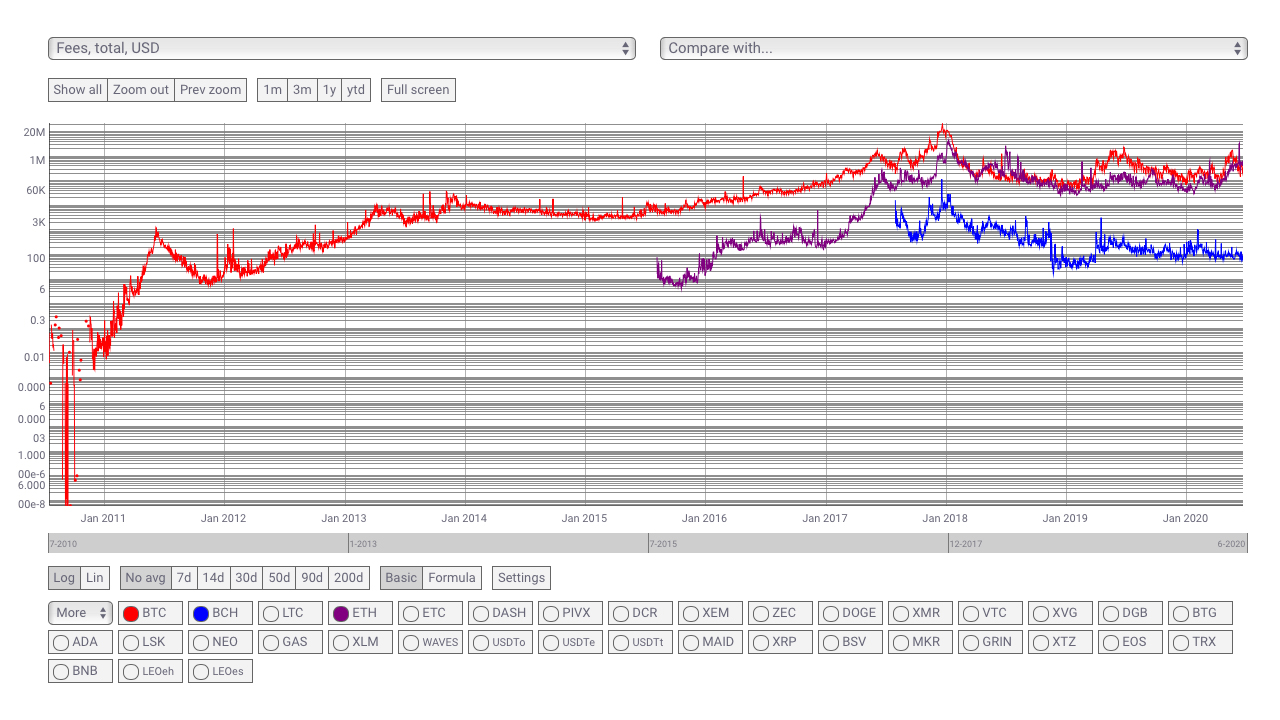

This week digital currency enthusiasts have been discussing network fees, specifically transaction fees associated with the Bitcoin and Ethereum blockchains. Last Sunday on June 21, one Ethereum proponent noted that during the last 16 days, Ethereum users have paid more to leverage the network than Bitcoin users.

Digital currencies like bitcoin, ethereum, bitcoin cash, and litecoin all have a network or miner fee associated with sending each and every transaction. This means in order to send a fraction of bitcoin (BTC), there must be enough BTC in the wallet to also cover the sending fee.

