Decentralized finance is growing at a rapid pace, and at the center of it all is Ethereum. Sentiment surrounding the largest altcoin in the cryptocurrency industry, however, is extremely low after a prolonged bear market.

The growth in DeFi has brought some positive buzz back to the altcoin, but pundits argue that without another ICO boom, Ethereum will never return to an all-time high.

Analysts from the award-winning Bitcoin margin trading platform PrimeXBT, have supplied data that puts a spotlight on if the quickly spreading DeFi trend will be enough to break Ethereum’s previous price record.

Remembering The Bitcoin Bull Run That Captured The World’s Attention

Alongside Bitcoin’s meteoric rise into the public eye, the second-ranked cryptocurrency, Ethereum, also skyrocketed.

Bitcoin FOMO was the result of the world learning about the powerful new cryptocurrency technology and, at the same time, learning of the wealth it generated.

Ethereum, however, the next generation of cryptocurrency that acts as more than just a currency or store of value, allowed for the creation of new cryptocurrencies.

Ethereum offers smart-contracts, or code-based agreements and operations. The platform can run decentralized applications and serves as a foundation for developers to build on.

Devs chose to build more and more new cryptocurrencies, launching them on the Ethereum protocol as ERC20 tokens through initial coin offerings.

ICOs Fuel Ethereum’s Rise to All-Time High Alongside Bitcoin

In initial coin offerings, Ethereum was exchanged for shiny new tokens promising to be the next Bitcoin. With Bitcoin’s record and meteoric rise fresh in people’s minds, Ethereum prices skyrocketed to over $1,400 per ETH token, due to surging demand.

The demand was primarily crypto investors buying the token to then exchange for ICO tokens. Later, the Securities and Exchange Commission stepped in and put an end to ICOs, deeming many of them unregistered securities listings.

Many projects fell as a result; others were canceled. Initial coin offerings never came back, and Ethereum’s demand also dropped. Lowering demand and increasing supply leads to sell offs and quickly falling prices. Ethereum fell by over 90% to just $80 at its low.

After a Two Year Downtrend, Ethereum Readies a Major Rally On Heels of DeFi

However, at the start of 2020, Ethereum closed seven consecutive green weekly candles in a row. The only other time in history the asset had such a positive run, was prior to reaching its all-time high.

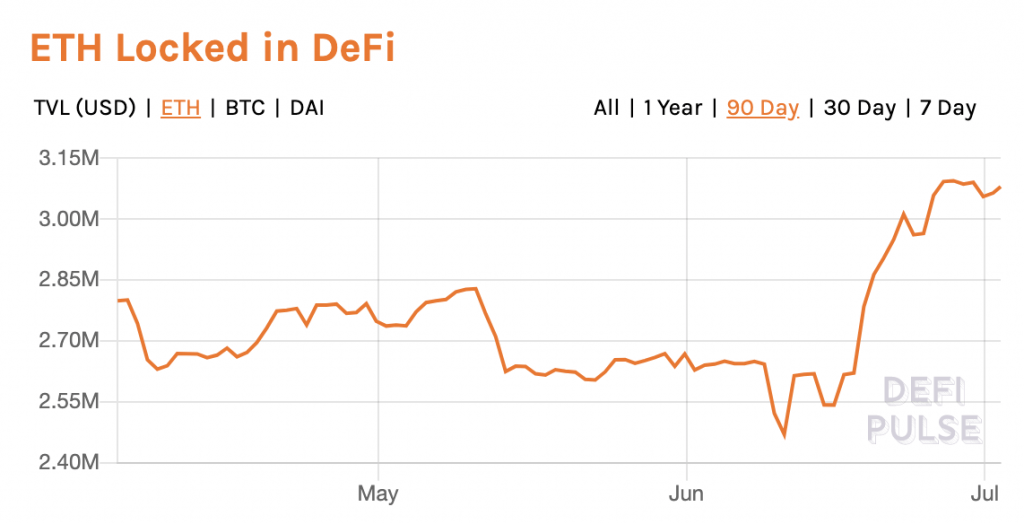

All signs pointed to a breakout. The rally was fueled by quickly rising ETH locked in DeFi applications. A powerful new use case had emerged for Ethereum, and its user base had gone parabolic.

However, the Black Thursday market collapse set back DeFi and put a stop to Ethereum’s bull run.

Now, markets have cooled off again, and Ethereum is once again flirting with resistance just as DeFi returns to previous highs.

Is Decentralized Finance the Catalyst For Breaking The ICO-Driven Record?

A fiery debate has reached a boiling point in the cryptocurrency community: can DeFi push Ethereum past previous highs set during the ICO boom, or will lightning never strike a second time for the altcoin?

Analysts believe that altcoins will never return to such highs, even if Bitcoin breaks its previous high. However, hedge fund managers point to a trillion-dollar market cap for Ethereum thanks to DeFi growth.

The fund manager claims that while there’s no denying the insane demand ICOs caused, DeFi is a far more sustainable trend for the long-term, that will bring Ethereum slow, but steady growth.

Such an achievement would do a lot more than taking Ethereum past $1,400. At the current circulating supply and a trillion dollar market cap, it would take the asset to well over Ethereum price predictions at more than $9,000 per token.

Trade Ethereum, Bitcoin, And Traditional Markets With Award-Winning PrimeXBT

If pressure from DeFi growth is building beneath Ethereum, a break of resistance may be days away. If the second-ranked cryptocurrency can break and close above $250, $500 will be the next pit stop on its way, potentially to $9,000 per ETH.

Traders seeking to take advantage of Ethereum’s big breakout can do so on PrimeXBT, an award-winning Bitcoin-based trading platform supplying the data used in these insights.

PrimeXBT offers long and short positions on commodities, forex, stock indices, and cryptocurrencies like Bitcoin and Ethereum. When Ethereum does make its move, prepare yourself with PrimeXBT.

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of EWN or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.