Bitcoin

Bitcoin may have only seen a small 2.5% price surge over the last week of trading, but it was action-packed. On Monday, it surged from $9,426 and managed to rise as high as $10,430 to re-test the 2020 high.

Unfortunately, it was unable to keep itself above $10,000 and dropped lower during the week to land at the $9,426 support. It has since bounced higher as it trades at $9,668.

Looking ahead, if the buyers continue, the first level of resistance to overcome lies at $9,815. This is followed by $10,000 and $10,220 (1.618 Fib Extension). Additional resistance is found at $10,430 (2020 high).

On the other side, the first level of support lies at $9,426. Beneath this, support is located at $9,150, $9,000, and $8,700.

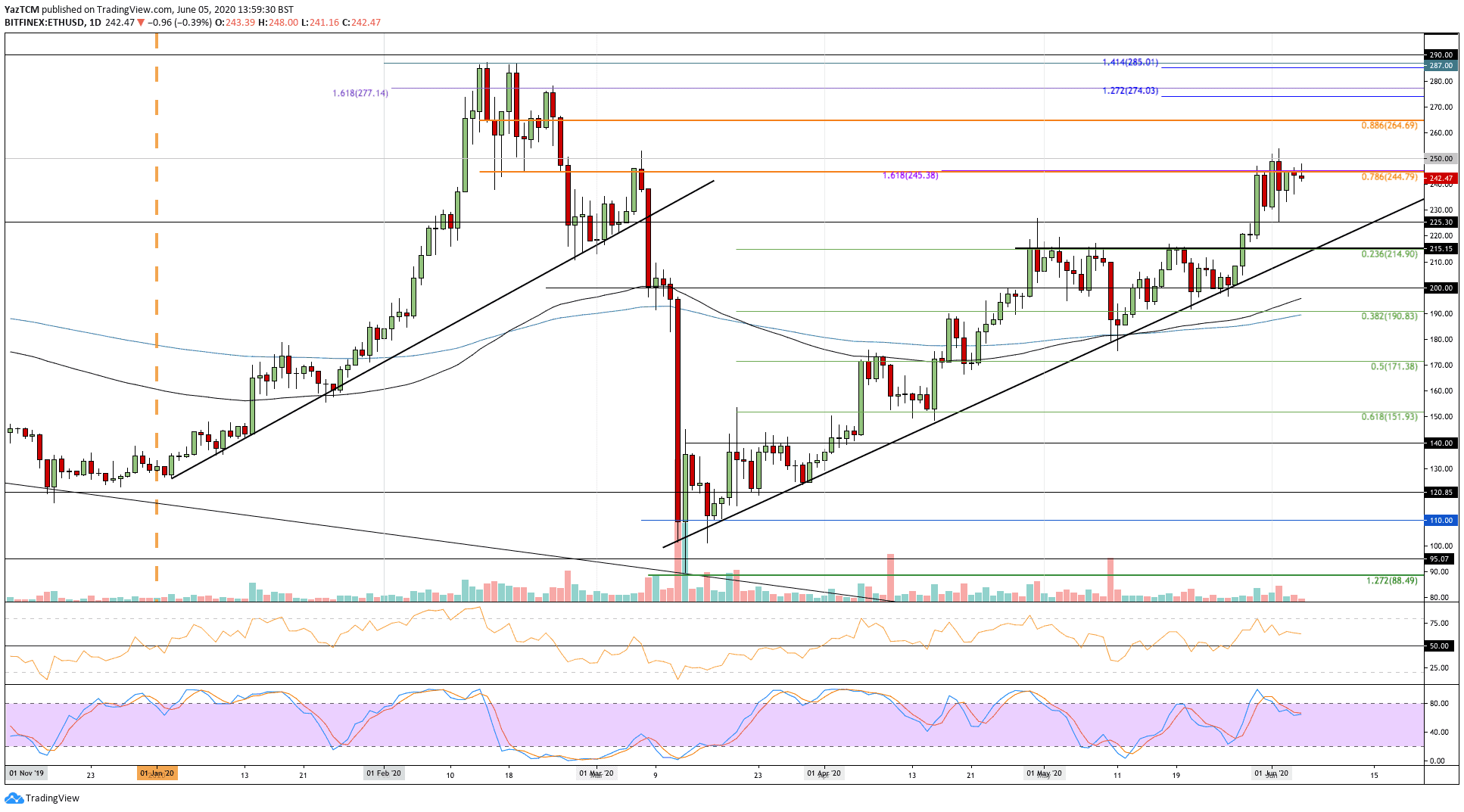

Ethereum

Ethereum underwent an impressive 10% surge this week as the cryptocurrency climbs as high as $242. ETH tested the $250 level during the week after the coin broke above previous resistance at $215 and started to rise.

The cryptocurrency is now struggling at the $245 resistance level and must push higher beyond there for the bullish pressure to continue.

Looking ahead, once the buyers overcome the $245 level, resistance lies at $250, $265 (bearish .886 Fib Retracement), and $277.

On the other hand, if the sellers push lower, the first level of support is located at $225. Beneath this, added support lies at $215 and $200.

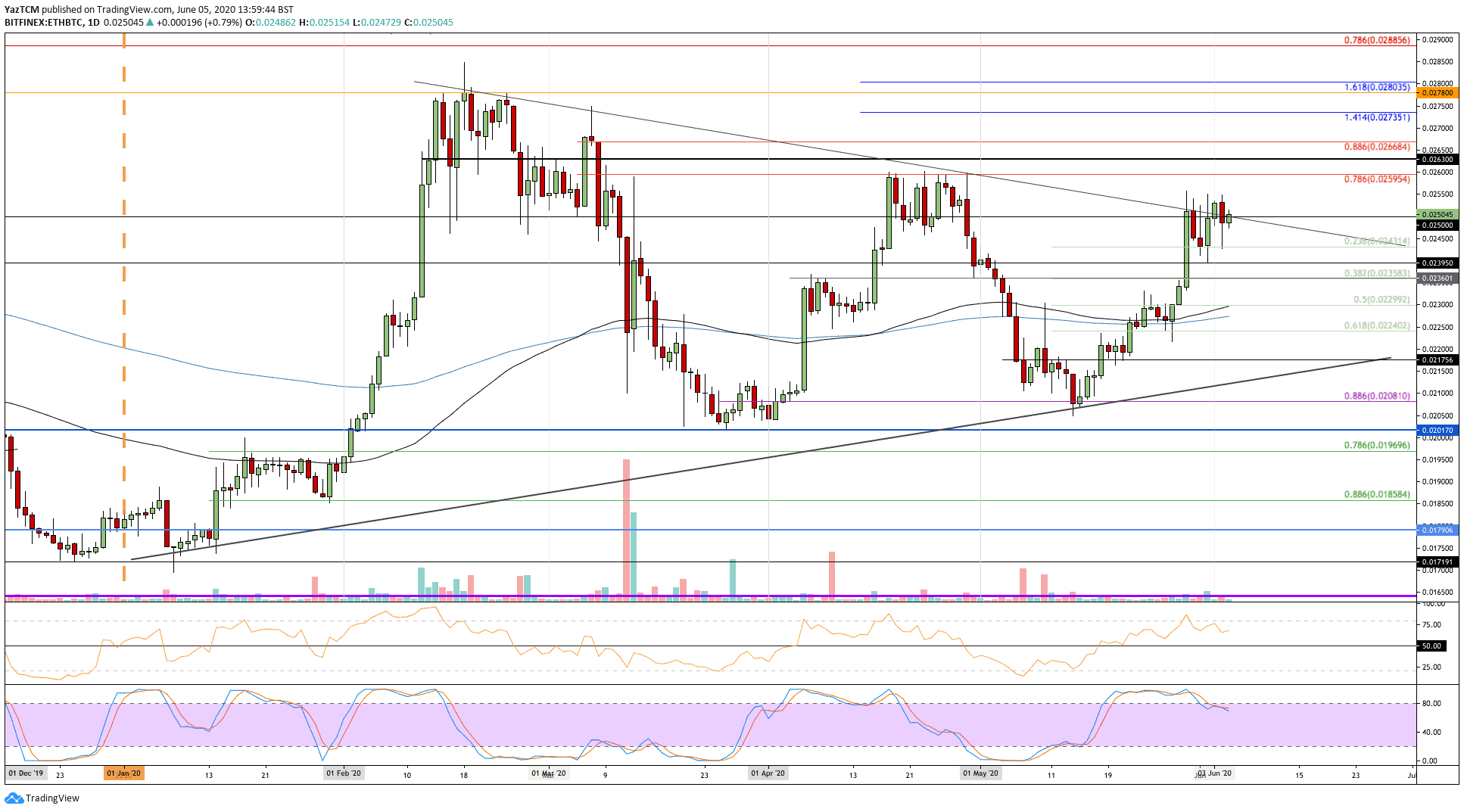

Against Bitcoin, ETH reached the upper boundary of a symmetrical triangle pattern last week as it hit 0.025 BTC. The coin traded sideways from here after dropping into the 0.0243 BTC support and returning to 0.025 BTC.

Moving forward, the first level of resistance to overcome lies at 0.0255 BTC. Above this, resistance is found at 0.026 BTC (bearish .786 Fib Retracement), 0.0263 BTC, and 0.0266 BTC (bearish .886 Fib Retracement).

Toward the downside, support is located at 0.0243 (.236 Fib Retracement). Beneath this, added support lies at 0.0239 BTC and 0.0235 BTC (.382 Fib Retracement).

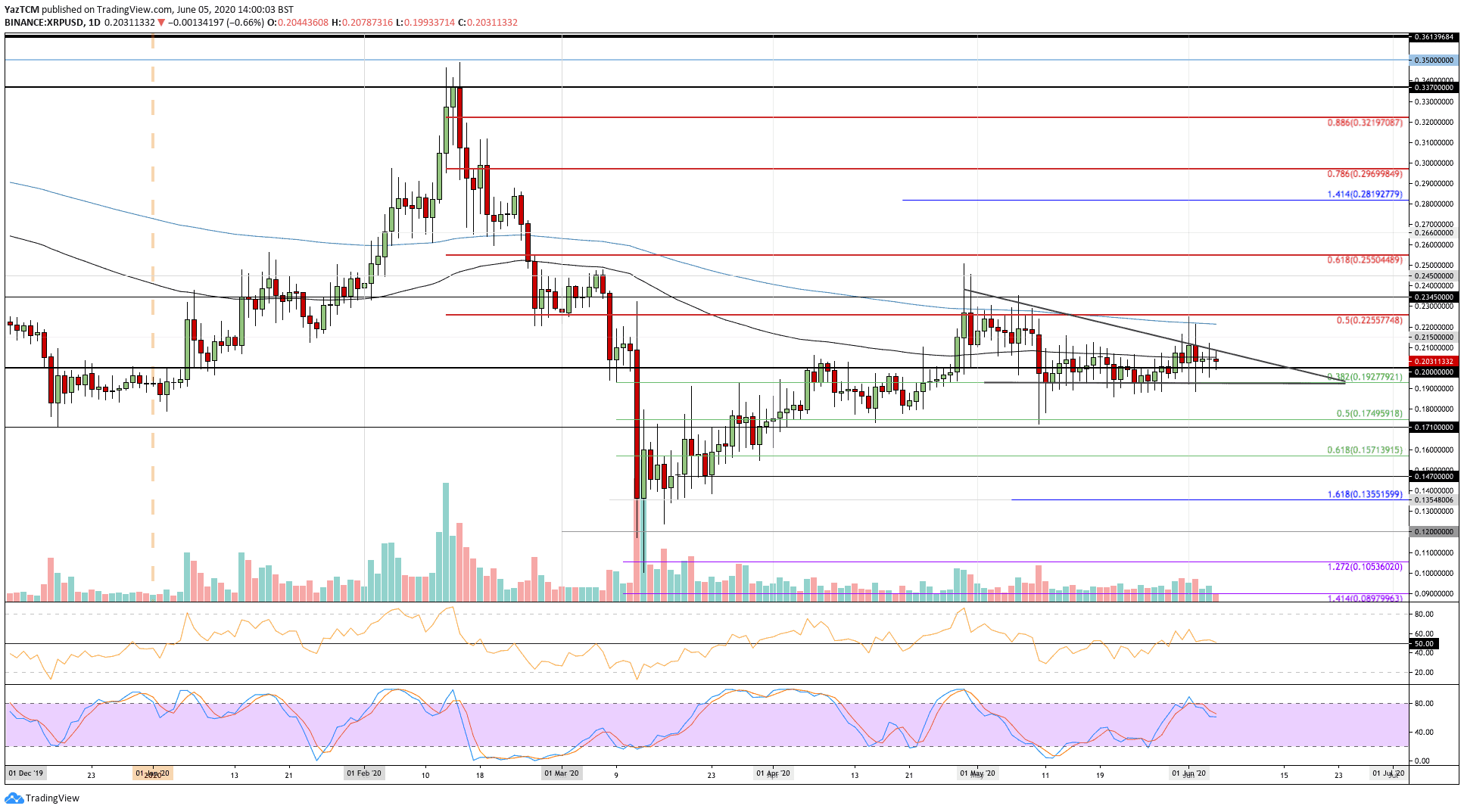

Ripple

XRP did see a small 2.5% price rise over the past week, which allowed the coin to reclaim the $0.20 level. However, XRP remains trapped within an acute descending triangle pattern. The cryptocurrency did attempt to push past the upper boundary this week but failed on each attempt and was rejected.

XRP is still trading sideways as we wait for a breakout in either direction as we approach the apex.

Looking ahead, if the buyers manage to push above the upper boundary of the triangle, the first level of resistance lies at $0.215. Above this, resistance lies at $0.225 (bearish .5 Fib Retracement & 200-day EMA), and $0.234.

On the other side, the first level of support lies at $0.2. Beneath this, support is found at $0.192 (.382 Fib Retracement), $0.18, and $0.175 (.5 Fib Retracement).

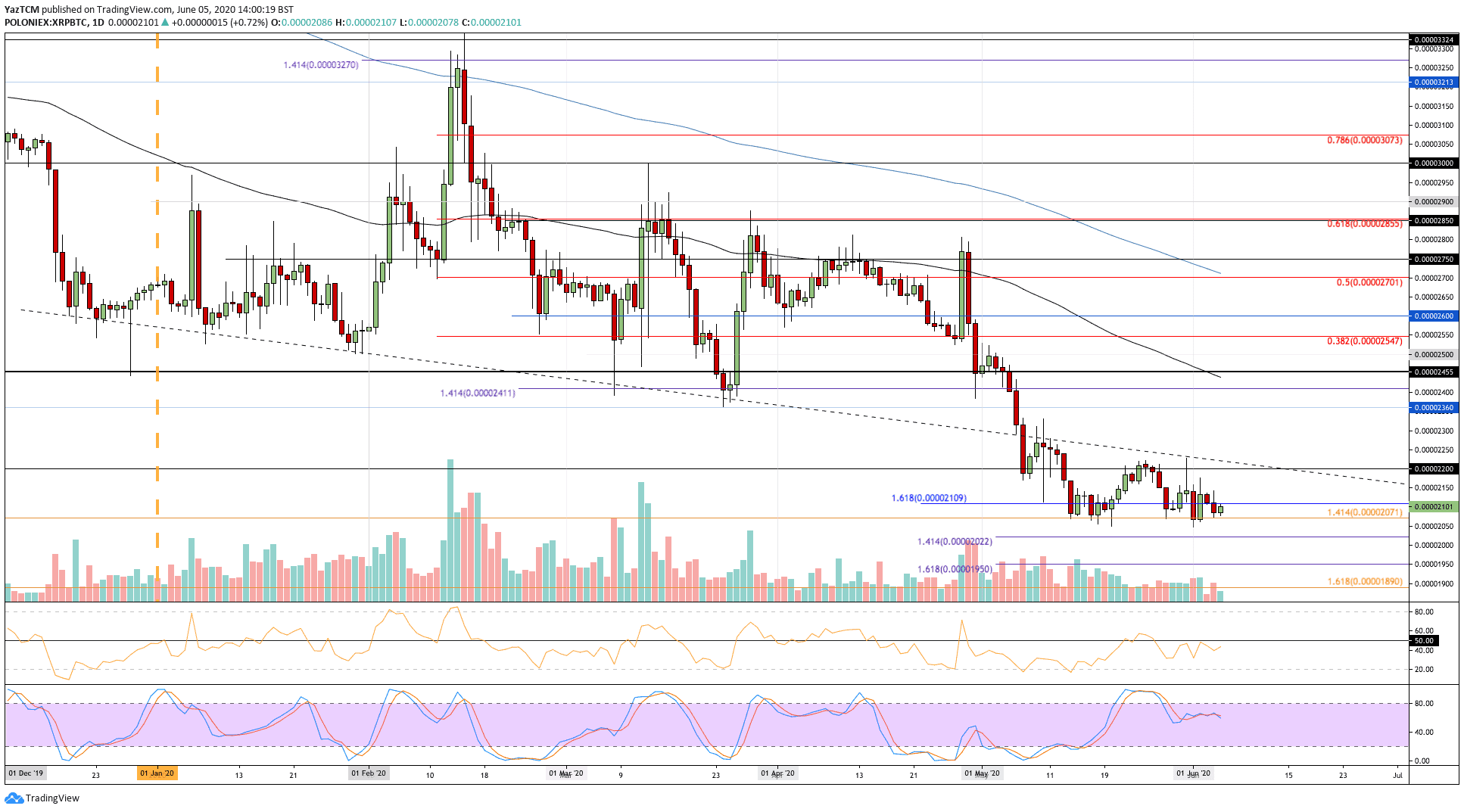

Against Bitcoin, the situation is quite gruesome for XRP as it trades at multi-year lows. The coin did manage to push as high as 2200 SAT during the week, but the sellers quickly stepped in and pushed the market back down to 2100 SAT to trade near 2-year-lows for XRP.

Moving forward, if the sellers break the support at 2070 SAT, demand can be expected at 2022 SAT, 2000 SAT, and 1950 SAT.

On the other side, the first level of strong resistance lies at 2200 SAT. Above this, resistance is expected at 2300 SAT, 2360 SAT, and 2400 SAT.

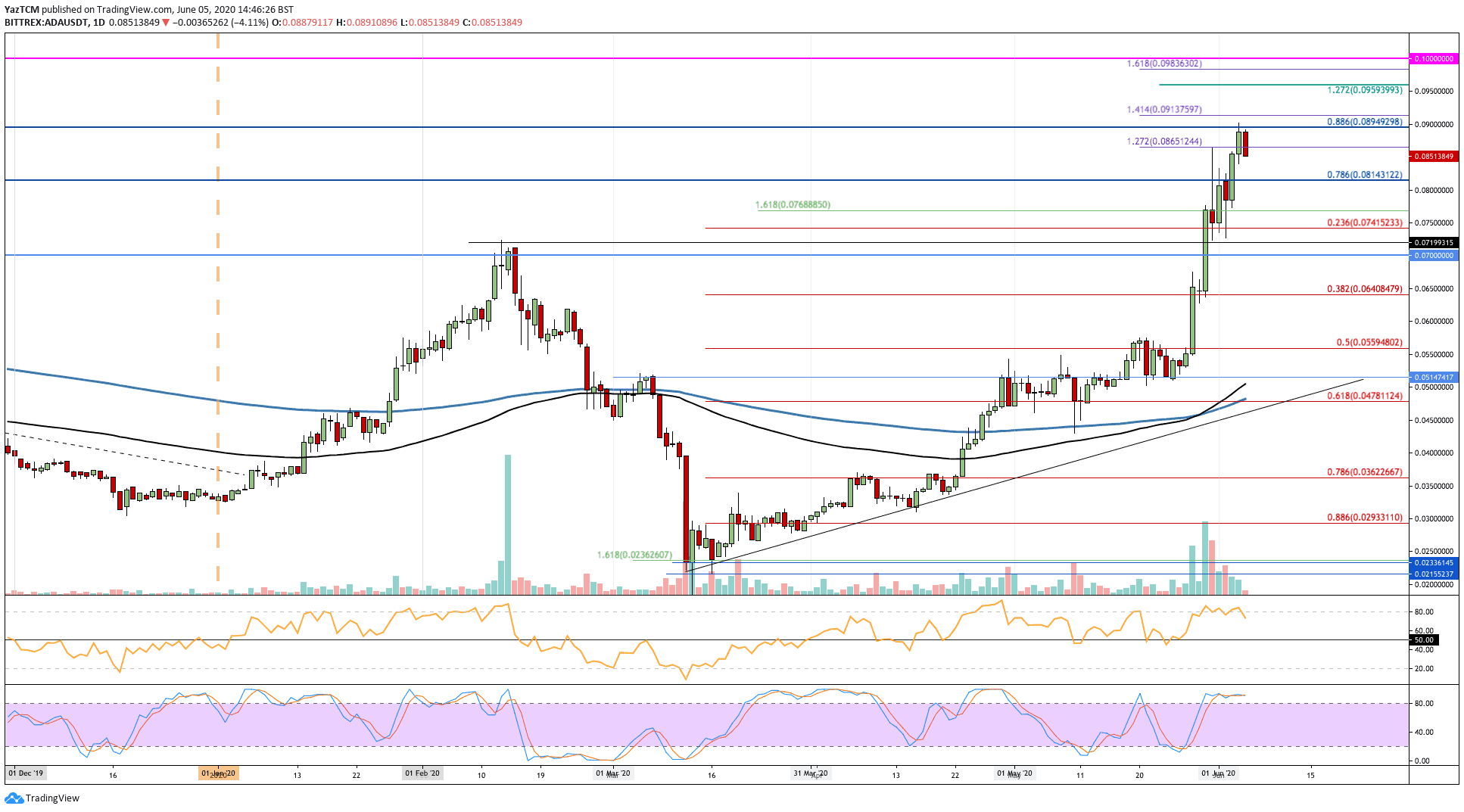

Cardano

Cardano saw an impressive 35% price surge over the last week of trading to allow ADA to rise from the $0.065 level to reach as high as $0.09. The coin reached resistance at a bearish .886 Fibonacci Retracement level, which caused it to drop to the current $0.0851 trading level.