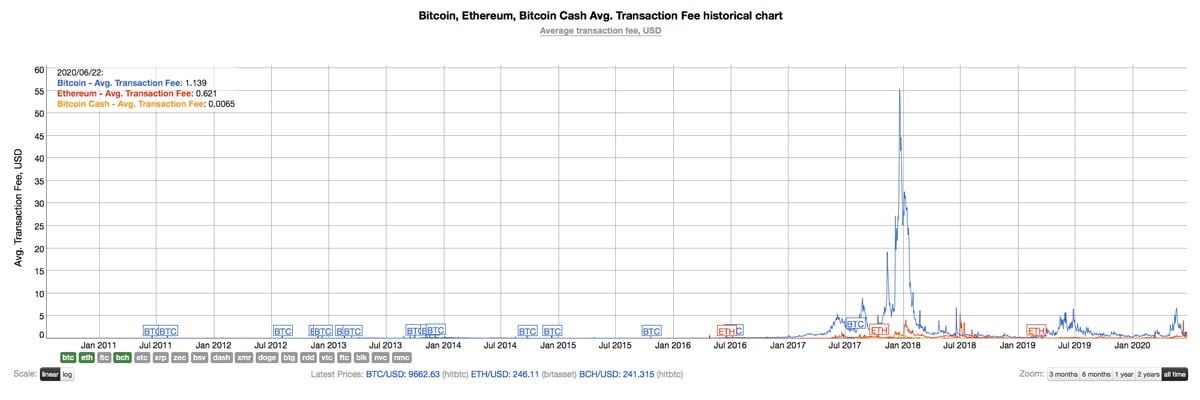

At the time of publication, the data site bitinfocharts.com shows the average BTC network fee was $1.14 per transaction on June 22. Ethereum (ETH) network fees show the average fee on that day was around $0.62 per send. Bitcoin cash (BCH) has an average fee of $0.006 per transaction or six-tenths of a U.S. penny. Now not all BTC fee recording websites are exactly the same as there are many different averages depending on the site used.

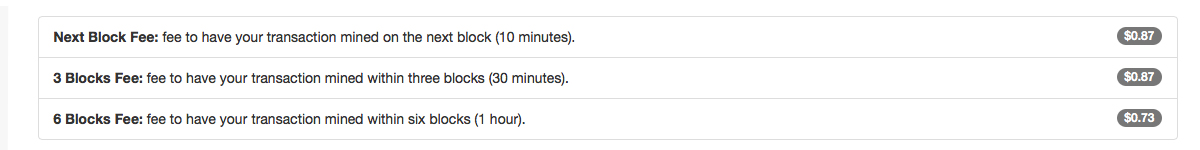

According to the fee calculation website offered by billfodl.com, the next block fee required to have your transaction mined on the next block (10 minutes) is $0.87 today. Similarly, for June 23, the average fee for getting into the next three blocks is the same price. If an individual paid $0.73 per BTC fee, the transaction would possibly confirm within six blocks (1 hour).

