Ethereum, Binance Coin, and Ontology looked bearish at the time of writing, a surprising finding especially since it followed the latest surge in Bitcoin’s price. However, with DeFi and ETH gathering steam, the larger altcoin market seems to be enjoying a rally, and hence, this might be the best time to take advantage of the existing momentum.

Ethereum [ETH]

Source: ETHUSD on TradingView

Ethereum is still the second-largest cryptocurrency in the market with a market cap of $29 billion. Trailing it is the infamous stablecoin Tether aka USDT. Ethereum’s most prized creation is the ERC20 token, which now rules most of the DeFi landscape. Although nascent, the TVL in Defi recently hit a whopping $3.36 billion and consists of various tokens built on the Ethereum blockchain.

At press time, ETH was highly overbought, with the same highlighted by the Relative Strength Index. As seen above, the retracement from the recent pump will push the price of ETH down to its immediate support at $250. Depending on how many people take profits, the price might go lower than $250 to the next support at $221.

Binance Coin [BNB]

Source: BNBUSD on TradingView

While Binance and BNB are being mocked on Twitter for placing BNB as the top DeFi token, the future for BNB looks good, at least in terms of price performance.

As seen above, the price has been consolidating and was close to a breakout on the charts. Judging by the MACD indicator, the short-term future looked bullish for BNB. However, considering the position of the price, near the top side of the consolidation pattern, there might be a retracement soon.

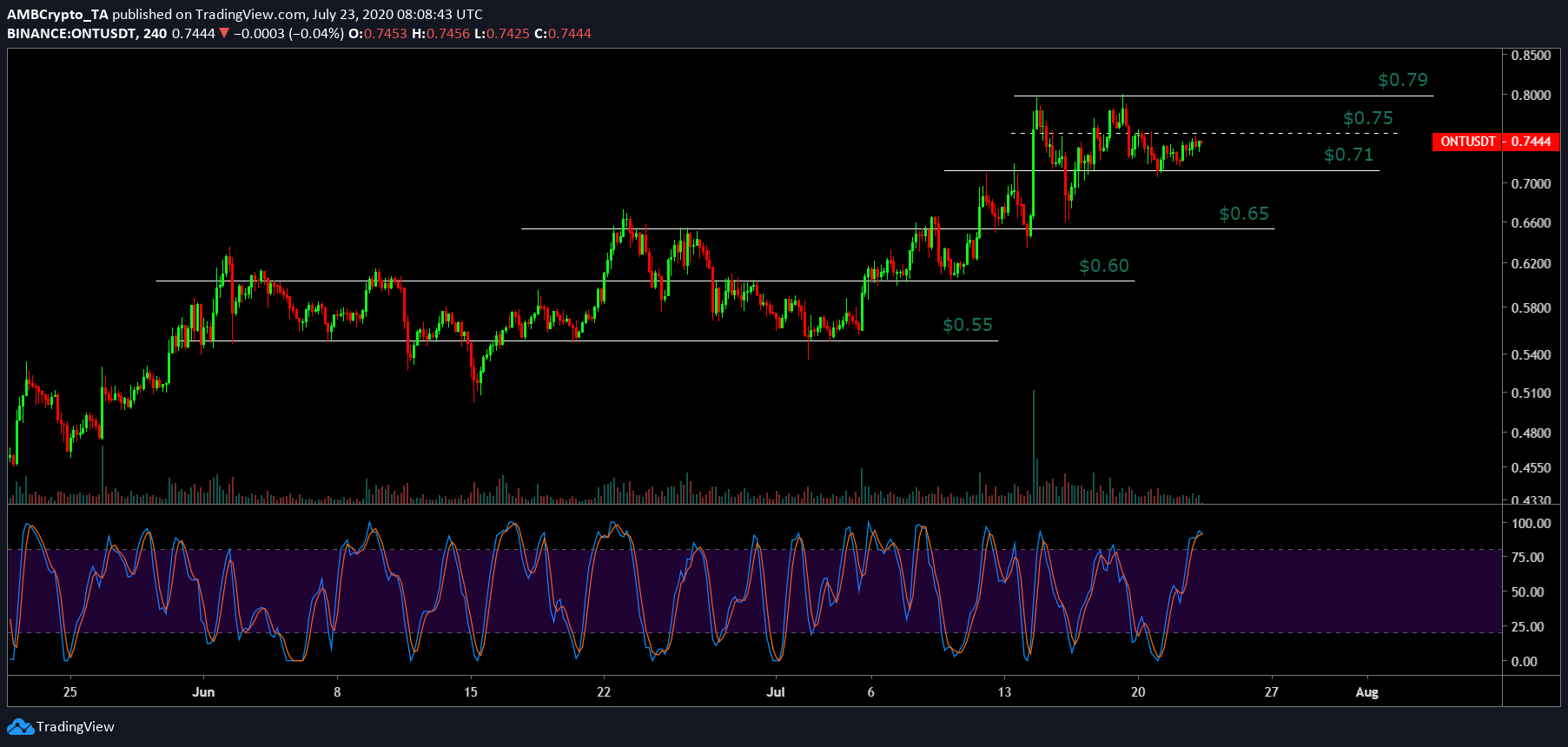

Ontology [ONT]

Source: ONTUSD on TradingView

From the attache charts, it can be observed that ONT was due for a retracement. The resistance at $0.75 will push the price down to the support at $0.71 and subsequently, to $0.65, if the sellers put enough pressure.

Additionally, the Stochastic RSI was in the oversold zone, indicating a retracement as well. Hence, considering both the resistance at $0.75 and the Stochastic RSI, the likely way ONT will move is down. With a market cap of $517 million and a 24-hour volume of $85 million, the token will see a small fall in its market cap due to this move.