Bitcoin Cash, Ethereum Classic and Zcash are among top altcoins looking to ward off a bearish sentiment observed over the past 24 hours

As Bitcoin ranges at around $9,400, altcoins have also struggled to find gains in today’s European trading session.

Here is a price analysis check for Bitcoin Cash, Ethereum Classic, Dogecoin and Zcash. Over the past two days, these coins have followed Bitcoin’s movements in its failed attempts to breach $10k.

Bitcoin Cash

Over the course of the month, BCH’s price has approached highs near $265 before recent declines saw it fall past major support zone at $250. Sellers were also responsible for the token cutting below the 100-day simple moving average, as can also be seen on the shorter 4-hour timeframe.

The plunge last weekend also saw BCH/USD test the $225 support area.

Bitcoin Cash’s price is trading just below $241 on the day after increased volume led to upsides on Tuesday.

After hitting a high of $238.43, the cryptocurrency has gained 1.5% in intraday trades to breach resistance at $239. The BCH/USD pair is currently testing support at $241, potentially bouncing higher if the RSI continues to show reflect that bear control is weakening.

Ethereum Classic

Ethereum Classic is down 7% over the past seven days, taking the token’s value to $6.29 against the USD at time of writing.

After breaching support at $6.39, ETC/USD finds its next support at $6.25 — with the upside now hitting major resistance at $6.89.

On the daily chart, the RSI is pointing south, suggesting that ETC/USD is currently oversold. However, the MACD indicator looks as though price will change direction as it crosses the signal line. Buyers need to hold support at $6.22 to retain the advantage.

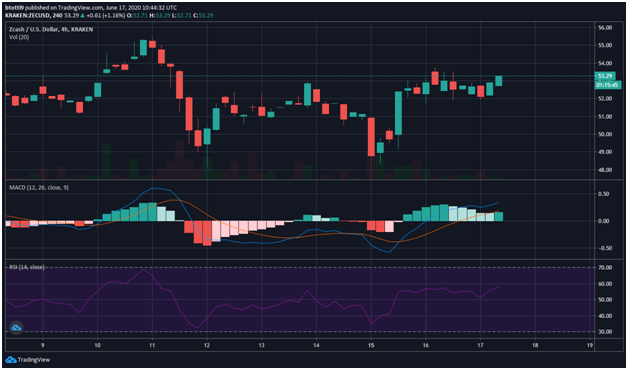

Zcash

Zcash is one of the biggest losers among the top altcoins, with the privacy-focused token having dropped 1.43% today at the time of writing.

The price of Zcash recently shaved off 8% to touch lows of $48.8.

Strong resistance waits at prices around $55 and $58, however, the RSI is showing bullish sign.