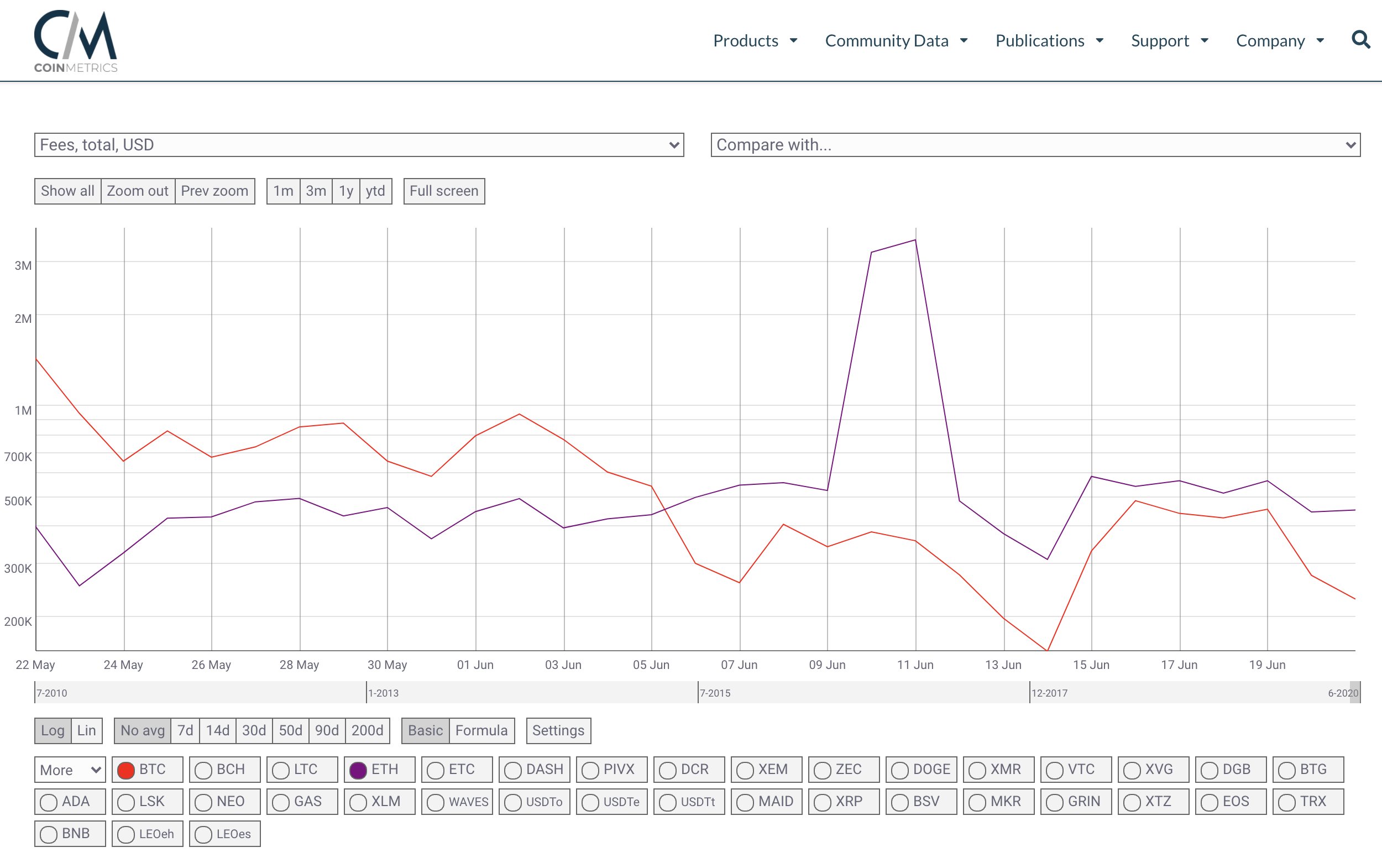

The six-block fee would bring ETH transaction fees much closer to current BTC fees which bitinfocharts.com shows is $0.62. Coin Metrics charts show that ETH transaction fees have been consecutively higher than BTC’s fees in June. The well known ETH proponent on Twitter Eric.eth (Eric Conner – @econoar) told his 15,000 followers on Sunday:

For 16 straight days, Ethereum users have paid more to use the network than Bitcoin users.

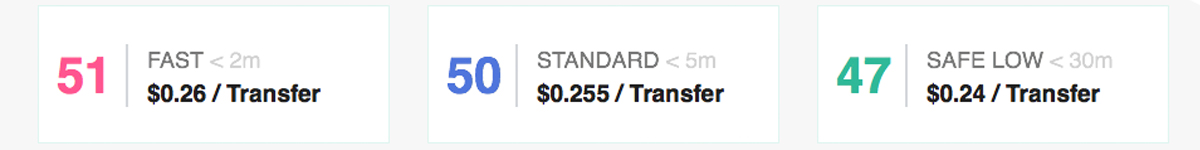

Since the tweet, Ethereum transaction fees have dropped according to Coin Metrics data. The web portal ethgasstation.info, a website that provides ether gas price recommendations, notes that ETH fees are much lower than BTC’s average as far as stats on billfodl.com is concerned.

All the fees measured in gwei highlight that the gas amount it takes to send an ETH transaction and ERC20 token as well, is $0.26 for the fastest transaction confirmation time. Every tier lower is only a U.S. penny cheaper for standard and safe but low fee transactions.

Now during the last few years and especially since 2017, we know that when the price of ETH or BTC rises and is used more often, fees grow much larger. At the height of 2017, BTC fees jumped higher than $50 per transaction on December 22, 2017. On that same day, ETH fees were around $1.40 per ETH transaction.

Now, this occurrence doesn’t happen with bitcoin cash (BCH) since the block size has increased to 32MB. Before the block size upgrade, on that same day in mid-December 2017, the average BCH fee did rise to $0.31 per transaction. However, during the September 2018 stress tests, after confirming over 2.4 million transactions per day outshining BTC’s best day by 5x, the average BCH transaction (txn) fee was $0.003 per txn.

Since then BCH fees have not risen past the $0.008 txn fee naturally and have been consistently under a U.S. penny per transaction for the last two years. According to Coin Dance stats it is currently 815.51x more expensive to transact on Bitcoin (BTC) on June 23, 2020.

Transacting on the Bitcoin Cash chain is also much cheaper than transacting in ETH as it is 8,566.66% more expensive to transact in ETH than it is to leverage bitcoin cash. This data is all publicly available by leveraging sources like ethgasstation.info, bitinfocharts.com, Coin Metrics data, and billfodl.com.

What do you think about the difference in transaction fees between ETH and BTC lately? Let us know what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, ethgasstation.info, bitinfocharts.com, Coin Metrics data, billfodl.com.

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer