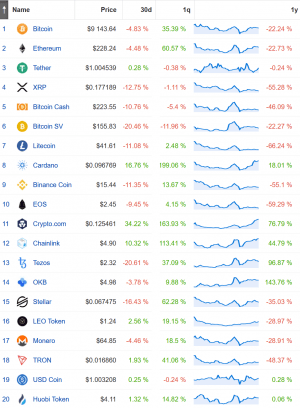

As bitcoin (BTC) and other major coins still trading well bellow highs, seen in June of 2019, only five tokens among the top 20 cryptoassets by market capitalization are in the green on a 12-month basis.

While the crypto market was more or less on fire this time of the year last year, the situation now is that the number one cryptoasset, BTC, is down more than 20% over the past 12 months. The same also goes for most of the other major cryptoassets, with ethereum (ETH), bitcoin cash (BCH), bitcoin SV (BSV), and litecoin (LTC), all trading down by more than 20% over the same time period.

Among them, litecoin stood out as the worst performer, with a 12-month loss of more than 66% as of press time on Friday (13:48 UTC).

Despite losses being seen across most of the major cryptoassets, however, some coins also stood out with strong gains over the past year. Most notable were crypto.com coin (CRO), tezos (XTZ), and OKB, which saw 12-month gains of 77%, 97%, and 144%, respectively.

(OKEx’s exchange token OKB, is ranked number 14 in terms of market capitalization by Coinpaprika and Coingecko, while CoinMarketCap, owned by Binance, ranks it as the 34th most valuable cryptoasset.)

Besides the abovementioned assets, the only other coins in the top 20 with green numbers over the past 12 months were chainlink (LINK) and cardano (ADA), with gains of 45% and 18%, respectively. (Technically, the USDC stablecoin and huobi token (HT) are in the green too, with an increase of 0.28% and 0.06% respectively, that might be erased any minute).

Digging a bit deeper and looking at the on-chain analytics for each asset as provided by blockchain analytics firm Into The Block, LINK stands out among the year’s winners. According to the data, chainlink’s LINK token has been a profitable bet for the greatest number of holders, with a whopping 100% of token holders currently said to be “in the money.”

However, chainlink’s “in the money” score was closely followed by crypto.com coin, where 96% of holders were making profits, according to Into The Block’s data.

Also, interesting to note is that despite BTC being down for the year, more of bitcoin’s holders were “in the money” – with 70% currently profitable – than what the situation was for better-performing assets like ADA, where 69% of holders had positive account balances in fiat terms, the data showed.