As a former investment professional, I am constantly asked about Bitcoin (BTC-USD) and various other coins in the cryptocurrency universe. In a nutshell, I am far from convinced. The analogy that Bitcoin is to the blockchain as email was to the internet seems apt – blockchain, not Bitcoin, is the key. Yet, following the bursting of the 2017 bubble, another mighty run-up has emerged this year.

Source: Coindesk

For the various reasons cited in this article, I have no intention of participating in the 2020 version of the Bitcoin boom. Instead, I see a prime opportunity to capitalize on Bitcoin’s volatility without making a directional call via equity in Bitcoin-related futures exchanges (e.g., CME Group (CME) and Cboe Global Markets (CBOE)) or exchange tokens (e.g., Binance Coin (BNB-USD)).

Bitcoin Has Failed to Live Up to Its Intended Use Case

Per the Satoshi whitepaper, the initial intent of the Bitcoin cryptocurrency was for payments at lower transaction costs in a decentralized manner (i.e., without the involvement of centralized, third-party financial institutions). Bitcoin was clearly built on libertarian principles – through the network, participants were provided with a means by which to bypass the fiat currency system while maintaining transaction security.

Source: Satoshi Whitepaper

Yet, Bitcoin does not quite live up to its intended use case as P2P cash – based on a comparison with existing online providers (e.g., TransferWise (TWISE)), the cryptocurrency fails to hold its own in terms of cost, speed, and transparency.

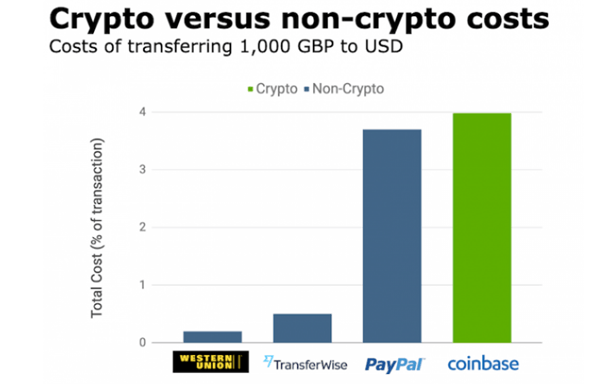

On cost, Western Union (WU) and TransferWise remain the cheapest options by far at <1% on a $1,000 transaction. Money transfer through the Bitcoin network, on the other hand, costs ~4% (via Coinbase), which is above even PayPal’s (PYPL). This seems far too high, in my view, to ever sustain mass adoption as a cash-like medium of exchange.

Source: FXCIntelligence

Speed is another key hurdle – Bitcoin transactions are settled in ~10 minutes. This simply does not cut it, in my view, given day-to-day transactions require seconds, not minutes, for settlement. Since Bitcoin is typically exchanged through a third-party, the compliance issue is also a hurdle, whether one transacts in Bitcoin or fiat.

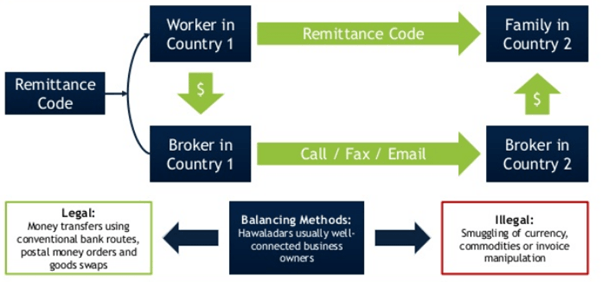

Admittedly, having transactions recorded on a blockchain does make it easier to track, but conventional payment services sent through a centralized network also offer similar tracking capabilities today. Arguably, users of the latter system benefit more from having an accountable third-party that can manually ensure the payment has arrived by messaging the retail agent in the receiving country. Here’s a sample flow chart depicting Western Union’s remittance strategy:

Source: SlideShare

As Bitcoin does not provide a significant enough benefit compared to conventional methods of money transfer and does not have a clear pathway to matching existing options, I fail to see how it can live up to its intended use case at any point in the future either.

Current Use Cases Are Debatable

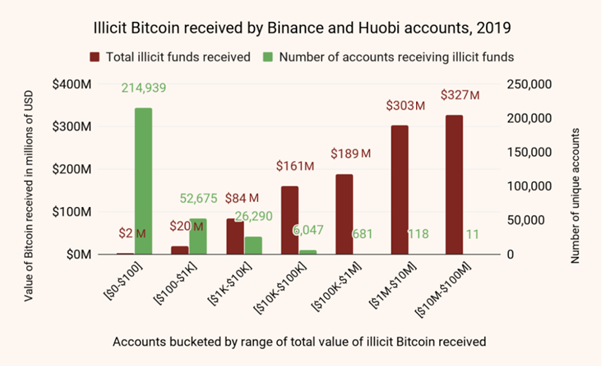

While Bitcoin has clearly failed to live up to its original use case (facilitating casual transactions at low cost), Bitcoin’s pseudonymous nature has allowed it to emerge as the preferred currency of cyber criminals. Per Chainalysis, a whopping $2.8bn worth of Bitcoin was sent to exchanges (e.g., Binance and Huobi) in 2019 alone.

