Litecoin is currently caught within a slight uptrend that has allowed it to post some large gains throughout the past few days.

Notably, LTC is currently climbing higher while Bitcoin, Ethereum, and most other major altcoins see stalling momentum. This is a sign that it is incurring technical strength that is independent of the rest of the market.

While examining the on-chain factors underpinning LTC, however, it appears that there are some mixed signs with regards to this movement’s strength.

Among other things, Litecoin’s daily active address count is showing signs of faltering, and its network volume is currently lagging far behind its price.

Litecoin breaks market-wide consolidation trend as it pushes towards $70

While Bitcoin is consolidating around $11,000, Litecoin is currently pushing higher, with its buyers looking to target its next resistance at $60.00.

At the time of writing, LTC is trading up over three percent at its current price of $57, which marks a notable climb from weekly lows of $44.

Today’s upswing marks a breakout after a single-day consolidation phase, and it has allowed the crypto-asset to outperform many of its peers.

These fundamental metrics may spell trouble for LTC’s ongoing upswing

There are a couple of fundamental metrics that spell trouble for Litecoin’s ongoing uptrend.

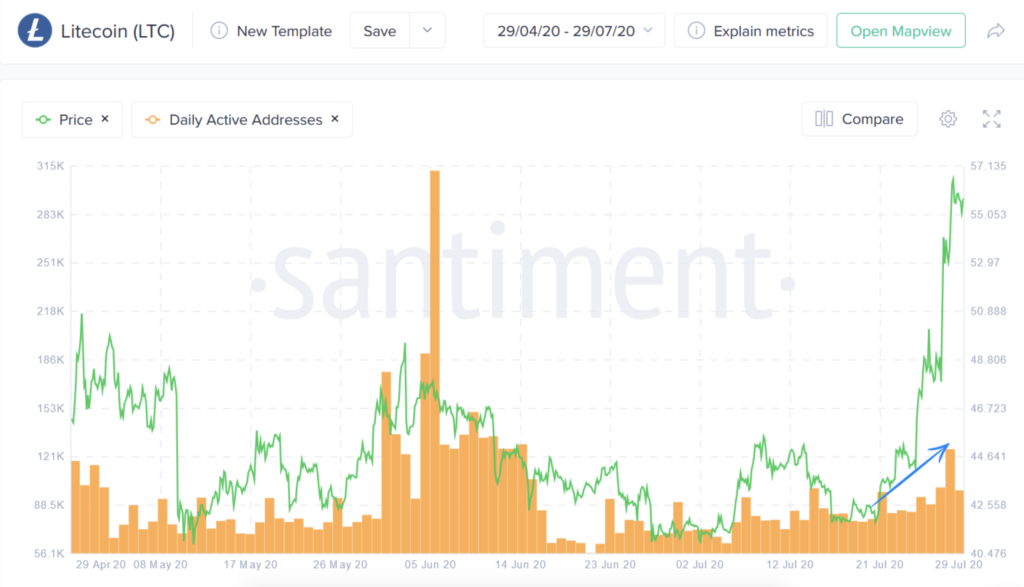

Analytics platform Santiment pointed to these in a recent blog post, explaining that daily active addresses and network activity are both flashing warning signs.

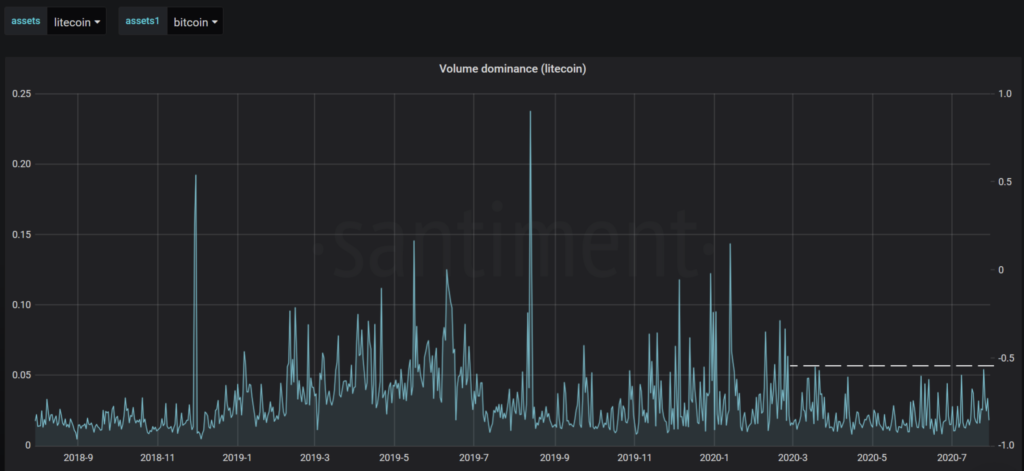

While looking towards the cryptocurrency’s network volume, it has not seen any type of notable spike despite the rising price. They conclude that this may signal that LTC is trying to “pump into deflating fundamentals.”

“While Litecoin’s price continues to rise, its network volume has yet to catch up, and trying to pump into stagnant or deflating fundamentals is rarely what you want to see in a coin.”

This isn’t the only factor that may be counting against Litecoin.

Santiment data also illustrates a sharp decline in the number of addresses sending and receiving the digital asset, showing that there may not be enough investor activity to support the ongoing upswing.

While speaking about this metric, the analytics firm explained that although it’s still too early to declare a clear downtrend while looking at daily active addresses, it is something to watch closely.

“Keep an eye on Litecoin’s daily active addresses in the next couple of days – after a few strong days correlating with the price action, the amount of addresses sending or receiving LTC dropped by -15% compared to the day prior.”

If these metrics don’t start trending upwards in the near-term, there’s a high probability that Litecoin’s uptrend will be fleeting.

Like what you see? Subscribe for daily updates.