A currency dealer monitors exchange rates in a trading room at the KEB Hana Bank in Seoul on August … [+]

AFP via Getty Images

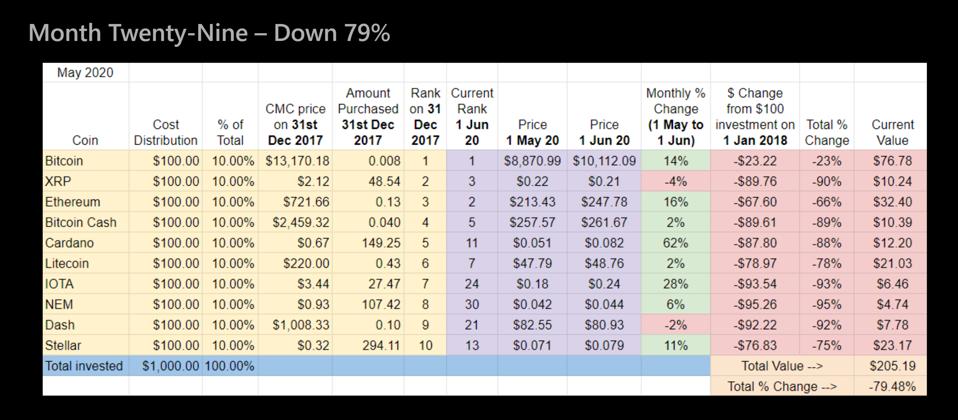

An anonymous investor bought $1,000 worth of ten top crypto assets on January 1, 2018 and regularly kept track of the portfolio’s performance.

At the time, top crypto assets by market capitalization were: Bitcoin, XRP, Ethereum, Bitcoin Cash, Cardano, Litecoin, IOTA, NEM, Dash, and Stellar.

The investor put $100 in each of the top ten crypto assets and measured their performance over time.

As of June 1, 2020, the $1,000 portfolio was worth $205.19.

The performance of top ten crypto assets bought in January 2018.

toptencryptoindexfund.com

It recorded a 79.48% loss after two years and five months, as the price of Bitcoin dropped from $13,170 to $10,112,

Since June 1, the price of Bitcoin declined further to $9,400 after a sudden 9% intraday plunge on June 11. As of June 13, the $1,000 portfolio is worth less than $200.

The $1,000 portfolio was created after the price of Bitcoin had crashed from its record high at above $20,000 on BitMEX to $13,170 by around 34%.

Hence, the capital was invested during a period in which retail investors could have reasonably thought to invest in cryptocurrencies. It followed a strong fear of missing out (FOMO) rally in December 2017.

Three key regions saw extremely high demand from retail investors: China, South Korea, and Japan.

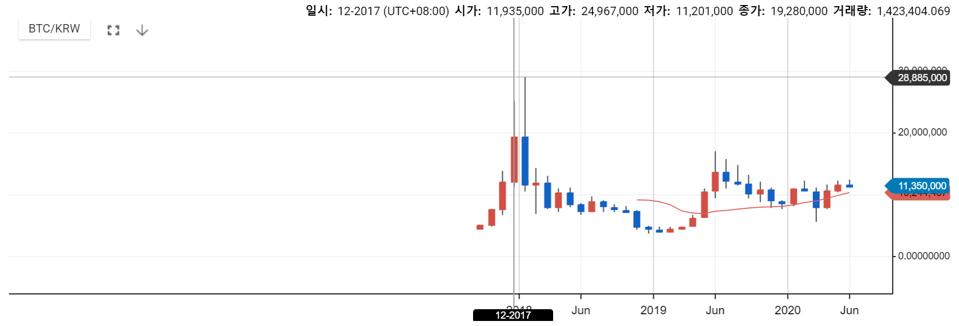

The demand for cryptocurrencies was so high back then that the premium of Bitcoin in South Korea’s crypto market exceeded 20%.

When Bitcoin was being traded at around $20,000 across the world, the price of Bitcoin in South Korea rose to as high as $24,000.

The price of Bitcoin hit $24,000 on South Korea’s biggest exchanges.

Upbit.com

In January 2018, prices of crypto assets had come down with increasing regulation from governments.

As such, retail investors that did not enter the market prior to the rally in 2017 could have considered that it may have been a compelling time to invest in cryptocurrencies.

However, late 2017 to early 2018 was when even industry executives and cryptocurrency developers thought crypto assets were overvalued.

Vitalik Buterin, the creator of Ethereum, famously said during the run up of Bitcoin to its all-time high that he did not believe the crypto ecosystem had done enough to achieve a $500 billion valuation.

“So total cryptocoin market cap just hit $0.5T today. But have we *earned* it? How many unbanked people have we banked? How much censorship-resistant commerce for the common people have we enabled?… The answer to all of these questions is definitely not zero, and in some cases it’s quite significant. But not enough to say it’s $0.5T levels of significant. Not enough,” Buterin said in December 2017.

Crypto assets including Bitcoin are increasingly being considered as stores of value as time passes. But, the majority of cryptocurrencies are still experiments after all, which contain a considerable risk of failing over the long-term.

Out of the abovementioned top ten cryptocurrencies, only six remain as leading assets.

Bitcoin has seen a noticeable increase in institutional adoption, improvement in infrastructure, a rise in liquidity, and strengthening fundamentals over the years.

Still, the performance of the $1,000 portfolio suggests investors have to approach crypto assets with caution, like other high-risk assets like single-stocks, when investing with a long-term thesis.