- The largest crypto-asset management firm in the world, Grayscale, has revealed that it has shifted its portfolio towards Bitcoin and Ethereum at the cost of XRP, LTC and BCH.

- Grayscale’s investment in crypto products in 2020 exceeds the total investment of the last 7 years.

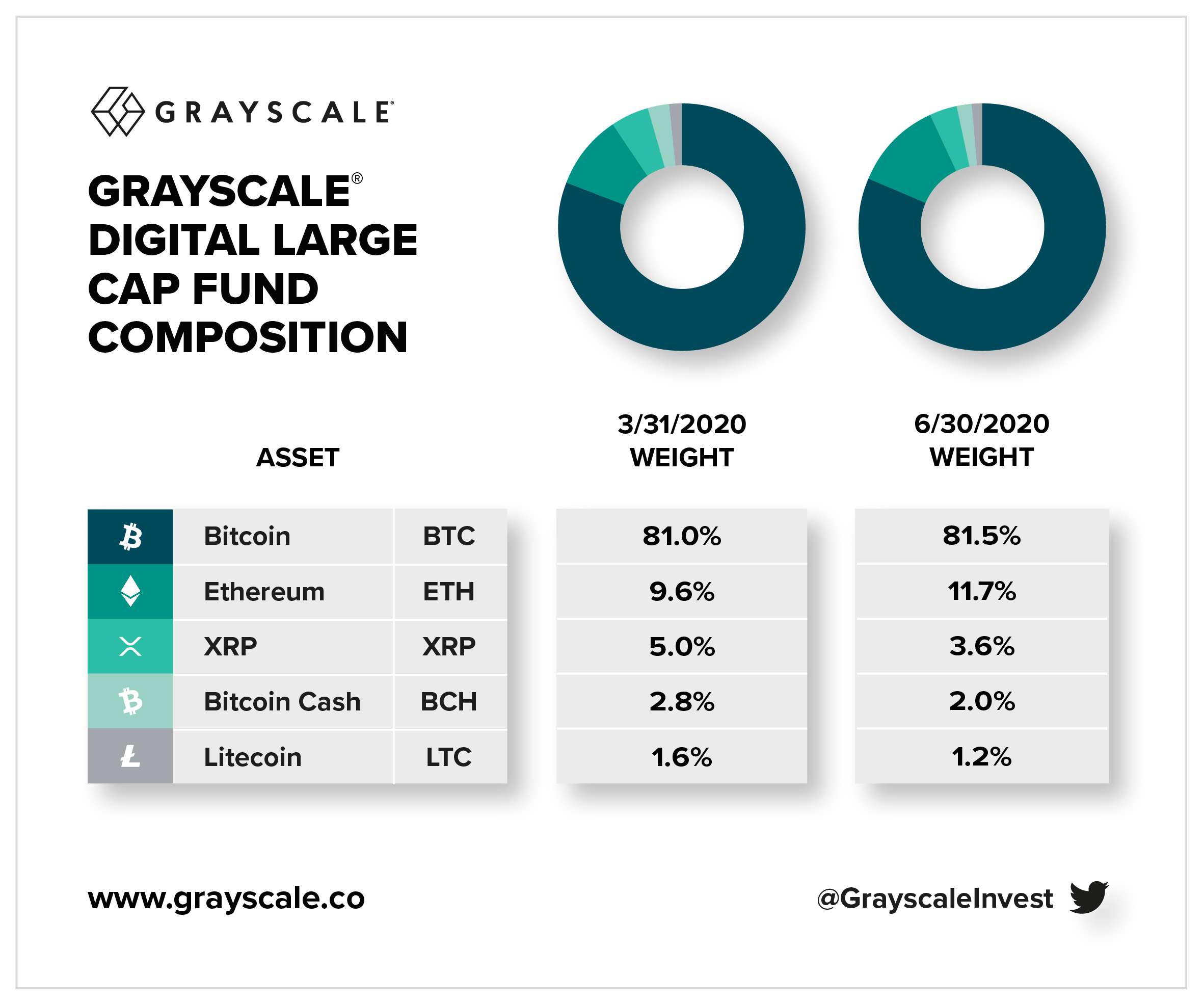

Following the release of its quarterly report, crypto asset management company Grayscale has published an update on the weighting of its Digital Large Cap Fund (“DLC Fund”). According to Grayscale, it will increase its exposure to Bitcoin (BTC) and Ethereum (ETH), but will reduce its allocation of XRP, Bitcoin Cash (BCH) and Litecoin (LTC).

1/ Following the Quarterly Review (6/30/20), we are pleased to announce the updated weightings for Grayscale Digital Large Cap Fund (“DLC Fund”)

— Grayscale (@GrayscaleInvest) July 6, 2020

Grayscale gives priority to Bitcoin and Ethereum

According to Grayscale, the DLC is a passive fund based on strategic rules. Customers of the active crypto asset management company can use it to gain exposure to 70% of the crypto market segment. For this purpose, the DLC fund is composed of the 5 cryptocurrencies mentioned above. As announced via Twitter, Grayscale has decided not to add any new crypto assets after its last quarterly valuation.

As a result, Grayscale adjusted and increased its holdings of Bitcoin by 0.5% between March 31 and June 30, 2020, so that they now represent 81.5% of the DLC Fund. Regarding Ethereum, Grayscale increased its holdings by 2.1% and its share in the fund by 11.7%. The other cryptocurrencies saw their percentages fall.

