This week cryptocurrency proponents discussed the firm Grayscale Investments, as the firm purchased 9,702 bitcoins (over $110 million) in the past five days. The news follows Grayscale informing the U.S. Securities and Exchange Commission (SEC) that the Bitcoin Trust (GBTC) grew over $1.6 billion in 2020.

Last Friday, Grayscale Investments filed a quarterly report with the SEC detailing that the firm’s Bitcoin Trust (GBTC) has increased significantly in value. The filing notes that the trust increased in value by over $1.1 billion as of June 30, 2020, from over 125,000 BTC to 387,000 BTC.

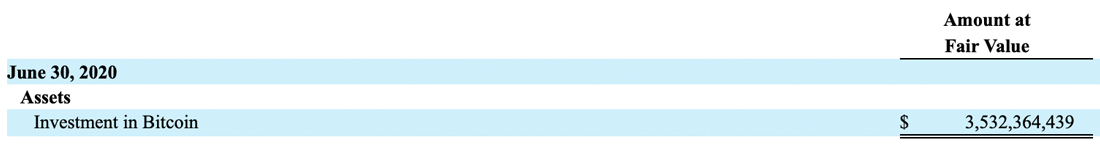

June 30 exchange rates show the company’s assets under management (AUM) were valued at $3.5 billion. “The Trust determined the fair value per Bitcoin to be $9,134.09 and $7,145.00 on June 30, 2020,” explains the SEC filing.

In addition to the recent SEC filing, crypto observers have watched Grayscale obtain a massive amount of bitcoin (BTC) during the last five days. On Reddit, an observer explained that Grayscale purchased 5,973 BTC (over $68 million) a few days ago.

After that purchase, the crypto enthusiast noticed the company obtained another 3,729 bitcoins ($42 million) two days after the $68 million purchase.

The recent purchases add 9,702 bitcoins ($110 million) to the trust’s stash, which indicates Grayscale’s Bitcoin Trust is a whopping 401,385 BTC (AUM) or $4.6 billion using today’s exchange rates. Of course, the discussion on Reddit about Grayscale’s recent purchases spurred a lot of speculation.

A number of bitcoiners couldn’t agree on how the crypto assets were actually purchased. “Judging by the lack of impact on the price, I’m going to guess they bought a cash-settled futures contract rather than actual bitcoins,” one Redditor wrote.

A few other individuals were in complete disbelief that Grayscale bought that many coins, as it didn’t seem to affect spot market prices. Most people attributed Grayscale’s purchasing to over-the-counter methods.

“It’s done OTC, with multiple brokers taking their time to carefully procure the coins needed from multiple markets,” exclaimed one bitcoiner commenting on the subject.

The $100 million Grayscale BTC purchase follows the recent announcement from Microstrategy Inc. (NASDAQ: MSTR). The $1.33 billion intelligence company Microstrategy revealed it purchased 21,454 (BTC) for it’s “new capital allocation strategy.”

What do you think about Grayscale buying 9,702 bitcoins? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, SEC

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.