The Ethereum market has been noticing a spike in its value given the surge in the Bitcoin market. This spike was of 11%, however, according to the daily chart of Ethereum, it has been marching upwards for the past 6 days and has managed to appreciate its value by 58%. The value of ETH has boosted from $236.18% on 21 July and peaked on 27 July at $372, registering a yearly high.

Source: ETH/USD on TradingView

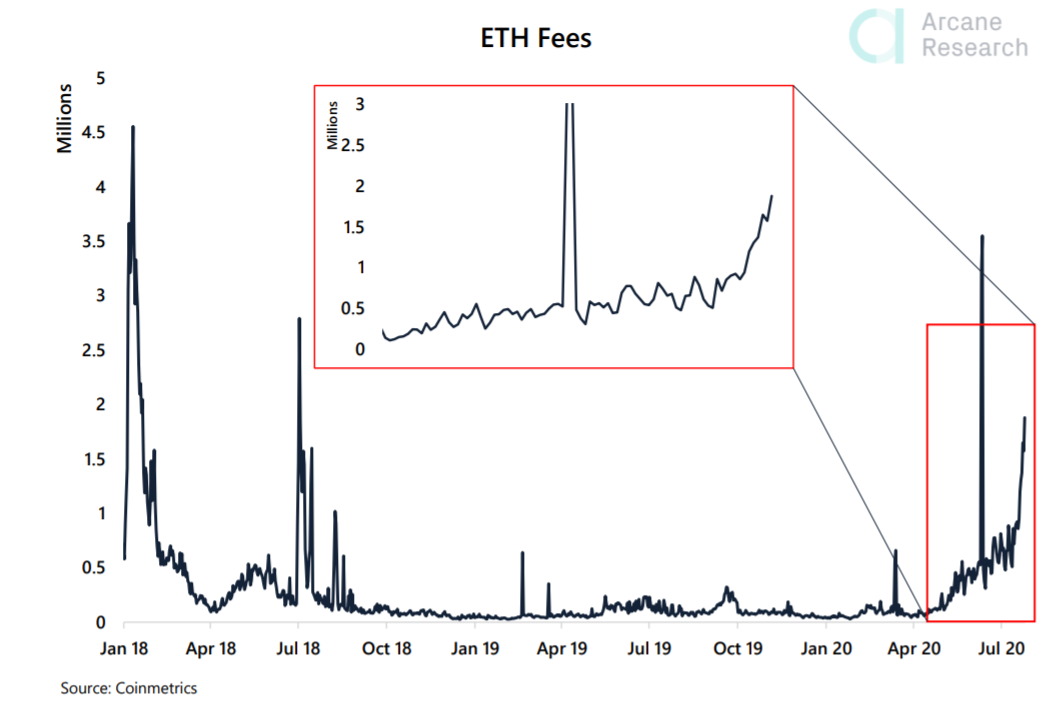

The increasing value of Etheruem also brought many traders back into the market. This was indicated through a growing value of Ethereum fees. As per data collected by Arcane, Ethereum’s transaction fees were at a 2-year high of $1.8 million on 25 July. the median transaction fee was $0.72, which was nearly 10x the median fee of April.

Source: Arcane

This increase in fees was mainly driven by increased activity in DeFi. The total value locked in DeFi has reached $3.64 billion, which is an increase of approximately 230% in the last two months. However, all of the DeFi was not supporting this growth but a few projects like Maker, Compound, and Balancer.

Maker was the largest contributor to the total value locked and also the first DeFi project to surpass $1 billion in TVL on 27 July. While others fix the focus on the beginning of the growth of DeFi recently with Compound in June. As the second-largest DeFi lending app distributed its governance token, COMP, there was a lot of activity seen on the blockchain. It gave way to yield farming, a controversial way to put the use of cryptos to earn more tokens.

However, as these incentives garnered larger capital for DeFi, it also gave rise to the risks associated during an unfortunate event of a crash. Blockchain Capital’s senior associate, Aleks Larsen explained this risk in his recent blog. Larsen stated:

“One can imagine a situation where an outside protocol creates incentives that — without any action of its own — can drive dangerous behavior in another protocol and ultimately result in cascading liquidations and user losses.”

This gives way for many to speculate whether DeFi was just another bubble like the ICOs that were common a few years ago and whether it was going to burst. There might not be a lot of support to this theory, but there were various users looking to benefit from this alleged bubble. A Twitter user @DarkCryptoLord stated:

“This honestly feels like 2017 all over again. And now we are the chads who survived 2015-2016 bear market. Please let this defi-driven-bubble continue till at least end of 2020 please please”

While stablecoins balance, especially of Tether on Ethereum also increases. Currently, the total supply held on the blockchain was close to 6.40 Billion USDT, while the transaction amount on 27 July was reported at a yearly high of 3.555 billion USDT, as per etherscan. Thus, the ecosystem has been reporting growth with increased utilization, but other use cases are suffering due to the attention shifting to some DeFi projects and Tether.