This Exchange News was brought to you by OKCoin, our preferred Exchange Partner.

Bitcoin and the rest of the crypto market have struggled over recent weeks. After an attempt at breaking the crucial resistance of $10,500, BTC failed, undergoing a retracement that dragged altcoins lower.

Some see this retracement as a precursor to an even further drop. Yet according to an executive of Glassnode, a massive crypto bull run is on the horizon as Bitcoin turns fundamentally positive.

Bitcoin is on the verge of a massive bull run: on-chain data

Rafael Schultze-Kraft, the CTO of blockchain analytics firm Glassnode, released an extensive thread on Jun. 26 outlining 12 signals indicating increasing Bitcoin investor confidence.

The take-away: BTC is “long-term extremely bullish.”

1/ A thread showing 12 charts that illustrate #Bitcoin investor confidence and increased HODLing behavior.

Spoiler: This is long-term extremely bullish.

(data @glassnode)

Let’s dig in ?

— Rafael Schultze-Kraft (@n3ocortex) June 26, 2020

A handful of the bullish statistics and metrics that Kraft observed are as follows:

- More than 61 percent of the entire Bitcoin supply has not moved in over a year. This is an all-time high. More holding = less potential selling pressure.

- BTC is in a macro buy zone according to the Reserve Risk metric, which tracks long-term holders.

- Holders are not only not selling their coins, but they’re also increasing their allocation to the crypto market. Data shows that the net “HODLer” has increased their positions 90 percent of the days thus far in 2020.

- Bitcoin’s network velocity, meaning the speed at which coins are transferred, is at 10-year lows. Some have argued that this is bearish, but the Glassnode founder argued that this shows “strong support” for Bitcoin’s store-of-value/digital gold narrative.

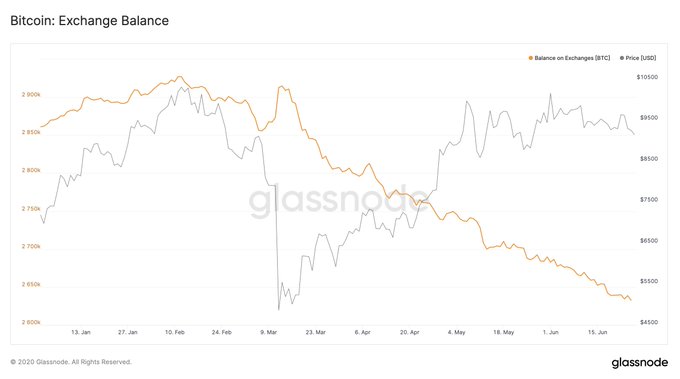

- Investors are withdrawing coins en-masse from exchanges like Binance, Coinbase, Gemini, Bitfinex, and all their ilk.

With this data in mind, Schultze-Kraft came to the following conclusion on the future of crypto prices:

“Much hodling going on. I’m extremely long-term bullish on BTC. Don’t let yourself get distracted by short-term price action – and always remember to zoom out and look at the bigger picture.”

Not the only bull

Glassnode’s CTO isn’t the only industry exec or Bitcoin analyst to have recently touted optimistic sentiment.

Mike McGlone of Bloomberg Intelligence recently said on Twitter that Bitcoin is a “caged” bull eyeing a breakout to $13,000.

As reported by CryptoSlate earlier in June, the senior commodities strategist previously said that “something needs to go really wrong for BTC not to appreciate.” This optimism about the asset’s price was derived from a confluence of trends, including Bitcoin’s adoption by CME traders, the block reward halving, a growing correlation with gold, and Grayscale Investments‘ purchasing of BTC.

There’s also a recent analysis by an ex-Goldman Sachs VP that indicates Bitcoin will rise as the U.S. dollar weakens:

“The Fed’s commitment to prolonged use of QE may represent a major turning point for the US Dollar. A break below [a close-by level] would confirm a major decline for the USD with implications across asset classes.”

Like what you see? Subscribe for daily updates.