A technician inspects the backside of bitcoin mining at Bitfarms in Saint Hyacinthe, Quebec on March … [+]

AFP via Getty Images

In early 2020, researchers predicted the cost to mine Bitcoin will be at around $12,000 to $15,000 after the block reward halving in May. But, it is now much cheaper to mine BTC than the initial estimates. The low breakeven price to mine Bitcoin may leave it vulnerable to a correction.

Bitcoin has become more affordable to mine in recent weeks due to two main factors: difficulty adjustments and cheaper electricity in Sichuan, China due to the rainy season.

A low breakeven price of Bitcoin can raise the probability of a price pullback because miners have more incentive to sell BTC, which may increase selling pressure in the short-term.

On May 11, the third block reward halving in the history of Bitcoin occurred. A halving is activated every four years and it decreases the amount of BTC miners can generate by half.

A halving is necessary for Bitcoin because the dominant cryptocurrency has a fixed supply of 21 million BTC. As it reaches towards its maximum supply, the rate of producing BTC decreases to provide balance.

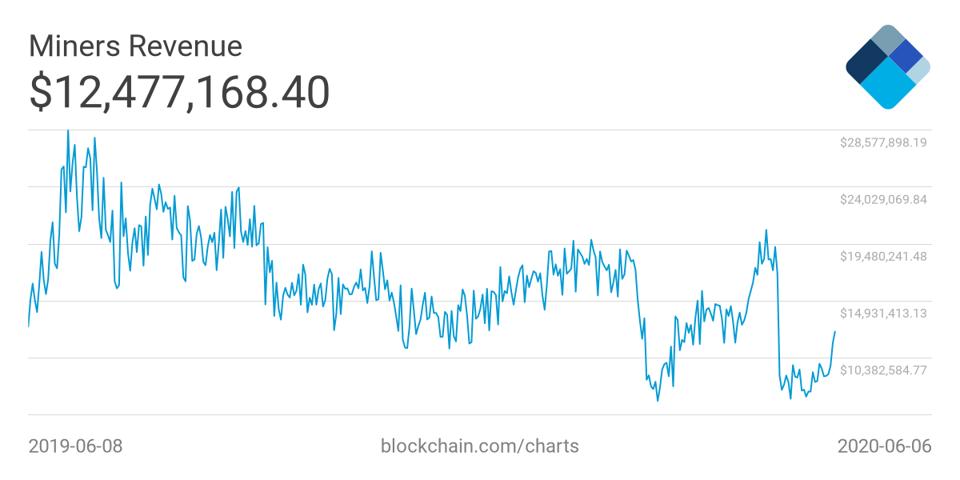

But, when a halving happens, miners experience a near-50% cut in their revenues overnight. As such, it typically leads over-leveraged miners to capitulate or stop operating due to high costs.

Revenue of Bitcoin miners fall steeply after the halving.

Blockchain.com

When fewer miners are mining BTC, the Bitcoin network automatically adjusts the difficulty to mine BTC.

Since Bitcoin miners use computing power to mine, big mining centers can usually mine more BTC after the difficulty adjusts.

The Bitcoin blockchain network saw two difficulty adjustments in the past three months, allowing major miners to see higher revenues in the short-term.

Here’s where the extra surplus of BTC becomes a problem.

According to several Chinese miners based in Sichuan, China, electricity in the region costs around $0.04 per kilowatt-hour.

Due to the rainy season and the abundance of hydropower plants in the area, mining industry executives state that large mining centers in China can often negotiate lower electricity prices.

With $0.04/kwh, miners based in China said that the breakeven cost to mine Bitcoin hovers in the $5,000 to $6,000 range.

Even individual miners running commercial mining equipment like the Antminer S9 is operating at a breakeven cost of $8,206.

“To be completely accurate: Given current difficulty, 0.04$/kWh and S9 running custom firmware bringing it down to 71W per TH efficiency. The cost to mine 1 BTC is 8206.64$. Meaning its still profitable,” one miner said.

Considering the cost to mine Bitcoin for both big mining centers and individual miners can range in between $5,000 and $8,500, miners have more incentive to sell to cover operational costs rather than to hold onto the BTC they mine.

According to data from ByteTree, Bitcoin miners did not sell much Bitcoin in the past week. Around 6,825 BTC were mined and 6,298 BTC were sold, leaving 527 BTC in net inventory.

Bitcoin miners did not sell more than they mined in the past seven days.

ByteTree

In previous weeks, especially throughout March, on-chain data shows that miners sold more Bitcoin than their revenues.

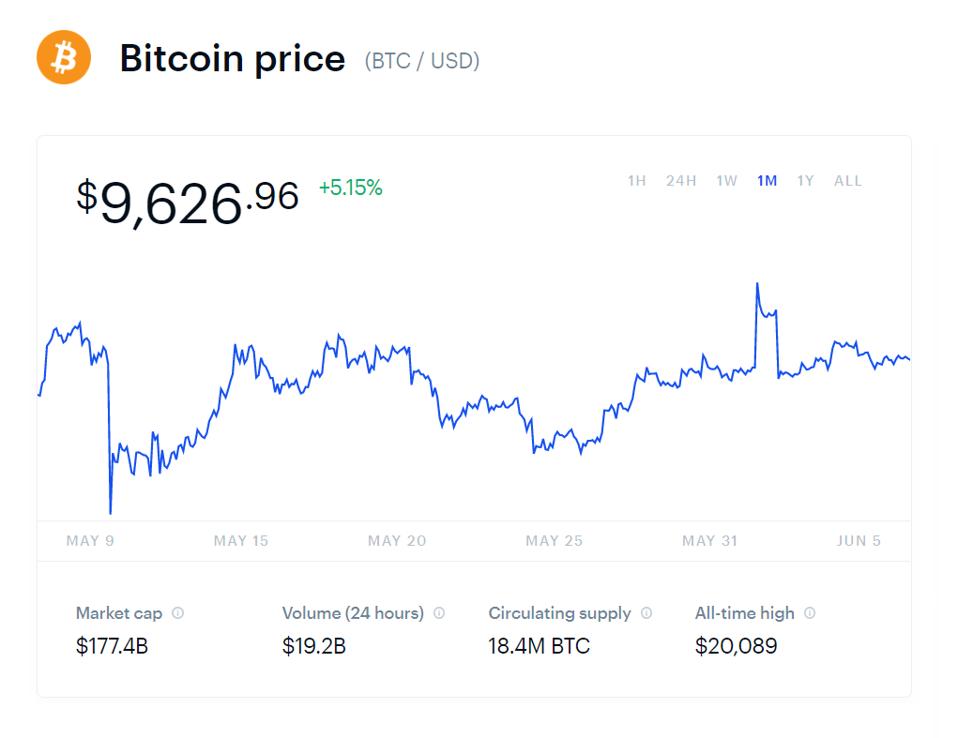

Yet, the price of Bitcoin struggled to see a short-term rally despite the noticeable decline in selling pressure from miners since the start of June.

The price of Bitcoin struggles to break out despite low selling pressure.

Coinbase

The relatively cheap cost to mine Bitcoin and the failure of BTC to break out of a multi-year resistance level at $10,500 with fewer sellers in the market raise the likelihood of another correction.