Source: Chainalysis via Yahoo Finance

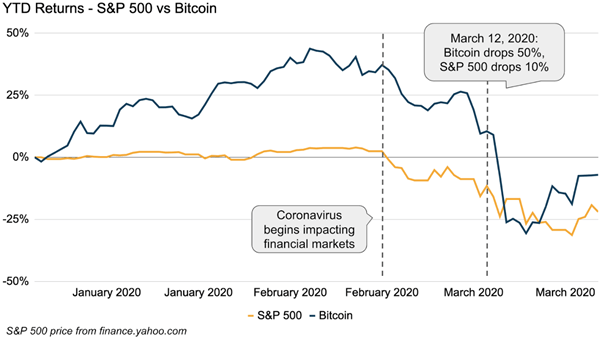

Besides the clear value proposition for criminals, speculators have also been attracted to the wild price swings of Bitcoin. March, for instance, saw a staggering ~50% price drop in one day. Per Coinbase, the extent of the drop was attributable to the extent of the leverage being used, with >100x leverage not unusual in this realm. Here’s Coinbase on the episode (note the mention of 5-30x leverage being “more sensible”):

Bitcoin has some offshore exchanges that offer 100x+ leverage, where $1 of Bitcoin could be used as collateral to back $100 in purchasing power. To be fair, this is very risky — a position leveraged to 100x would get force-closed if the market moved just ~1% against you. So most traders hold positions at a more sensible 5–30x leverage, but still notably higher than 2–3x.

Source: Coinbase

Bitcoin Mining Entails Negative Externalities

The process of mining new Bitcoin (“Proof-of-Work”) also impinges on government territory. The rent from creating fiat currency (seigniorage), for instance, goes to governments, which indirectly allows for incomes to be taxed at a lower rate than otherwise. In this sense, the benefit of fiat issuance is shared. The prospect of a Bitcoin standard, on the other hand, would disrupt governments’ seignorage revenue and the resulting shared benefit.

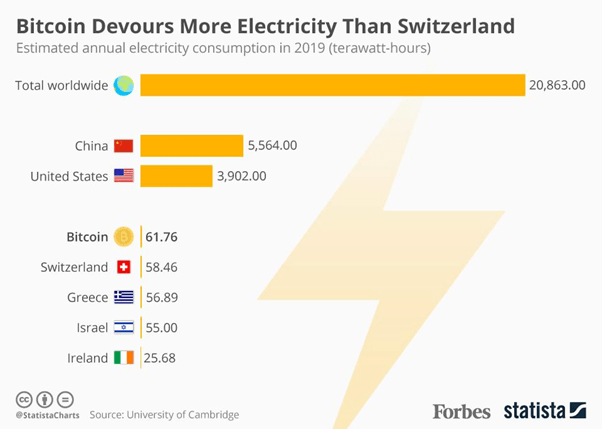

The mining process also wastes enormous amounts of electricity on solving complex computational tasks in the process, resulting in negative externalities from an environmental perspective. At this stage, Bitcoin mining has significantly impacted global electricity demand – mining already uses more energy than some developed nations.

Source: Forbes

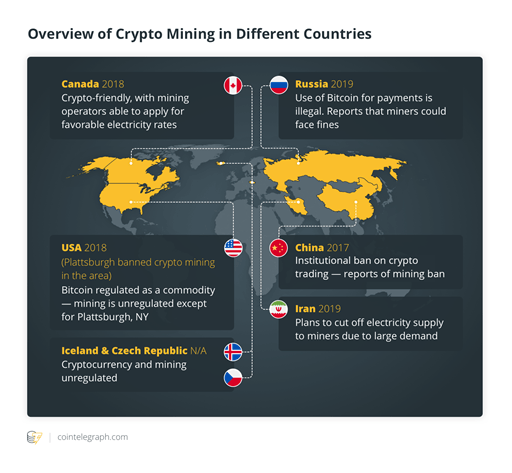

This process seems wasteful, in my view, and I would not be surprised to see superior mining algorithms (e.g., Proof of Stake) eventually take hold. Perhaps more damning is the prospect of more restrictive government regulation – given Bitcoin mining will continue to impact electricity pricing, governments are increasingly incentivized to outlaw the practice.

Source: Cointelegraph

Bitcoin Security is a Risk

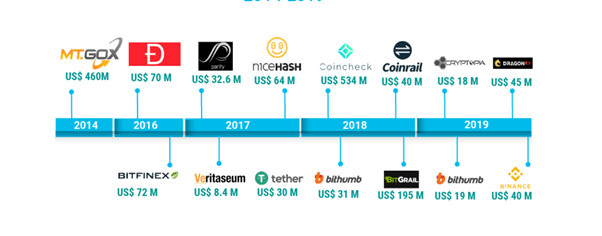

Admittedly, there has yet to be a full-fledged hack on the Bitcoin network itself – but this does not mean Bitcoin is and will remain secure into perpetuity, in my view. Holders of Bitcoin, for instance, are constantly exposed to the risk of theft given the numerous well-documented hacks of well-established Bitcoin wallets and exchanges (see timeline graphic below). Note that once Bitcoins are stolen, there is no recourse.

Source: Fintechnews

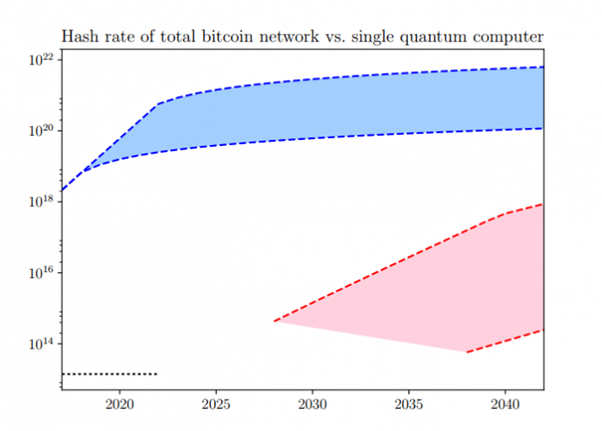

The biggest risk, however, lies in the rise of quantum computing, which would make it very likely that Bitcoin private keys can eventually be generated from their corresponding public keys. Per MIT Technology Review, this could happen within the decade. In a best-case outcome, this could lead to additional forks, but in the worst-case outcome, this would entail a complete wipe-out of Bitcoin’s value. Even if quantum computing does not spell the end of Bitcoin, it does introduce far too serious a risk to the Bitcoin story for it to emerge as a widely-adopted currency.

Source: MIT Technology Review

Another key stumbling block is custody – Bitcoin storage typically comes in the form of digital vaults, with holders storing sheets of paper on which the corresponding private keys are printed. This introduces a wide range of attack vectors, from physical theft to online hacking, which in turn, has led to the costs of Bitcoin storage eclipsing even some gold vaults. In some cases, Bitcoin custody can cost up to 15x that of gold. Even then, hacks continue to take place.

Rampant Price Manipulation

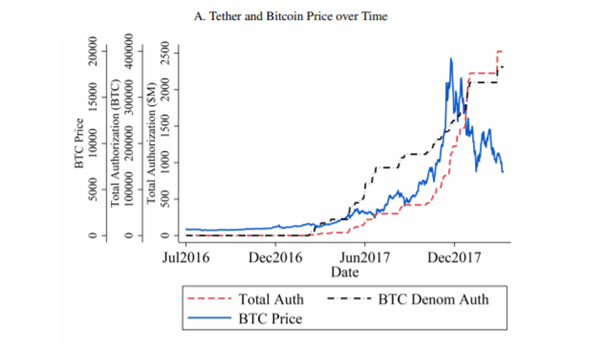

As an early-stage asset class, it is perhaps unsurprising that Bitcoin’s price discovery is inefficient. What few account for, however, is the extent to which Bitcoin prices are manipulated – per a 2019 study, a single trader had manipulated the price of Bitcoin “sharply higher” during the 2017 run-up to $20,000 using Tether, a stable coin pegged to the USD. U of Texas’ John Griffin calculates that Tether manipulation accounted for a whopping half of the increase in Bitcoin’s price over the period.

I’ll refrain from taking a stand on the study’s findings, but I would note the credibility of the authors (both affiliated with credible academic institutions) and the fact that the paper was peer-reviewed (published in the Journal of Finance). It is also notable, I think, that the sharp price increase has tracked tether issuance fairly closely.

Source: Griffin/Shams 2019 Paper

These findings also, interestingly, come on the heels of the U.S. Justice Department’s investigations into Tether’s role (among other cryptocurrencies) in “a tangled web involving Bitcoin, Tether, and crypto exchange Bitfinex might have been used to move prices illegally.”

Regardless of whether one thinks these investigations and studies are credible, negative news flow like this makes it much harder for regulators like the SEC to approve a Bitcoin ETF. It also complicates the private sector’s efforts to enter the space while maintaining regulatory compliance (e.g., Facebook’s Libra launch).

Avoid Bitcoin; Profit From the Volatility Instead

Asset bubbles are nothing new – much like the California Gold Rush, some will hit it big here, and others will fail. I see the Bitcoin frenzy as a similar phenomenon. Yes, there is a chance one becomes an overnight millionaire; then again, there’s also a very good chance it all goes up in flames. I’m inclined to side with the latter, but I do not think the right trade here is directional. Instead, I think the more favorable risk/reward lies in profiting from the volatility.

Much like the Gold Rush, when Levi Strauss made a fortune selling the picks and shovels, I think the exchanges are the way to play the Bitcoin theme. Thus, while the speculators bet on Bitcoin’s rapid rise (or fall), I much prefer owning equity in exchanges such as the CME or CBOE, or exchange tokens such as Binance Coin – all of which extract rent off the millions of Bitcoin-related volatility, activity, and volumes in the form of cash flows.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.