Some much-hyped altcoins from 2017 are seeing a surge in prices as the DeFi market picks up steam and becomes a formidable sector in the broader crypto space.

Altcoins ZRX and OMG surge

0x protocol, which raised millions in an ICO in 2017, was one of the first decentralized exchanges (DEX) to hit the crypto space at the time. However, a lack in demand and the superior user experience provided by centralized exchanges like Binance proved difficult for the protocol, gaining little traction and hype.

But the tables have turned. DeFi is back in vogue and it is lifting altcoin projects upwards. An example is Chainlink, the decentralized oracle services provider, which remained undervalued for most of 2018-19 but saw a 700% increase in prices this year.

At press time, ZRX, the native token of 0x can boast a similar narrative. It went up by 71% earlier today backed by solid fundamentals.

0x notes that over 30 projects now use its tech to build their own applications, which have together processed over 713,000 transactions and handled over $750 million in altcoin trading volume. It’s first consumer product, Matcha DEX, has been a hit as well.

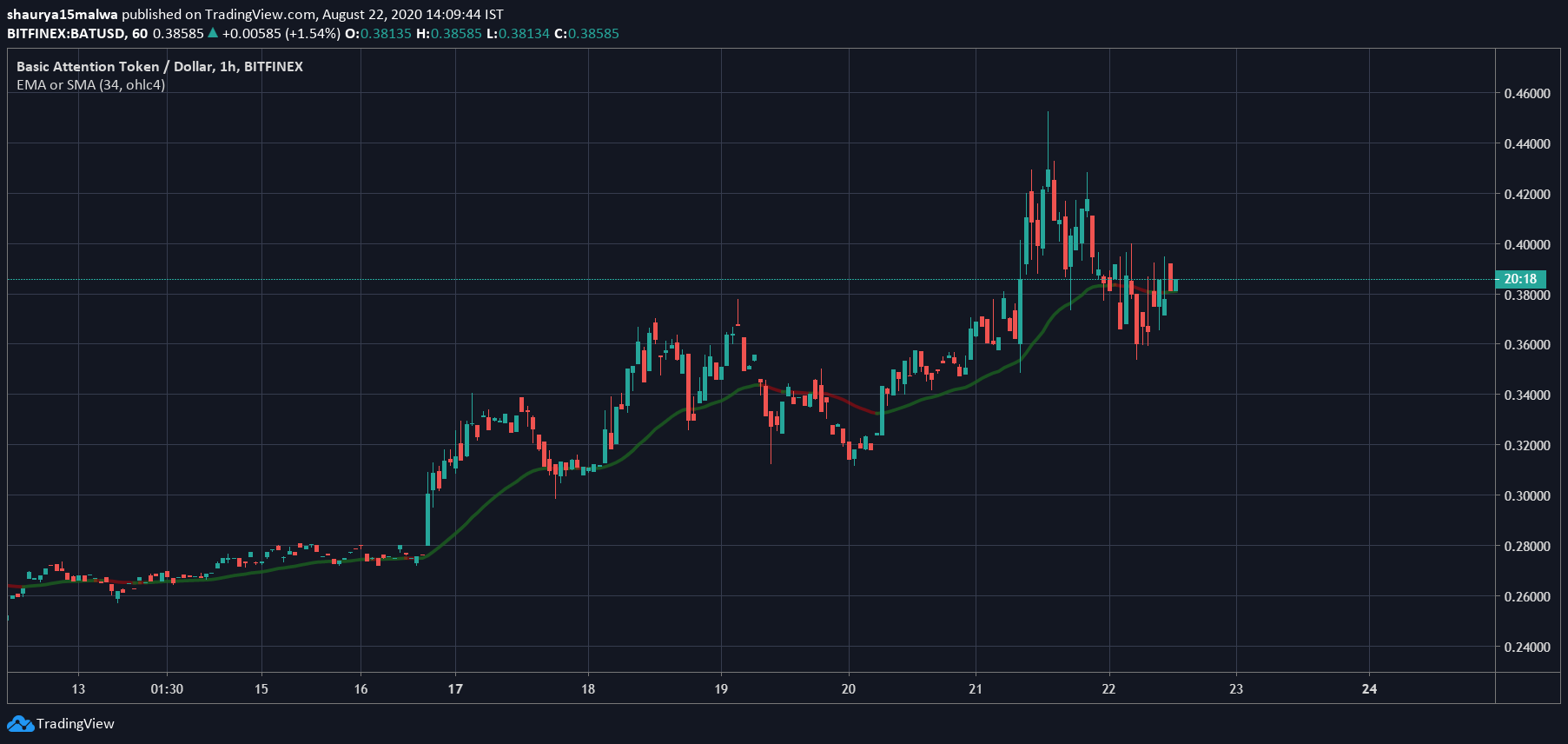

Basic Attention Token (BAT), has surged in the past week by 30%, charts show:

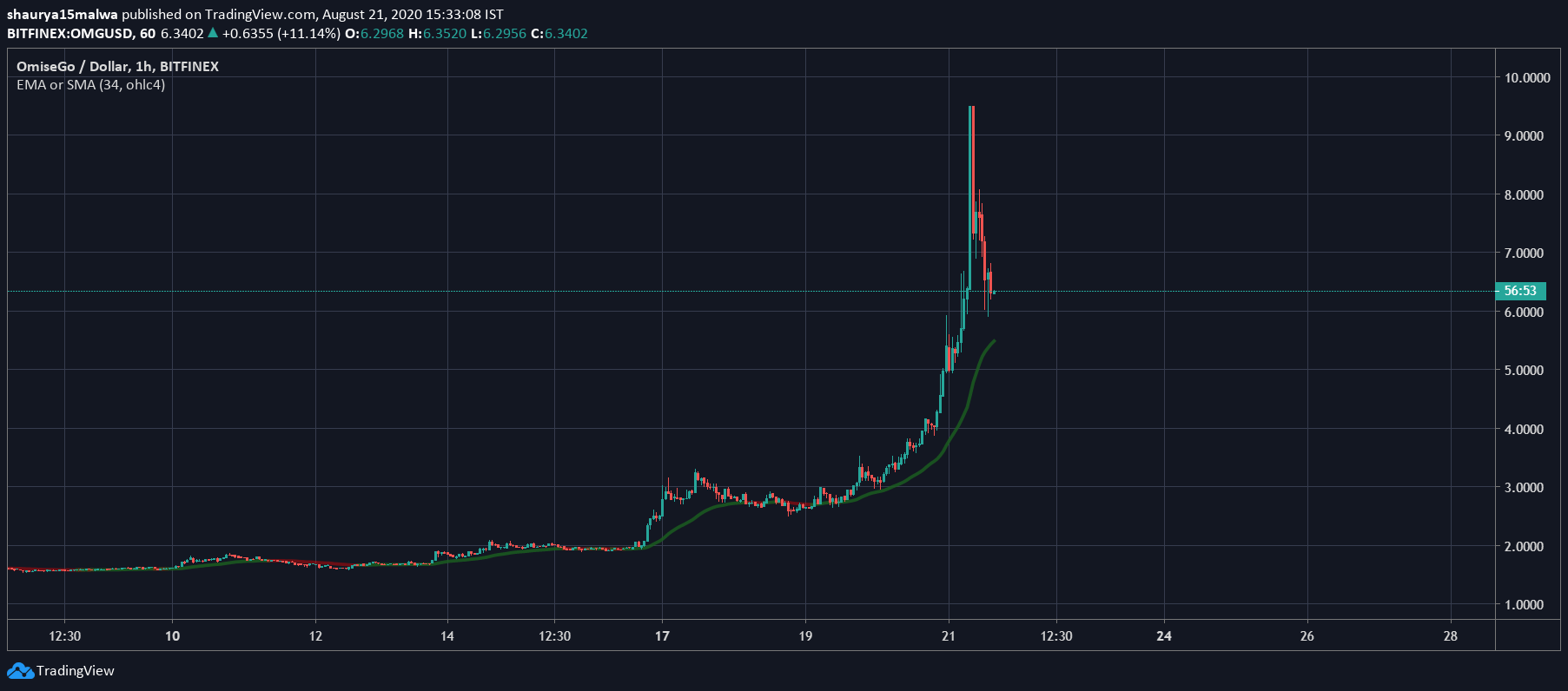

Another project, OMG Network, which rebranded from OmiseGo earlier this year, also saw a huge increase in its token, OMG’s, prices this week. The network was chosen by Tether, the stablecoin backed 1:1 with the US dollar and the world’s fourth-largest crypto network, as the latter looked to scale up and move away from the current high fees on the Ethereum network.

When #Tether? Well, now! Happy to announce that users will be able to withdraw and deposit @Tether_to #USDt to @Bitfinex via @OMGNetworkHQ, helping reduce #EthereumCongestion and lower gas fees for everyone! ? https://t.co/zlAxRsIt8t

— OMG Network (@omgnetworkhq) August 19, 2020

At press time, altcoin OMG surged over 475% since the start of August from $1.65 to over $9.50 today, on the back of the Tether news.

The DeFi “ripple” effect

Meanwhile, Andrew Kang, a prominent crypto figurehead and investor, pointed out that crypto “Ponzis” alike are enjoying growth as a result of DeFi.

The emerging crypto ponzis are having interesting ripple effects into the rest of DeFi because of their sheer size@BasedProtocol is actually increasing the value of $SNX for as long as Based continues to lock up capital

— Andrew Kang (@Rewkang) August 21, 2020

Kang noted Based Protocol, a meme project that “yield farmers” have their eyes on since last week, is actually “increasing the value of $SNX for as long as Based continues to lock up capital.”

He stated that SNX holders gain benefits because they now get more interest-free leverage. Meanwhile, another side effect, he noted, was the launch of CRV from Curve Finance which greatly increased the yield of sCRV.

Another side effect has been the launch of $CRV from @CurveFinance which greatly increased the yield of sCRV (and so has based). This resulted in more capital flowing into the sCRV pool which holds $145M of stablecoins, $24M in sUSD.

— Andrew Kang (@Rewkang) August 21, 2020

For crypto fanatics, the DeFi explosion led to a border explosion in altcoins and the so-called “altseason.“

Like what you see? Subscribe for daily updates.