Get Forbes’ top crypto and blockchain stories delivered to your inbox every week for the latest news on bitcoin, other major cryptocurrencies and enterprise blockchain adoption.

Getty Images

CRYPTO MARKETS

Bitcoin fell more than 8% in a steep selloff Thursday, mirroring the stock market’s worst day since March. It slumped to about $9,000 before recovering some of its gains Friday. About $78 million worth of long contracts in the futures market were liquidated during the decline. The pullback came after another rejection at the $10,000 resistance level, which it briefly surpassed following a statement by the Fed expressing concern about the economy on Wednesday.

Despite bitcoin’s stalled progress during the last month, its early adopters’ long-term confidence is unshaken. Crypto pioneer Adam Back predicted in an interview with Bloomberg that it will reach $300,000 in the next five years as investors rush to retain value while central banks print money to prop up the global economy.

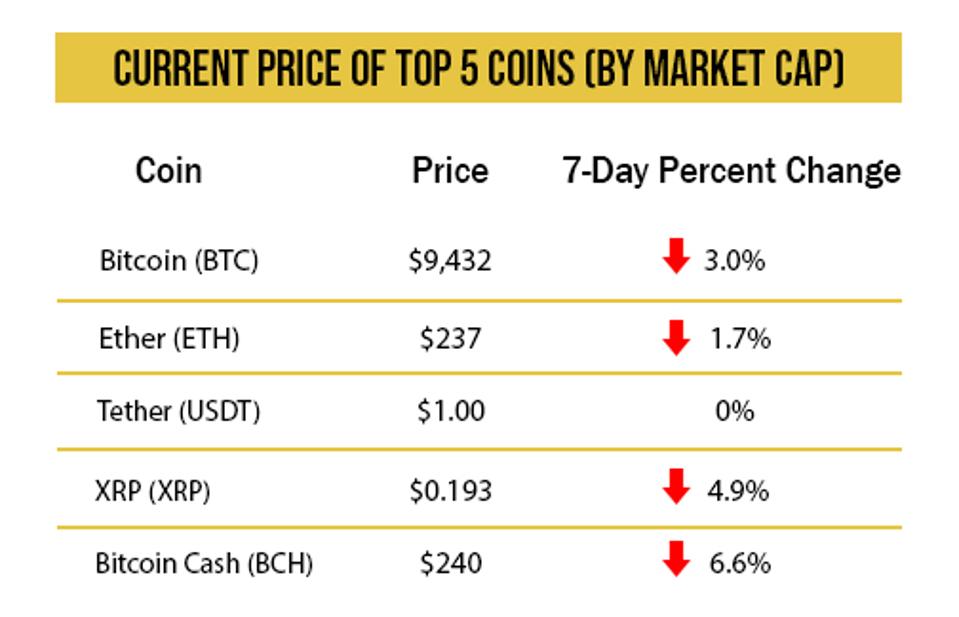

Source: Messari. Prices as of 4:00 p.m. on June 12, 2020.

BLOCKCHAIN IN WASHINGTON

A crypto veteran is now an insider in the federal banking system after former Coinbase general counsel Brian Brooks was appointed acting comptroller of the currency, making him the Trump administration’s top banking regulator. He’s already brainstorming ways blockchain can make transactions more efficient for the thousand-plus banks under his purview, noting that international money transfers on the SWIFT network can be painfully slow and put money at risk.

But don’t expect Brooks to advocate for a government-backed cryptocurrency in his new role. “I just don’t think that’s the role of government, quite honestly,” Brooks says. “But I think the Fed and the SEC need to be putting up frameworks of what that digital currency needs to be.”

News also broke last weekend that the IRS and the U.S. Drug Enforcement Administration intend to buy licenses from Coinbase for an analytics platform, sparking an outcry among Coinbase users about data privacy. Coinbase quickly tried to reframe the narrative and promised the data “does not include any personally-identifiable information for anyone.”

MAMMOTH TRANSACTION FEES

In one 24-hour span, an unknown crypto user incurred a $2.6 million transaction fee two separate times to transfer much smaller amounts of ether. The enormous fees raised suspicions of money laundering, but the more likely explanation is that it was a mistake in the user’s wallet software, particularly since the fee was the same both times. Ethermine, the group of miners that processed the transaction, is calling for the user to contact them to reclaim the funds.

MINING MATTERS

The breakeven price to mine bitcoin can be as little as $5,000 thanks to low electricity prices and an abundance of hydropower plants in China, far lower than the $12,000 to $15,000 range some researchers were expecting following the halving. This gives some mining centers turning a profit an incentive to sell the bitcoin they mine to cover operational costs. Don’t be surprised if this reality leaves bitcoin vulnerable to a correction soon.

JEKYLL AND HYDE AT GOLDMAN?

Goldman Sachs made headlines in late May with a presentation to clients that panned bitcoin and cryptocurrencies, but internally, it may not be so dismissive. Former Goldman investment banker Ethan Vera, now a crypto mining executive, tweeted that “I really do think Goldman is further ahead than most of the other banks on bitcoin.”

Institutional support of bitcoin more broadly is growing. A survey by Fidelity found that a third of institutions in the U.S. and Europe are invested in cryptocurrencies. Inflows into the Grayscale Bitcoin Trust increased for the last eight weeks of the first quarter in a row, and 88% of its investments during that time frame came from institutions.

ELSEWHERE

Wild, Wild East: Why the ICO Boom in China Refuses to Die [Cointelegraph]

Bitcoin’s Recent Rally May Have Run Its Course, Technicals Show [Bloomberg]

Custody Battle Pits Institutional Boomers Against Crypto Upstarts [CoinDesk]