BTC/USD, LTC/USD, ETH/USD, US Dollar, Ethereum, Litecoin, Bitcoin – TALKING POINTS

- BTC/USD has been trading directionally for a while – when will it break out?

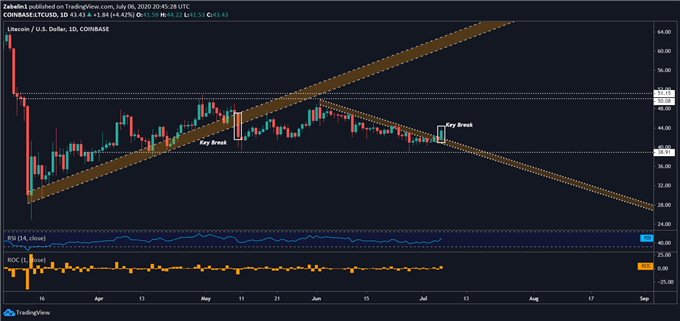

- LTC/USD has invalidated steep downtrend, opening a door for a bullish spike

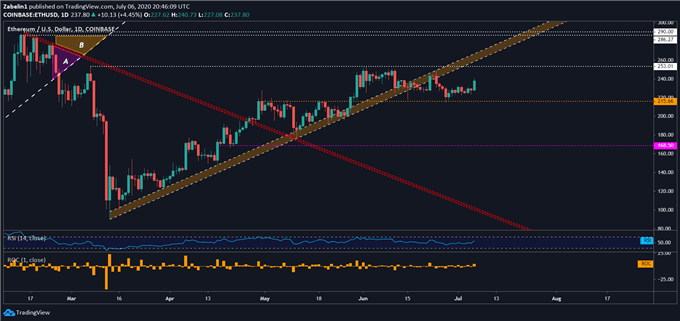

- ETH/USD sideways trading could be coming to an end, but in which direction?

Bitcoin Outlook

Since mid-June, BTC/USD has been seesawing between two tiers of an inflection range marked by the 9140.00-9288.44 parameter. If Bitcoin prices are able to surmount 9288.44 and the psychologically significant 10,000 market price, the next obstacle to clear may be the February swing-high at 10540.49. Conversely, if BTC/USD descends below 9140.00, its fall may be cushioned by frequently-tested support at 8520.13.

BTC/USD – Daily Chart

BTC/USD chart created using TradingView

Litecoin Outlook

After being rejected at the bottom layer of the 51.15-50.08 resistance range, LTC/USD fell almost 20 percent and was guided lower by a steep, descending resistance channel. However, Litecoin’s recent break above it could pave the way for additional gains if the downtrend’s invalidation inspires buyers to enter the market. The pair’s ascent may encounter some friction at familiar resistance at 50.08.

LTC/USD – Daily Chart

LTC/USD chart created using TradingView

Ethereum Outlook

Ethereum prices have been stuck in directionless trade, having ranged between support at 215.66 and resistance at 253.01 since late May. If ETH/USD is able to break out of the congestive cocoon, its ascent may encounter some friction at a narrow but critical resistance range between 286.27 and 290.00. Conversely, if it breaks below 215.66, the pair may trip down a slippery selling slope until it grasps onto support at 165.50.

Recommended by Dimitri Zabelin

Forex for Beginners

ETH/USD – Daily Chart

ETH/USD chart created using TradingView

— Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitriTwitter