Despite some crypto exchanges still increasing their trading fees, the future may bring about a highly anticipated reduction in fees as competition heats up in the industry, crypto research firm Arcane Research said in a new report.

Even though bitcoin itself can be considered “a homogenous product,” the same cannot be said about bitcoin trading, which is subject to varying degrees of counterparty risk, regulation, and liquidity, the firm said in the report, published yesterday.

This means that traders, for now, are willing to pay a premium to trade on exchanges that are seen as having better liquidity, being more regulated, safer, and so on. Over time, however, this difference is likely to be reduced, and fee levels will become more equally distributed across the exchange landscape, Arcane said, suggesting that free trading could become a thing:

“Over time we might move towards ‘fee-free’ exchanges as seen in traditional finance,” the report said, although it warned that these types of exchanges “might carry a hidden cost,” for example by selling their clients’ order flows to market makers.

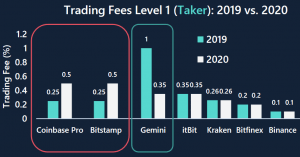

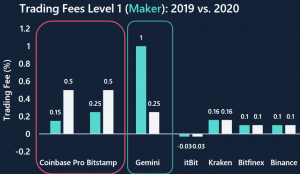

Looking at today’s situation, however, the report said that Coinbase Pro and Bitstamp are “by far” the most expensive exchanges to trade on for new retail traders, although fees here do get lowered for higher-volume traders.

Further, the report also showed that some exchanges, such as Gemini, have cut their trading fees between 2019 and 2020, while others (e.g., Coinbase Pro and Bitstamp) have increased their fees over the same period.

Lastly, the report also mentioned the Paxos-backed crypto exchange itBit, which already has gone down the path of ‘fee-free’ trading by offering rebates to users that effectively pays them to place maker (limit) orders on the platform.

In a bid to gain market share and more trading volume without relying on professional market makers, itBit instead offers an effective negative trading fee of -0.03% for maker trades that adds liquidity to the order book. Despite this effort, however, the report noted that itBit still appears to struggle with gaining market share, while having the lowest daily trading volume among all exchanges surveyed.

And although this differentiation in fees between exchanges has been taking place over the past year, the research firm still believes that increased trading in the future eventually will bring about lower and more equal trading fees for all market participants.