Three completely different methods brought the same spot-on predictions.

Update 3 June 2020

After about 14 hours above $10,000, Bitcoin crashed back down to $9,500 as quickly as it went up.

It appears to have been for the same reason it rose in the first place: whales traded big against the prevailing futures positions, triggering a squeeze. Basically, a big price movement starts liquidating futures contracts, which adds fuel to whatever direction the market is already moving.

The whales giveth, the whales taketh.

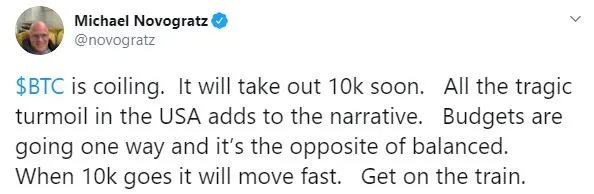

Michael Novogratz’s prediction: “When 10k goes it will move fast” ended up being correct twice in one day, on both the way up and the way down.

The article below has been left as it was originally published, way back in the heady days of 2 June 2020.

Bitcoin is finally back above US$10,000, for the first time since February 2020, shortly before the massive crash of March. It was straining mightily and unsuccessfully to get past $10,000 a couple of weeks ago, but today it just abruptly pinged from around $9,700 to $10,200 in an hour flat.

Seeing Bitcoin back above that psychological five-digit mark is a heartwarming thing. It feels like Bitcoin is back where it belongs now and that everything is all right in the world once again.

Of course, given the actual state of the world right now that just goes to show why the number one rule of trading is to not trust your feelings.

In that vein, let’s look at several different analysts who felt like Bitcoin was going to break $10,000 before it happened, and why they felt that way.

Feeling the wind in your hair

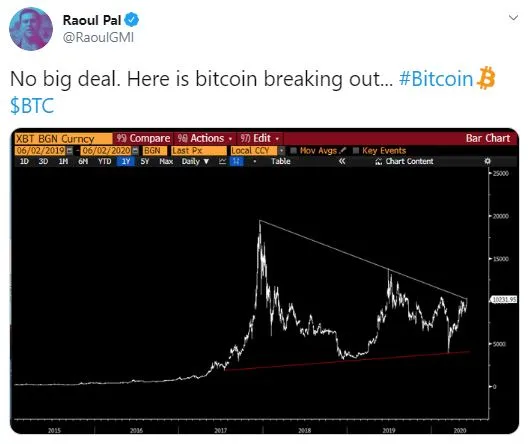

Some analysts are feeling the wind in their hair as they ride the Bitcoin rollercoaster out of the channel set following the 2017 highs, suggesting that Bitcoin may be on track to fundamentally shift out of its current price range.

The timing is impeccable, because it lines up uncannily with the predictions laid out by the stock to flow model of Bitcoin valuation.

More specifically, we hit the “red dot” phase of the model on 1/2 June (depending on timezone), as laid out by pseudonymous analyst PlanB, just hours before Bitcoin pumped above $10,000. So, quite a few of the “red dot” crowd were celebrating this price rise before it even happened.

