Source: R.Danyliuk – Shutterstock

- As the founder of Capriole Investments points out, the decision of the American OCC could trigger a global domino effect that will more than double the price of Bitcoin.

- The legalization of crypto-custody by US banks is proof that Bitcoin cannot be banned.

The past few weeks have seen perhaps the biggest news of the year for the crypto space. As CNF reported, the US Office of the Comptroller of the Currency (OCC) published a letter clarifying that all licensed banks in the US are allowed to offer cryptocurrency custody services. Specifically, the U.S. authority stated that every bank in the country may store and manage cryptographic keys for its customers.

Even if Bitcoin reacted with a slight upward movement – the BTC price is close to USD 9,600 at the time of writing – the long-term effects could be massive. In a series of tweets, the founder of Capriole Investments, Charles Edwards, described why the OCC’s decision is so important. As Edwards explained, the decision will trigger a domino effect:

US financial institutions drive much of global financial actions. This will be a global domino effect, and enable:

Increased public awareness & trust in Bitcoin

Multiple new demand and on-boarding streams

Furthermore, Edwards also pointed out that it is now clear that Bitcoin and cryptocurrencies can no longer be banned.

Legalisation of US banking crypto custody is evidence why #Bitcoin can’t be banned. It is game theory playing out. Collaborative “banning” incentivises other countries not to ban.

Exhibit: legalisation in Germany, India, Korea earlier in 2020…now USA. This can’t be stopped.

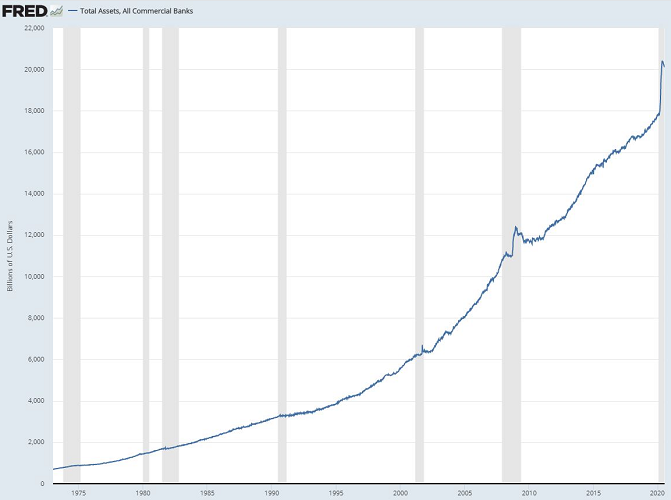

Edwards also said that the Bitcoin price could explode quickly if banks put only 1% in the market. According to the Digital Asset Manager of Capriole Investments, Bitcoin could more than double under the above condition. To substantiate this, Edwards referred to a diagram of the Federal Reserve, which shows that US commercial banks have assets of 20 trillion US dollars:

If US banks put just 1% of their assets into #Bitcoin as an investment, hedge or insurance… … the Bitcoin price more than doubles.

Just 1 NASDAQ stock (Grayscale) already owns 2% of circulating Bitcoin supply today.

It’s not hard to see where this is going.

Source: https://twitter.com/caprioleio/status/1286237259658919936

Messari study supports Edwards’ thesis

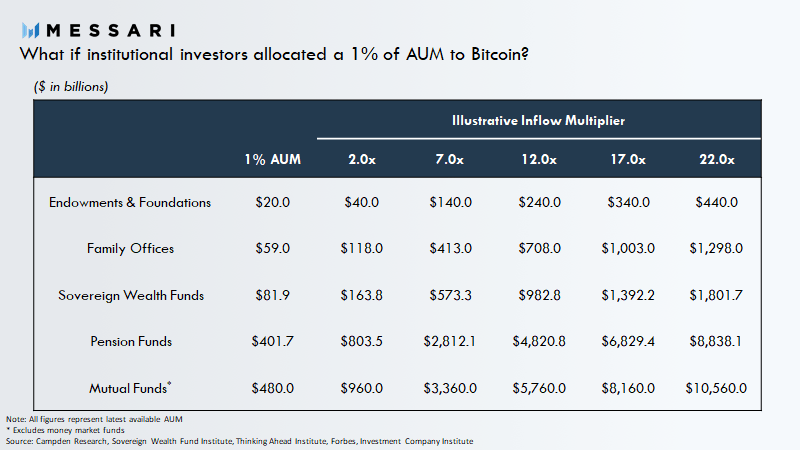

Already last month, Messari researcher Ryan Watkins explained that an institutional allocation of a total of 1% for Bitcoin could “slightly” increase the total value of Bitcoin to over $1 trillion (1,000 billion) USD. Watkins called it a “perfect storm” that could drive the Bitcoin price above $50,000 USD. According to the report, the storm would be driven by a phenomenon Messari describes as a “Fiat amplifier:

Flows in and out of an asset do not necessarily cause one-to-one movements in the price of the asset and can be amplified to much larger price movements.

If foundations, family offices, sovereign wealth funds, pension funds, and mutual funds were to invest only a small amount of between $20 and $480, depending on the institution, the investment could double up to 22 times, as the table below shows, due to the higher “liquidity and reflexivity”.

Source: https://twitter.com/RyanWatkins_/status/1275426694237741057/photo/1

OCC’s decision could thus lay the foundation for a massive bull run for Bitcoin.

Last updated on