Looking ahead, if the buyers regroup and push higher, the first level of strong resistance lies at $0.09. Above this, resistance lies at $0.091 (1.414 Fib Extension), $0.096, $0.098 (1.618 Fib Extension), and $0.1.

On the other side, if the sellers push lower, the first level of support lies at $0.081. Beneath this, support can be found at $).074 (.236 Fib Retracement), $0.07, and $0.064 (.382 Fib Retracement).

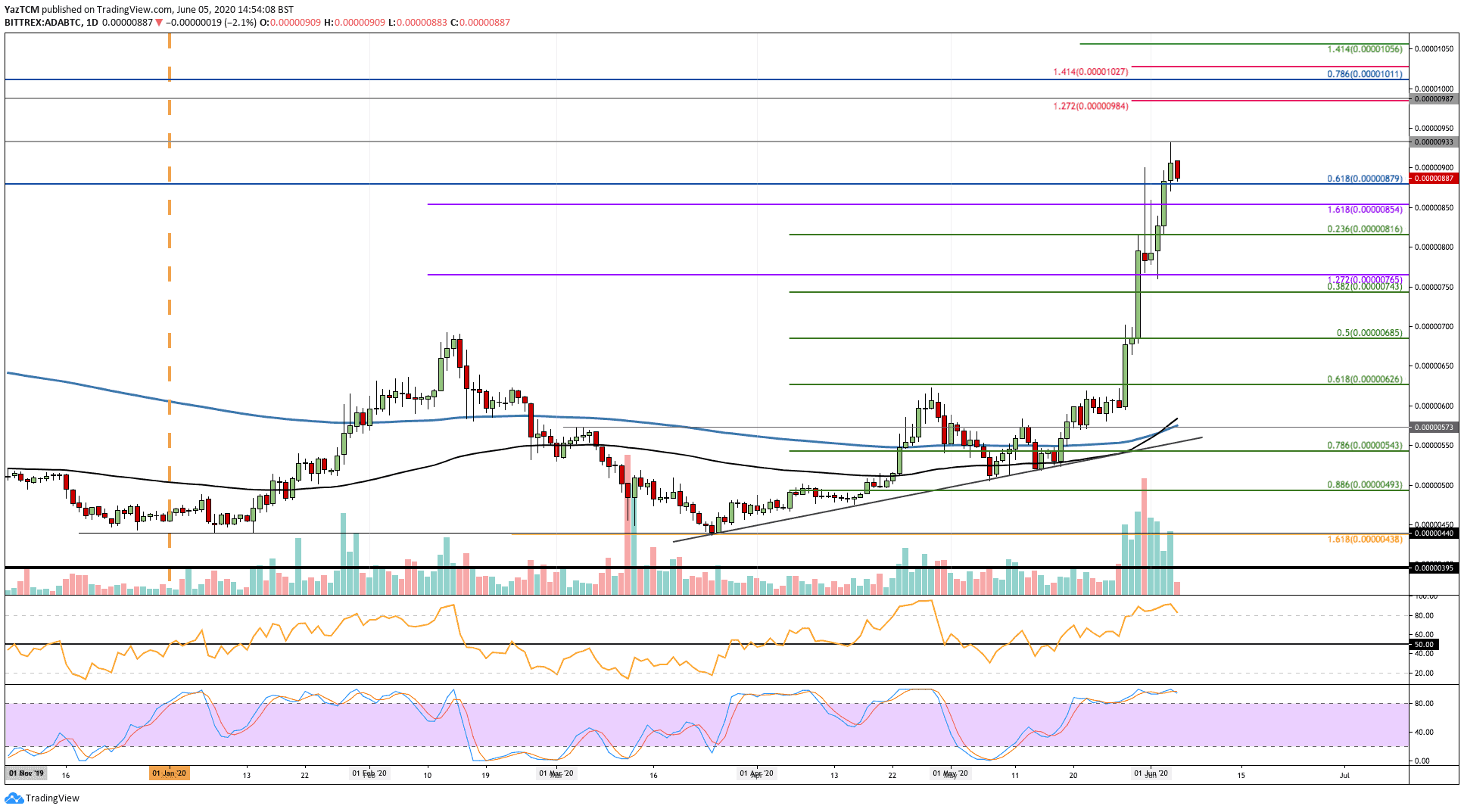

Against Bitcoin, ADA has also surged much higher as it climbed from 685 SAT at the start of the week to reach as high as 933 SAT. The coin has since dropped slightly to trade at 887 SAT. The push toward 933 SAT caused ADA to create a fresh 12-month high for ADA that had not been seen since June 2019.

