Disclaimer: The findings of the following analysis look into Ethereum’s bearish breakout and the recovery effort that followed. The emerging trend, at the time of writing, was bullish in nature since it seemed that the cryptocurrency’s support levels were holding up on the charts

The Bitcoin market noted a sudden depreciation in its price on 3 July, a movement that was also mirrored by the market’s second-largest cryptocurrency, Ethereum [ETH]. In fact, Ethereum’s price dipped from $230.98 to $224.61 within an hour and fell to $222. However, ETH’s price had started to recover within hours.

Source: ETH/USD on TradingView

ETH’s daily chart showed the uptrend that dictated the price of ETH over the past four hours, with the same moving towards the 50 moving average. At the time of writing, the price had already breached the 100 moving average, with the cryptocurrency rejecting $228.27.

Further, the price had been bouncing within an ascending channel for a couple of days before eventually submitting to the fate of a bearish breakout on the charts. The sudden surge in the price of the coin formed the peak of the channel, with the crypto then losing momentum.

The Fib retracement marked support points for the coin and underlined the fact that the price had already surpassed its support level at $231.48. The market’s rising bearish momentum had pressured the price of the coin into diving under $227.52, with the price rebounding soon after when ETH touched $222 on the charts.

Finally, a glance at the Relative Strength Index [RSI] revealed that the digital asset was in the buying territory after bouncing back from the oversold zone.

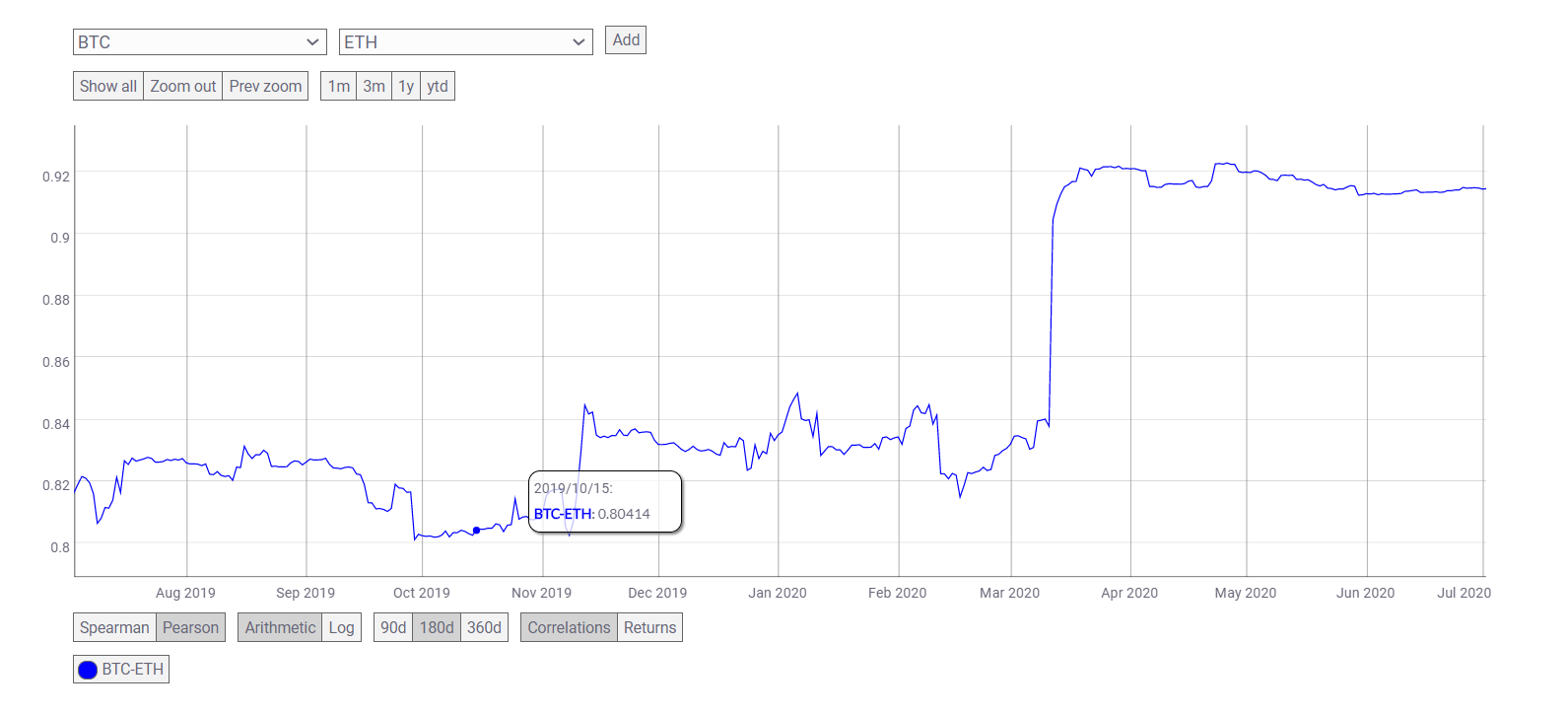

Source: CoinMetrics

The correlation between two of the world’s largest cryptocurrencies has been strong. Even though the chart suggested that the correlation was sloping downwards, it was still high. Thus, the dump that took place in the BTC market was responsible for ETH’s price slipping past the $227-mark. At press time, ETH was again moving sideways and was hovering around the aforementioned level.

Source: Coinstats

Your feedback is important to us!