The red dot

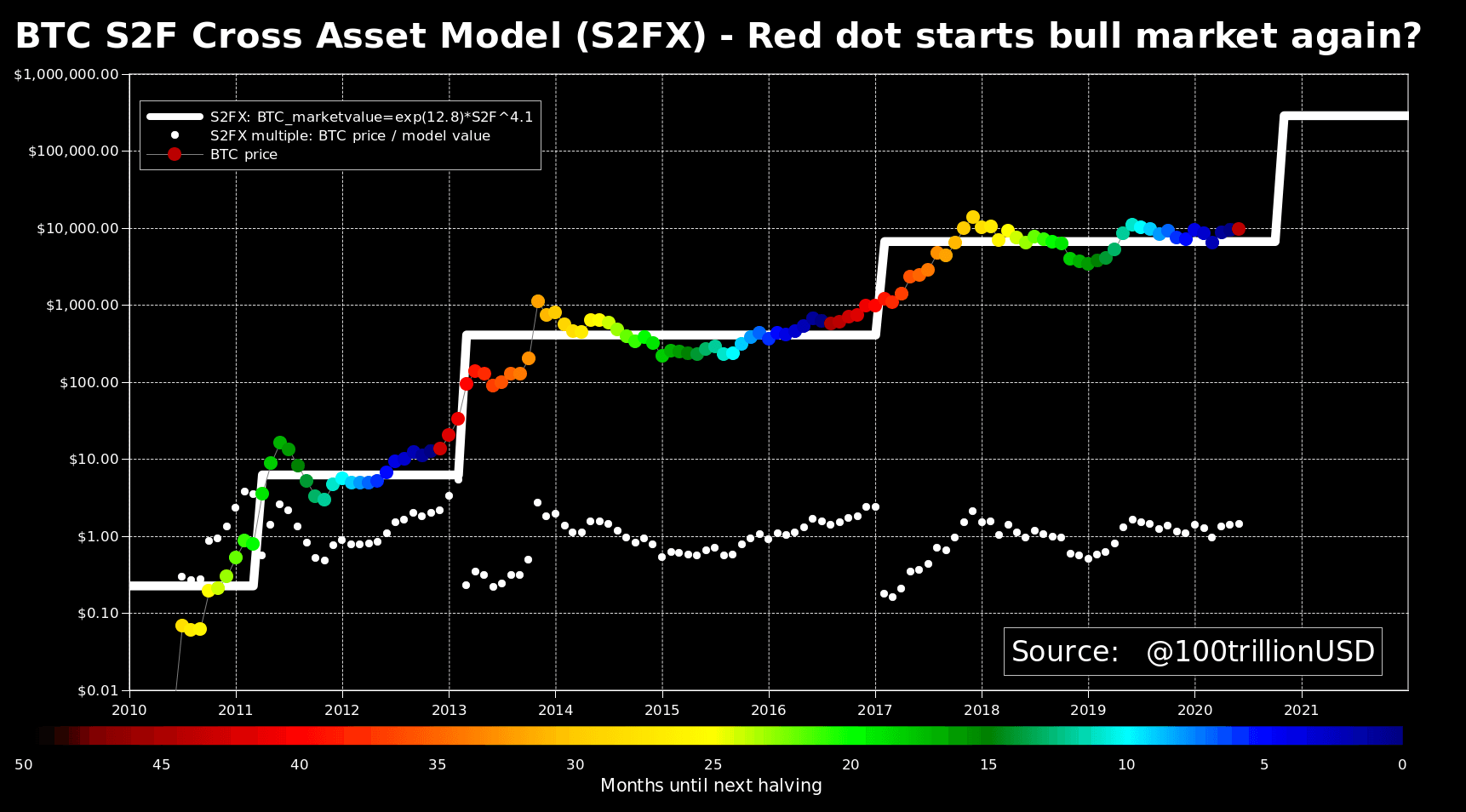

“The red dot” refers to the period immediately after the Bitcoin halving. It’s called “the red dot” because improvised symbolism is the cornerstone of all faiths including the Bitcoin religion, and because red is the colour of certain dots on the chart below.

The coloured dots on this chart are monthly Bitcoin prices, with the colour indicating how long until the next halving, and how long since the last halving.

The darkest blue dots are Bitcoin prices the month before each halving, while the darkest red dots (of the kind that popped out today) come out in the month after each halving. So, wherever the blue flips to red, that indicates a halving. As you can see, red dots have very consistently predicted a major Bitcoin price run since as far back as 2012.

In short, the red dot says that if history repeats itself, Bitcoin should see a major ascent this year to break $100,000 sometime next year. And now Bitcoin popped up above $10,000 just hours after the first dark red dot since 2016.

The thing about the red dot idea is that it simply says market forces will ineffably propel Bitcoin to higher price tiers, and that the power of maths means Bitcoin is simply destined to rise. That theory existed long before the Federal Reserve overclocked its printing presses in response to everything that’s happening in 2020.

This poses something of a philosophical dilemma for anyone who wants to believe that the stock to flow theory predicts Bitcoin prices, while also attributing its price rises to other factors like quantitative easing or the White House’s reaction to the ongoing protests, because it suggests Bitcoin prices would be doing the same thing regardless of what’s going on in the world.

Feeling it coming in the air tonight

Other experts successfully called the rise before it happened by looking at more earthly factors, citing the general state of the world as a driver of Bitcoin prices, just generally feeling the vibe in the air and presumably tasting Bitcoin trading volume on the wind.

The tightest prediction around probably belongs to Galaxy Digital’s Michael Novogratz, who pulled off this call about an hour before Bitcoin prices jumped above $10,000.

Bitcoin’s “coiling” was pointed out by others, who noted that Bitcoin had been settling into a tighter price range over time, which usually heralds a sudden, big move in one direction or the other.

The tension in the air may have given it the push it needed to go up instead of down when the time came. It’s worth noting that the exact timing of the rise lines up closely with some of the US president’s more fiery statements of the day.

“There was a sharp spike in the price this morning as US President Trump spoke to the press regarding the ongoing protests, which have been unfolding in cities across America. In the speech, he proclaimed that he would “mobilise all available federal resources civilian and military”. This quickly made headlines around the world as the mobilisation of the military in the United States is a rare occurrence,” points out eToro analyst Matthew de Corrado. “For cryptoasset investors, this may have signified an escalation in the tension, and has no doubt caused some uncertainty over what could transpire in the coming few days.”

Novogratz’s first prediction (“Bitcoin will rise to $10k”) has come to fruition, but the second (“Bitcoin will rise even faster after $10k”) is still in the making and may hinge on current affairs, de Corrado said.

“In my opinion, Bitcoin, typically responds to depreciation of currency, global uncertainty and governmental instability. As we’ve seen this morning, the threat of using military action may have had a bullish effect on the asset. Any further instability in the US could put further upward pressure on Bitcoin,” he said.

Feeling it

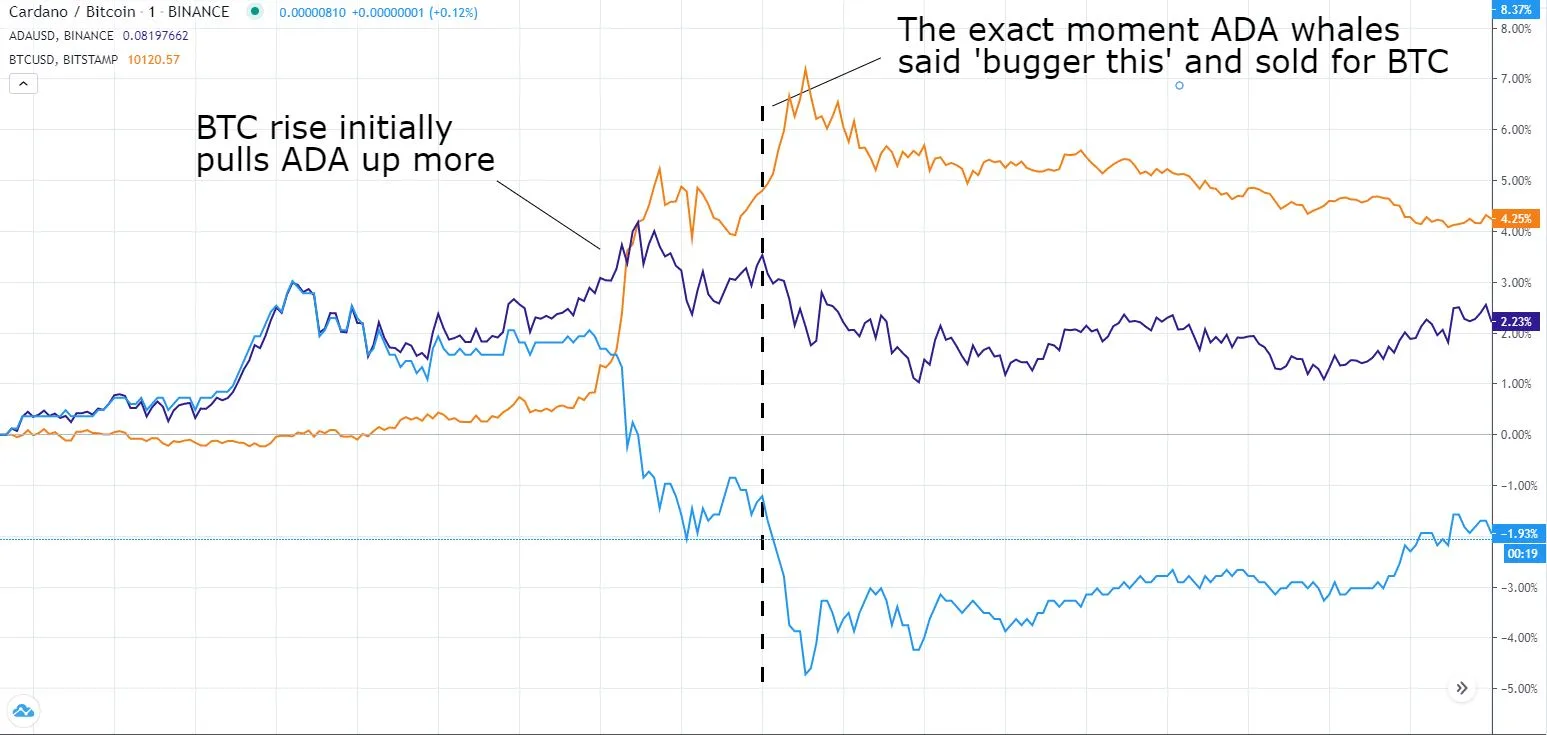

Craig “TraderCobb” Cobb also felt the move coming a full day in advance, as foretold in the charts. Some pretty high cap altcoins have been making major gains lately, he noted, and when people take profit against them they’ll be trading back into Bitcoin.

“People trading the Cardano bitcoin cross will be taking profits back to Bitcoin when they do. Cardano/Bitcoin added 50% in 2 weeks. Due to the relative size of Cardano market cap wise with a 1.9 billion token value, the recent move higher is a lot of money to potentially flow back to Bitcoin,” he wrote roughly 24 hours before Bitcoin made its move.

“Another example is Ethereum over the same 2 week period which has put on an impressive 14.85% against Bitcoin. Ethereum is the second highest by market cap behind bitcoin with $25 billion to its name which is another large amount of money if profits were to be taken and put into Bitcoin.”

“So here we have 2 of the big market cap players both having added impressive gains against Bitcoin recently. These moves will account for a large portion of the possible money flow back to Bitcoin,” he predicted.

That’s exactly what happened. Bitcoin’s sudden ascent initially dragged altcoins up with it, but then after Bitcoin crested $10,000 a lot of money bailed from altcoins back to Bitcoin, pouring gasoline on the fire and giving Bitcoin the cash infusion it needed to convincingly stay above $10,000.

