In summary:

- Bitcoin and Ethereum have regained losses witnessed during the Coronavirus crash of mid-March.

- Litecoin seems to be struggling to regain a footing after dropping below $50.

- LTC risks losing the $40 psychological support.

- However, the weekly chart prints a falling wedge offering some hope for investors.

Savvy crypto traders and investors have realized a certain sense of consolidation with regards to the price movement of Litcoin (LTC) after the Coronavirus crash of mid-March. During the event, LTC dropped from $64 to a local low of approximately $25. At the time of writing this, Litecoin is valued at $44. The latter value is 68% of its pre-crash price of $64.

Litecoin is Lagging Behind Bitcoin and Ethereum

Doing a similar analysis on Bitcoin and Ethereum during and after the Coronavirus crash of mid-March, we observe the following.

- Bitcoin dropped from $9,100 to $3.700 during the Coronavirus crash of mid-March.

- At the time of writing this, BTC is trading at $9,450.

- BTC’s current value is 103% of its pre-crash price.

- Ethereum dropped from $250 to $87 during the crash.

- At the time of writing this, ETH is trading at $214.

- ETH’s current value is 85.6% of its pre-crash price.

- Litecoin seems to be lagging both BTC and ETH in its recovery from the Coronavirus crash of March.

Brief Technical Analysis of Litecoin

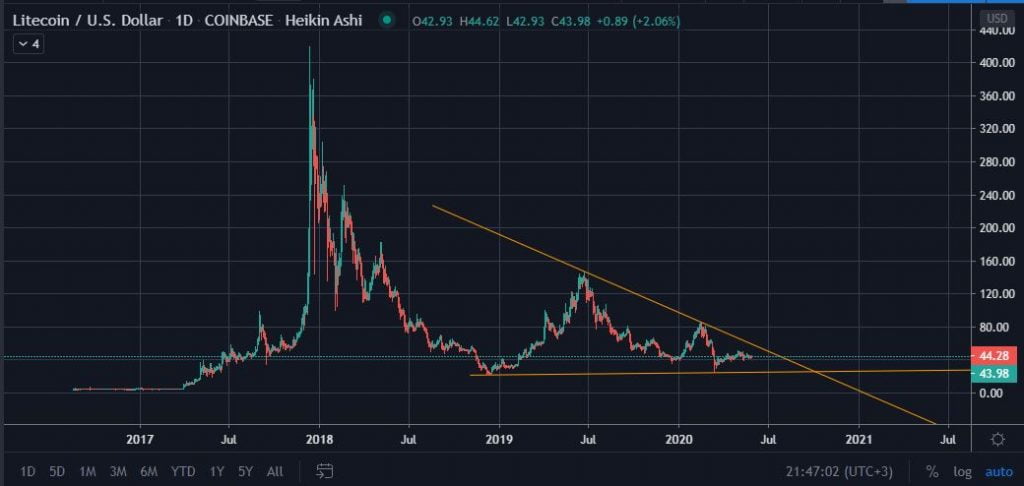

Further checking the 1-Day LTC/USD chart courtesy of Tradingview.com, we observe the following.

- Buying demand is decreasing with trade volume also declining.

- MFI is neutral at around 48 further provide evidence of the earlier noted consolidation.

- The current price of $44.31 is below the 50-day, 100-day, and 200-day moving averages.

- The aforementioned moving averages are now areas of resistance for Litecoin.

- LTC’s short term support zones are at $43, $41.43, $39.39, $38, $36.64 and $34.46.

- Litecoin’s short term resistances are at $44.76, $46.30, $47.48, $49.21, $49.98 and $50.88

Hope on the Weekly Chart

However, when we zoom out a bit and observe the weekly Litecoin chart, there is a bit of hope for LTC. The digital asset appears to be inside a falling wedge. If this wedge resolves to the upside, LTC has the potential of retesting its February 2020 peak of $85.

As with all technical analyses of altcoins such as Litecoin, traders and investors are reminded to keep an eye out for the price action of Bitcoin. Any large moves by BTC in either direction usually has a negative effect on all altcoins. Additionally, stop losses are advised to protect trading capital.

(Feature image courtesy of Pixabay.)

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of EWN or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.