Bitcoin’s funding rate has largely been negative for more than 3 months while the price barely moved. This shows that not only is the volatility low but buyers are being evened-out by sellers.

Bitcoin Funding Rate

Source: Skew

Funding Rate is used to measure the sentiment of an asset; to determine the dominating side – buyers or sellers. If the funding is positive, it means longs will pay shorts, and if it’s negative the shorts pay long. Another way to interpret this is that it is more expensive to short when the funding is negative and vice versa if it’s positive.

Hence, on most exchanges, including Binance, BitMEX, ByBit, etc funding rate is negative, which means that people are bearish on BTC. The reason for this can be explained with volatility, which is largely dampened and in the lower zone.

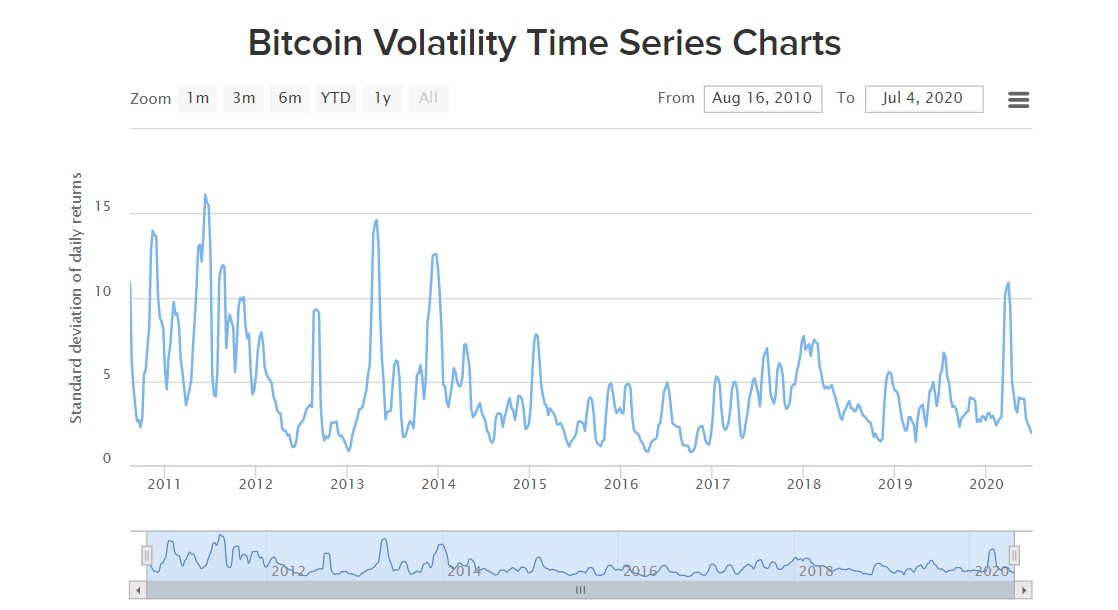

Source: BTCVol.info

As seen above, volatility is dipping towards the zone last seen in early 2016. A continuation of this can be expected, suggesting more sideways price action in the coming days. Bitcoin has been stuck under $10,500 for over 300 days, more days are likely to be added to that figure, considering the funding rate, which has been in the negative territory for more than 3 months.

Negative funding rate and its effects?

While the funding rate is only applicable for BTC, its effects can be felt in the entire ecosystem since altcoins have a strong connection with BTC. At press time, BTC dominance stood at 65%, which was enough to sway the altcoins to the tunes of BTC. If BTC does crash to $8,300 or by $1,000, the likelihood of altcoins following suit is more than possible.

Considering BTC was due for a drop of $1,900 when it was priced at $9,670 a month ago; since then, the price has dropped by $600 and hence, the further drop could span anywhere from $1,300 to $1,000.

Your feedback is important to us!