The cryptocurrency market recovery is driven by altcoins. XRP, BCH, ADA, LINK, XLM and other coins have been smashing resistance levels one after another with no particular fundamental reason. Bitcoin (BTC) is struggling at $9,300 and losing its market dominance. The total capitalization of all digital assets in circulation has reached $272 billion, while Bitcoin’s market share slipped to 62.7%.

Ethereum Technical Analysis: ETH/USD eying up $300 after a convincing bullish reversal pattern

In just three days, Ethereum was able to confirm a daily uptrend and break above an important long-term trendline. Bulls are now only facing the resistance area between $250-253.47 before $287.41, the 2020-high. Ethereum 2.0 is also getting closer and closer and might be having an impact in the price.

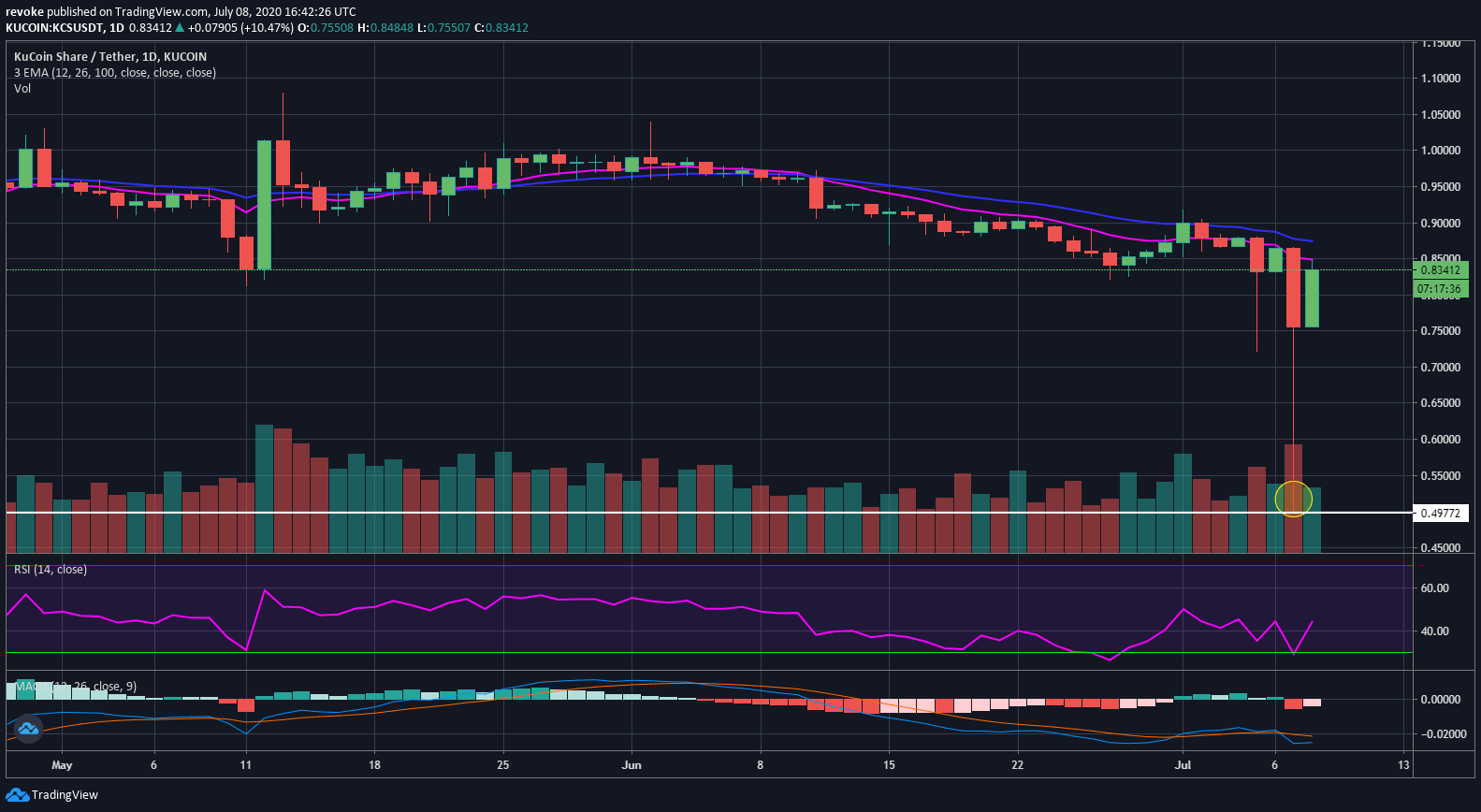

KuCoin Shares Technical Analysis: KCS/USD recovers from a 42% flash crash and gets closer to $1 again

KuCoin Share is a token created by KuCoin, the cryptocurrency exchange. KCS holders receive dividends in the form of other tokens. The flash crash on July 7 is definitely weird, although it can be attributed to a lack of liquidity. Fortunately, KCS crashed and recovered within 30 minutes but not entirely. KCS was trading at around $0.82 before the crash and only managed to recover to around $0.74. Hours later, bulls finally pushed KCS back up to $0.82.

The preceding article is from one of our external contributors.

It does not represent the opinion of Benzinga and has not been edited.

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

-637298172269519385-637298328672636941.png)