The gold line is Bitcoin, the light blue is ADA/BTC, the purple is ADA/USD.

ADABTC chart by TradingView

Where to next?

Here we have three completely very different predictive methods, all of which looked at completely different things but somehow managed to paint the same picture, flagging down a price rise hours before it happened.

Something else they all have in common is that they’re all expecting further rises.

The stock to flow model, or “the red dot” if you’re feeling symbolic, predicts future rises because the unstoppable weight of sheer maths says Bitcoin prices should go up, and that’s what the most consistent trend in Bitcoin says will happen.

Meanwhile, Novogratz is predicting a further rise because that’s where the zeitgeist is leading us, and Cobb suggests that Bitcoin at $10,000 could reawaken wider media interest and bring some new money in.

“We really need to see Bitcoin above $10,000 to get the media back and new money flowing in,” he wrote. “So, the question for bitcoin is how can the current market players get us above $10,000 to get the media chirping and the new money in?”

“Bitcoin is the headline grabber, you won’t see anything in the news about the recent move of Cardano. Bitcoin needs to break above $10,000 for the media to come back to it.”

Feeling contrarian?

The Bitcoin world appears to be feeling about as bullish as it ever has. But on the other hand, past performance does not guarantee future results, no matter how much it feels like it should.

It’s also possible that whales deliberately orchestrated this rise specifically hoping that a break above $10,000, in conjunction with the red dot and the general vibes of the times, would be enough to spur some retail FOMO. There are enough mysterious whales in Bitcoin’s ocean to move prices in all kinds of strange ways.

Plus, when we’re asking whether Bitcoin is going to go up or down right now, the wisdom of the red dot is quite limited. It’s all about tracing movements across years (with a yet-unknown degree of accuracy), rather than the day-to-day and week-to-week here. No matter how compelling or historically accurate it is, it can’t indicate short, sharp moves of the kind we saw today.

“While the stock-to-flow analysis produced by PlanB has done very well to date in tracking the price of Bitcoin and predicting its future movements, my immediate concern would be correlating intraday movements in relation to a model that looks at data spanning multiple years,” de Corrado said. “Investors should also remember that any historical data is not an indicator of future performance.”

In the end, it seems the most accurate way of predicting the future is to wait until it happens.

Also watch

Disclosure: The author holds BNB, BTC at the time of writing.

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.

Latest cryptocurrency news

Picture: Getty Images