Bitcoin, like the pied piper, has had an overwhelming influence on the market’s altcoins. As the major coin has been restricted between its immediate resistance and support, many altcoins have also been imitating this behavior. However, Chainlink, a new entrant in the CoinMarketCap’s top 10 cryptos, has been proving to be a beneficial investment, when most other coins are battling a stagnant market.

Chainlink has been reporting a 350% YTD compared to 28% of BTC. Even though the correlation between Chainlink-BTC has been moving like any other alt, its value has been appreciating, unlike others. This rising value garnered interest from many users in the crypto market, willing to earn that extra buck. According to data collected by Glassnode, as the digital asset became more liquid on exchanges, its on-chain holdings were also noticing a rise in popularity. Exchange withdrawals spiked alongside deposits, as the metric reached its second-highest peak.

Source: Glassnode

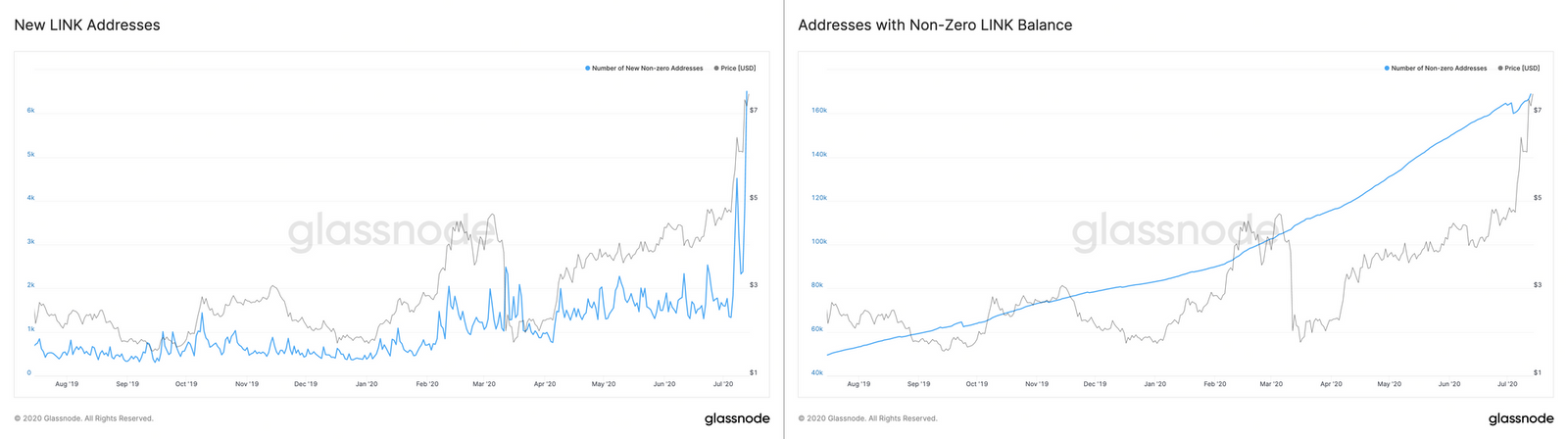

The number of new addresses acquiring Link per day has reached an all-time high, along with the total number of addresses holding the coin. Even though the number of addresses holding Link witnessed a decline, it turned around to overtakes its previous highs.

Source: Glassnode

As the demand for Link rose, the coin could experience another surge being a DeFi-enabled token. The platform has been exhibiting strong growth as users turn to earn high interest, Link could be the apt token as it provided one of the highest interest to users interested in protocols like Aave.

ChainLink has been positioned as an appropriate contingency plan in this consolidating market. With increased deposits, the price o Link has doubled, suggesting there was an even higher buying pressure. As the exchange withdrawals increased, the market was in the mood to hodl the coin rather than realizing immediate gains.