Of all the cryptocurrencies, XRP recorded the largest decline, down 1.4%, with XRP now accounting for 3.6% of the fund. Bitcoin Cash lost 0.8% and Litecoin 0.6%. As can be seen below, these two cryptocurrencies represent 3.2% of the DLC.

Source: https://twitter.com/GrayscaleInvest/status/1280150389506146304/photo/1

Grayscale announced that its next quarterly evaluation will occur in September 2020. By that time it may adjust the DLC Fund again. The crypto asset management firm has $33 million in net assets under management (AUM) located in its Grayscale Digital Large Cap Fund.

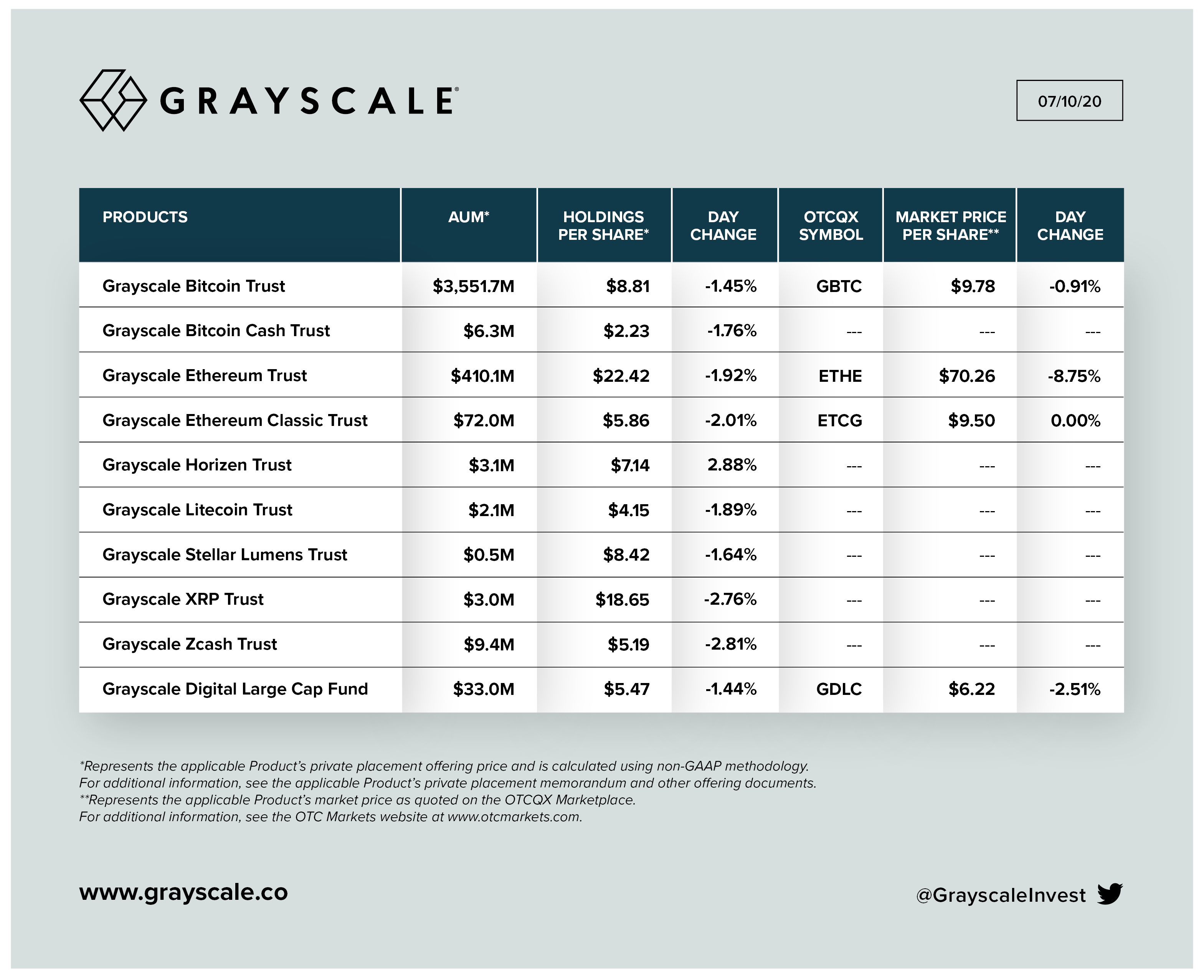

In addition, Grayscale revealed that it has $4.1 billion in its total assets under management (AUM). Of the products offered by the crypto asset management firm, the Grayscale Bitcoin Trust (GBTC) remains the largest with $3,551.7 million. The Grayscale Ethereum Trust has a total of $410 million and, although smaller than the BTC-based fund, handles a larger amount than all the other products offered.

Source: https://twitter.com/GrayscaleInvest/status/1281689373394821121/photo/1

The asset management firm has been one of the most important participants of the crypto market in 2020 by bringing institutional investors into the market. Compared to this year’s AUM of $4.1 billion, Grayscale’s investment in cryptocurrencies during 2019 was $1.17 billion in AUM. This represents a 250% increase, and an investment that exceeds anything Grayscale has done in previous years in terms of crypto assets.

Last updated on