A new token that allows traders to get short exposure to bitcoin (BTC) without actually shorting the asset has just been announced, with the company behind the innovation saying more tokens are to be rolled out soon as part of what it calls “a new paradigm in cryptocurrency investing.”

The new token, dubbed BTCSHORT, was announced by the issuing company Amun today, Wednesday, and aims to offer traders a way to get the “inverse return of bitcoin for a single day.” In other words, the token will be worth more as bitcoin falls in price, and vice versa.

Unlike some other derivatives on the market, Amun’s BTCSHORT token is not leveraged, although it’s still designed primarily for shorter holding periods of less than one day due to the daily rebalancing required for such derivatives.

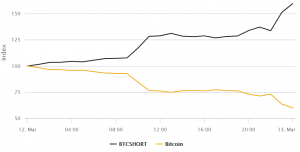

The chart below shows the performance of BTCSHORT if it was bought on March 11 and then sold at the end of March 12, when the crypto market crashed:

According to Amun, the new token, which is built as a standard ERC-20 token on the Ethereum (ETH) network, can be purchased on other crypto platforms like Liquid, Bitcoin.com, and HitBTC, Amun states on its website.

In addition to the short BTC token already launched, Amun says it is already looking at creating derivatives products for other digital assets. CEO of Amun, Hany Rashwan, told Coindesk that tokens that track the inverse of other cryptocurrencies will also be launched soon, with an inverse token for ETH being planned for the coming weeks.

The new token comes after Binance in March decided to delist several similar tokens that provided leveraged exposure both on the long and short side to cryptoassets like bitcoin, ethereum, EOS, BNB, and XRP, with CEO Changpeng Zhao then arguing that “users don’t understand them.”

Amun also stressed that BTCSHORT “is strictly not a security, carries many risks, and is not suitable for risk-averse token holders and traders. This type of token is best suited for sophisticated, highly risk-tolerant token holders.”

The company is part of the larger Switzerland-based 21Shares brand, which has made a name for itself in the industry as an issuer of crypto-tracking exchange-traded products (ETPs) that are publicly traded on several stock exchanges throughout Europe.

___

Learn more: Bitcoin ETP Issuer Amun: Trading Volumes Will Come From Retail