Looking ahead, if the buyers can regroup and push beyond 933 SAT, resistance can be found at 984 SAT and 1000 SAT. Added resistance lies at 1011 SAT (bearish .786 Fib Retracement) and 1055 SAT.

On the other side, if the sellers push lower, support is expected at 850 SAT, 816 SAT, and 800 SAT.

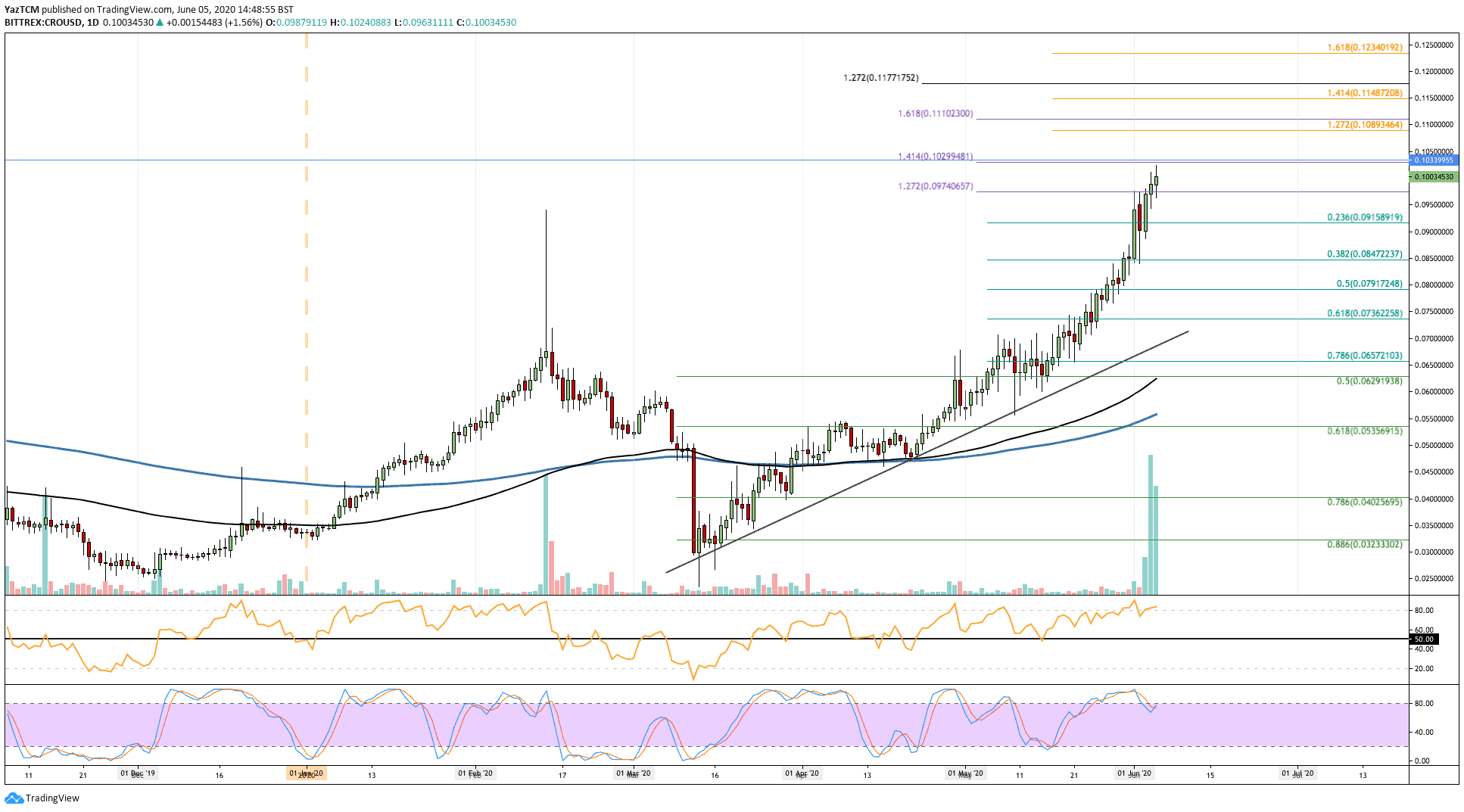

Crypto.com

CRO went through a serious increase of about 25% over the last week, which allowed it to reach as high as $0.1. CRO started the week off by trading at around $0.08 before surging higher.

Moving forward, if the buyers push beyond the $0.102 level, higher resistance lies at $0.011, $0.0115 (1.414 Fib Extension), $0.012, and $0.0123 (1.618 Fib Extension).

