on Ethereum, ended in disaster, with $60 million in ether stolen.

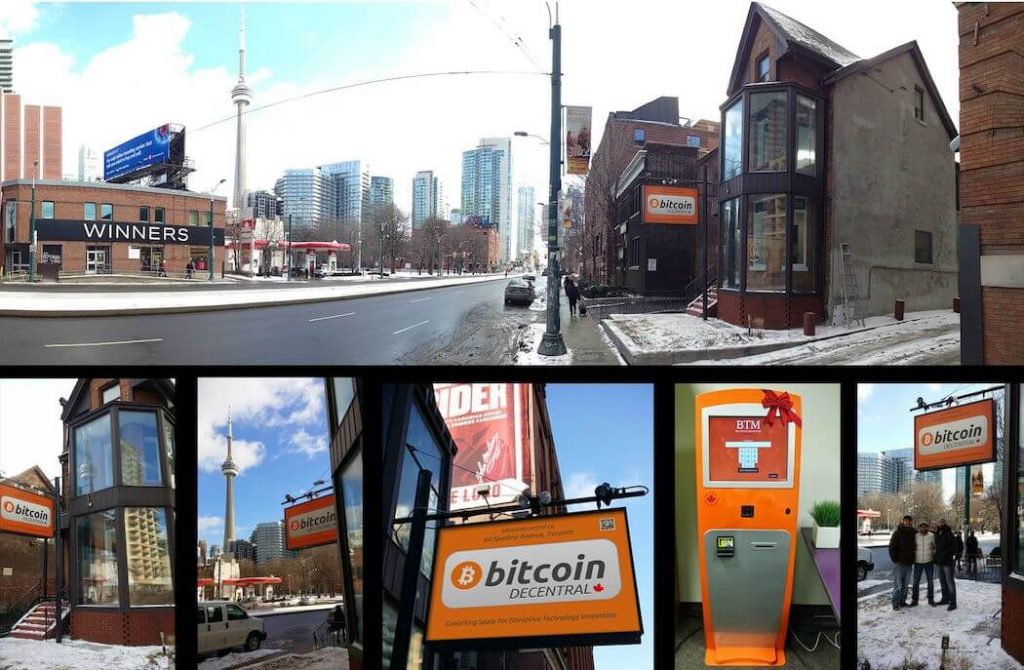

After spending some time in the US and Switzerland, in 2014 Buterin returned to Canada to dedicate himself to Ethereum. To encourage “local community development” of Ethereum, Buterin and the platform’s other founders launched a series of incubators in cities around the world, the first of which was based inside Decentral, a Toronto-based innovation hub, where a “substantial portion” of Ethereum’s early development took place.

Ethereum’s development to date can be understood in terms of two key events, which altered the platform’s trajectory: the DAO hack and the initial coin offering (ICO) boom.

The DAO hack began with the first attempt to conduct DeFi on Ethereum. It ended in disaster, with $60 million in ether stolen by an anonymous hacker.

Decentral opened its doors in 2014 in downtown Toronto.

The event, which was ultimately attributed to a feature in Ethereum’s code, led to questions about the platform’s security. It also caused a split in its community that resulted in its separation into two different blockchains, Ethereum (ETH) and Ethereum Classic (ETC), both of which still operate today.

A year later, Ethereum appeared poised to gain mainstream adoption, as many enthusiasts predicted it would become the world’s most valuable cryptocurrency, on the heels of 2017’s ICO wave.

RELATED: Halifax startup Groundhog lawsuit alleges US-based Consensys stole code to create rival product

Swept up in the ICO boom, the value of cryptocurrency rose dramatically in 2017, only to drop precipitously in 2018, suggesting that cryptocurrency had not yet become a mainstream investment, but instead had simply become swept up in a larger, hype-fueled bubble, populated by scam ICOs. The associated ether sell-off, post-ICO boom, was more severe than Bitcoin.

Stark called the period a “mixed blessing” for Ethereum. “It showed a lot of growing pains of the early network.”

Vergne referred to the chapter as a successful experiment in coin issuance, fundraising, and crowdfunding for Ethereum. “What [Ethereum] managed to build from that moment onwards is unprecedented,” he added. “It gave rise to a new way of funding organizations that we didn’t have before.”

The state of blockchain in Canada

Although Ethereum was incubated in Toronto, the blockchain’s community has largely developed applications outside of Canada.

Blockchain industry consultants surveyed by the ICTC argued that regulatory uncertainty has “disincentivized several blockchain companies from staying in Canada, including noteworthies like Ethereum.”

Brian Mosoff, the CEO of Ether Capital, a Toronto-based company dedicated to investing in Ethereum, told BetaKit that many Ethereum developers have left for more favourable jurisdictions. He noted that Canada has higher taxes and heavy and unclear regulations that decentivize crypto.

Many Ethereum developers have left Canada for more favourable jurisdictions.

-Brian Mosoff, Ether Capital

Mosoff sits on the Ontario Securities Commission’s FinTech Advisory Committee, and the Investment Industry Regulatory Organization of Canada’s (IIROC) Crypto-Asset Working Group, advising on FinTech developments, IIROC rules, guidance, and policy matters, and investor protection, and market integrity.

Stark offered a more optimistic view, arguing that Canada has “always punched above its weight in the cryptocurrency world.”

“Besides being the place where Ethereum was founded, there was also a big early Bitcoin community here, in Toronto, Montreal, and Vancouver,” said Stark. “Today, not only are there many great Ethereum companies built in Canada, but there are also many Canadians all around the world involved in Ethereum.”

RELATED: Canadian securities regulator publishes additional guidelines for trading crypto assets

The ICTC report referred to Canada as “a mid-level player in the global blockchain ecosystem.”

“As a country, we are no longer leading the way in blockchain innovation,” the report stated. “However, our legacy with Ethereum as well as new and noteworthy research and development in hubs across the country mean that we are also by no means at the back of the line.”

The future of Ethereum

Following years of development, the first phase of Ethereum 2.0 is tentatively expected to launch by the end of the year.

“The researchers and developers who are leading this project are pushing forward the state of the art in cryptocurrency,” said Stark. “Once complete, the new network will have significantly more capacity, will be more secure, and more decentralized. It will set Ethereum up to reach its potential as a piece of critical global infrastructure for commerce, finance, and a lot more.”

Traditional financial institutions are increasingly considering the use of blockchain technology and cryptocurrency.

Vergne noted that moving forward, DeFi will likely be the first area of growth when Ethereum 2.0 is implemented. “It will also kickstart a new wave of innovation in other sectors, and it could be online gaming that becomes huge,” he stated, also pointing to other potential uses within supply chain and government applications, as potential areas of growth.

The blockchain expert also highlighted that traditional financial institutions are increasingly considering the use of blockchain technology and cryptocurrency. “What we’re seeing, potentially, is DeFi applications becoming mainstream, and becoming a valid, regulated option for investors, and not just the institutional investors … but also for retail investors.”

If Ethereum’s transition to 2.0 succeeds, said Vergne, it could remain the number one platform to power the DeFi ecosystem.

Illustration designed by Rawpixel via Freepik