The average fee for a transaction on the Bitcoin network has fallen roughly 91% from $6.56 on May 20th to just $0.56 on June 14th, reaching back below $1. The amount represents a low that the network hasn’t seen since April, before the Bitcoin halving that took place on May 11th.

The Most Diverse Audience to Date at FMLS 2020 – Where Finance Meets Innovation

Over the past several days, falling transaction fees have coincided with a small slump in the price of Bitcoin: on Thursday, June 11th, Bitcoin briefly reached as high as $9,930; at press time, that figure was just $9,160.

However, Bitcoin’s price and the amount paid off in transaction fees have not always correlated throughout the past several months; when Bitcoin transaction fees were at their highest on May 20th, the price of Bitcoin was roughly $9,685; as transaction fees were falling on June 2nd, several weeks later, the price briefly rose above $10,100.

Fees started to notably increase several weeks before the halving occurred. On April 28th, the average fee was $0.66; by May 1st, that figure had nearly quintupled to $2.84.

What caused the uptick in fees?

On the Bitcoin network, transaction fees typically increase when the network is experiencing periods of heavy usage; because the Bitcoin network can only process between 3.3 and 7 transactions per second, a backlog of transactions can easily form during periods of high trading volume.

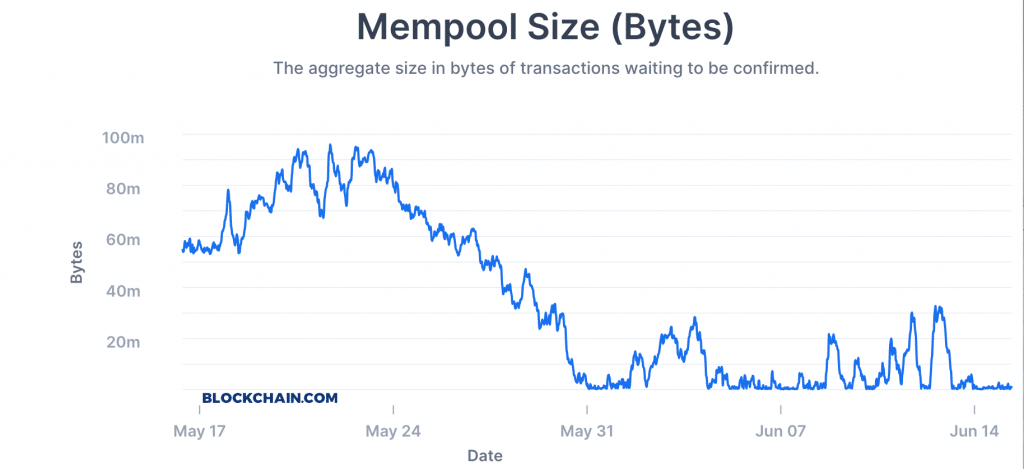

Therefore, it’s no coincidence that as Bitcoin’s fees increased, Bitcoin’s ‘mempool size’–which is the aggregate size of transactions waiting to be confirmed–also skyrocketed during the periods when Bitcoin’s transaction fees were at their highest.

Suggested articles

FBS CopyTrade Became the Best Application for Copy Trading in 2020Go to article >>

Ryan Watkins, who works as a research analyst in Messari crypto, pointed out on Twitter that while fees have continued to fall on the Bitcoin network, there was a prolonged spike in the price of transactions on the Ethereum network, bringing fees on Ethereum above Bitcoin’s for several days.

Ethereum scaling solutions will be critical in how this trend develops.

Last week Tether announced its launch on OMG Network, a layer 2 scaling solution.

USDT’s move to OMG Network could relieve pressure on the Ethereum blockchain and reduce fees.https://t.co/iyAUnp0gxV

— Ryan Watkins (@RyanWatkins_) June 9, 2020

“While Ethereum fees have previously surpassed Bitcoin fees multiple times in the past, most instances were just momentary spikes, “ a report from Messari reads. “The last time Ethereum fees were above Bitcoin fees on a sustained basis was mid-2018, during the tail end of the ICO craze.”