Alternatively, if the sellers push lower, the first level of support lies at $0.097. Beneath this, support is located at $0.091 (.236 Fib Retracement), $0.084 (.382 Fib Retracement), and $0.08.

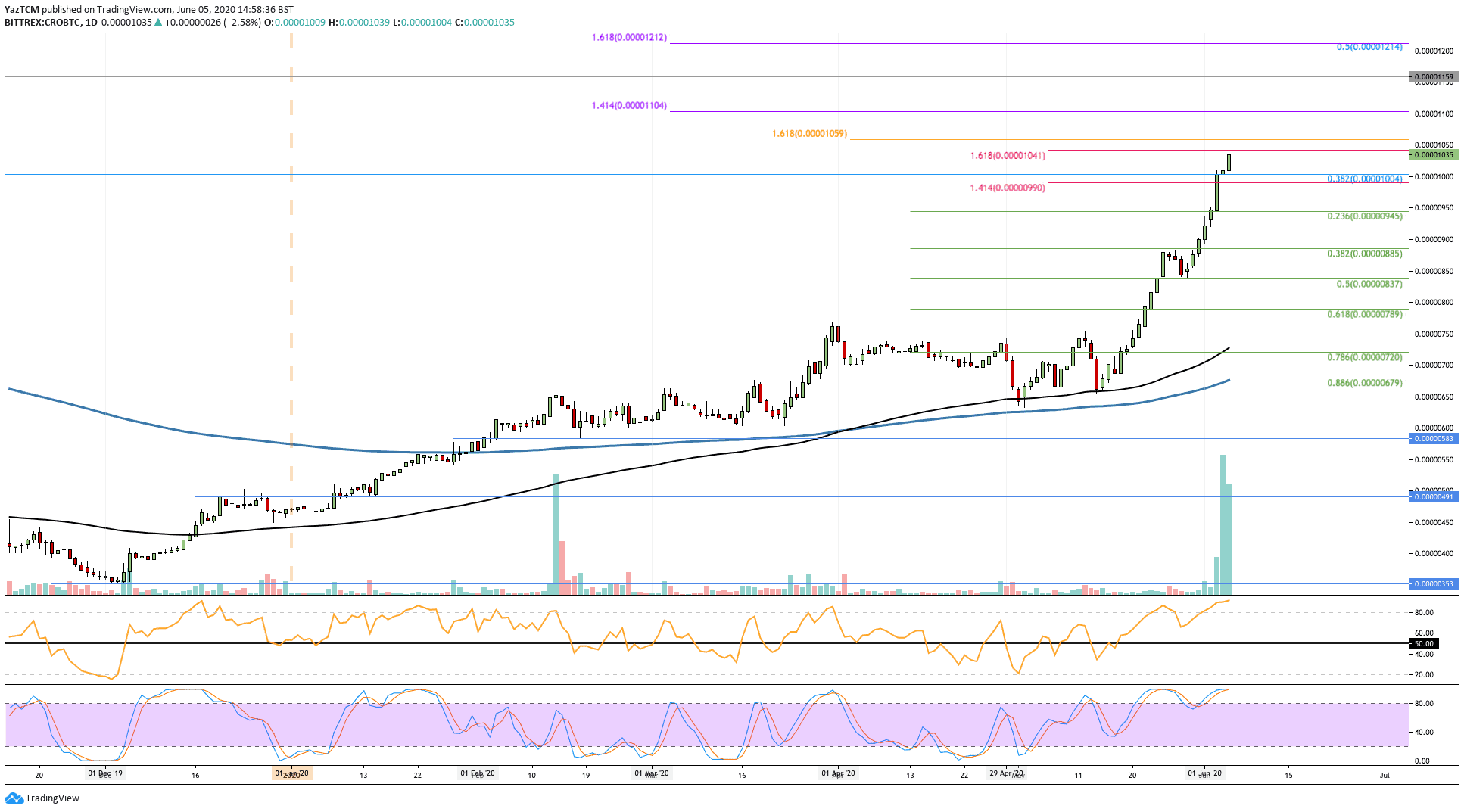

Against Bitcoin, CRO managed to push higher above the previous resistance at 885 SAT and reach as high as 1041 SAT during the week.

Looking ahead, once the buyers break 1041 SAT, resistance is expected at 1060 SAT, 1100 SAT, and 1160 SAT.

On the other side, support lies at 1000 SAT, 945 SAT (.236 Fib Retracement), and 885 SAT (.382 Fib Retracement).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.