The following is a contributed article from a content partner of Benzinga

Stablecoins are gradually growing in prominence as a type of cryptocurrency that satisfies the store of value requirements of money. In 2016, there were only about 11 stablecoins in the market, the number increased to 21 in 2017. By 2019, the Consensys State of Stablecoins report placed the number of live stablecoins at 66, and about 134 other stablecoins were being developed.

Stablecoins are predominantly issued on the Ethereum blockchain because the lack of interoperability across different blockchain networks means that stablecoins mined on one chain are practically useless on other chains. This piece explores how the adoption of cross-chain bridges could solve some of the scalability challenges preventing the mass-market adoption of stablecoins.

A surge in stablecoin interest

The Ethereum Blockchain is the most popular platform for issuing stablecoins because it laid the groundwork for the ERC20 standard. However, the Ethereum Blockchain is currently home to about 267,881 token contracts with more than 500M transaction count and about 103,102 pending transactions. Hence, stablecoins issued on Ethereum will continue to compete with other projects to access to network resources.

According to Blockchain’s 2019 The State of Stablecoins report, about 93% of the stablecoin market and transaction activity revolves around the ERC20 based Tether (USDT). The chart below from the Stablecoin Index shows how the market cap of major stablecoins have fared since COVID-19 was declared as a pandemic on January 30.

The fact that the market cap of Tether has climbed more than 108% from $4.65B to $9.66B further underscores the oversaturation of stablecoins on the Ethereum network. Unsurprisingly, ERC20 token (especially Tether stablecoin) transfers have been identified as the primary reason behind the surge in the recommended gas prices in Gwei.

Ethereum state bloat issue

The Ethereum blockchain seems to be getting bloated. There are some predictions on how the Ethereum Blockchain size will soon exceed 1TB and on how the resulting blockchain bloat could lead to painfully slow network activities that could further setback the widespread appeal of crypto assets.

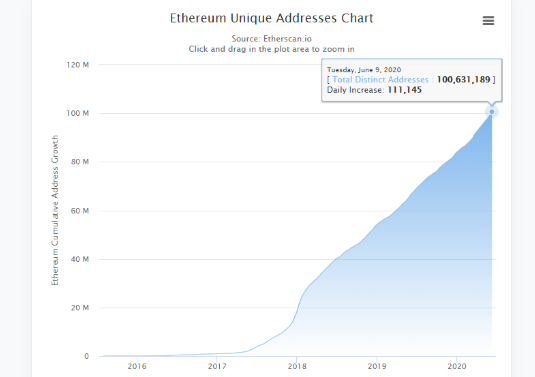

While such predictions are technically inaccurate, they underscore the reality of the ongoing bloating of the Ethereum State. The Ethereum State refers to all the initialized Ethereum accounts, which currently stands around 100,631,189 while adding about 111K new accounts every day.

Ethereum’s state bloat issue is well-documented and cross-chain transactions might be the key to reducing the bloating. Atomic Swaps and Decentralized Exchanges are two of the most popular workarounds being used in the blockchain industry to facilitate cross-chain transactions that will reduce the strain on any single blockchain.

However, some of the problems that make Atomic swaps (at the current state) an impractical sustainable solution for cross-chain transactions include the fact they sometimes attract expensive two-way on-chain transaction fees. Also, atomic swaps tend to be slow – for instance, Bitcoin swaps can take up to an hour to be settled. and this slow transaction time is impractical for the high volatility of the cryptocurrency market.

More importantly, Atomic swaps require that the tokens to be swapped must be programmable and have the same hashing algorithm. This insistence on the same hashing algorithm will in turn force token projects to stick to popular standards such as ERC-20, which furthermore compounds the bloating problem on the Etheremum blockchain.

Cross-chain bridges to the rescue

There are some other technical suggestions for reducing Ethereum’s bloat and enabling cross-chain transactions. For instance, ConsenSys researcher John Adler has made the case of optimistic rollups as a viable scalability solution. However, last month, Vitalik Buterin suggested that the use of instant cross-chain bridges could be the key to reducing Ethereum’s state bloat issue especially as it concerns issuer-backed stablecoins.

For stablecoins to unlock scale at a sustainable pace, they need to utilize bridges between blockchains to reduce the bloating challenges of the Ethereum network. Emerging solutions such as Hybrix will help in reducing the overconcentration of stablecoins on the Ethereum blockchain by enabling the cross-platform transfer of value across different distributed ledgers.

As a second-layer protocol, Hybrix could potentially end the competitive stance of distributed ledger technologies by encouraging existing or new stablecoins to be built on other blockchains with the full confidence that their tokens will enjoy the free transfer of value across blockchains. Hybrix currency supports cross-chain transactions between more than 30 blockchains and almost 400 tokens as it continues to facilitate a more collaborative ecosystem of decentralized projects.

More importantly, the Hybrix protocol leverages the underlying data layer of the blockchain to enable cross transactions. Hence, it doesn’t require blockchain projects to implement any hard-forks neither does it require them to implement atomic-swap on their ledgers before enabling cross-chain transactions.

Conclusion

Stablecoins appear to be sticking around – the Bank For International Settlements in its Investigating the Impact of Global Stablecoins report encourages “central banks, individually and collectively, to assess the relevance of issuing central bank digital currencies (CBDCs) in view of the costs and benefits in their respective jurisdictions”.

Also, the IMF reports that countries should explore the ideas of Synthetic Central Bank Digital Currencies “sCBDC”. The IMF notes that sCBDCs backed by sovereign reserves might be the safest and most liquid digital assets in the crypto market.

If stablecoins become easily transferable with cross-chain transactions while simultaneously getting the backing of legacy institutions and central banks, they could easily unlock the next level in the journey towards the mass-market adoption of cryptocurrencies.