Get Forbes’ top crypto and blockchain stories delivered to your inbox every week for the latest news on bitcoin, other major cryptocurrencies and enterprise blockchain adoption.

Getty

MISSION ACCOMPLISHED

Bitcoin’s halving, a once-every-four-year event that cuts the reward miners receive for each new coin they create in half, was executed without a hitch Monday afternoon. If the trend that followed its first two halvings continues, its price could soar to all-time highs in the next year. Twin brothers Cameron and Tyler Winklevoss, the founders of the Gemini exchange, said, “We’re set for another order of magnitude step up — whether $20,000 is the bitcoin base, maybe we see $100,000.”

On the supply side, the halving magnifies the importance of cost efficiency for miners. With the return for mining each bitcoin becoming suddenly less enticing, the average breakeven price for miners could be at least $10,000, not far from where the price of bitcoin is now. If inefficient miners need to liquidate their rewards to stay afloat, it could flood the market with supply and threaten even more miners with a price decline.

CRYPTO MARKETS

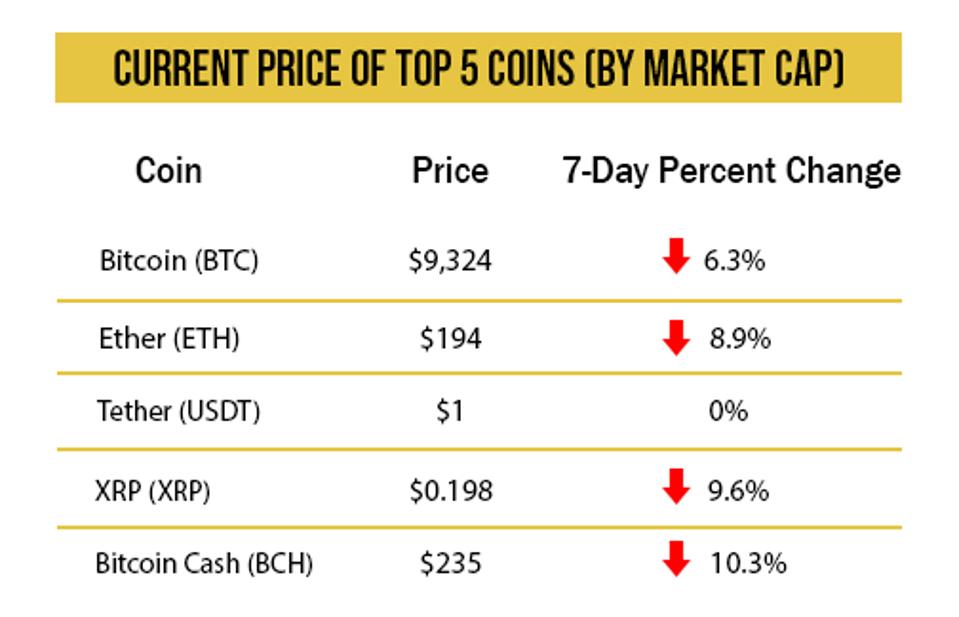

Bitcoin crashed 10% in the span of half an hour last Saturday, leading to an outage on Coinbase, a recurring problem recently for the popular American exchange. But bitcoin recouped most of its losses as the week progressed, nearing $10,000 again Thursday while the stock market dipped to its lowest in three weeks. Investors appeared to be spooked by Fed Chairman Jerome Powell’s warning that the U.S. is facing an “extended period” of weak economic growth “without modern precedent.”

Source: Messari. Prices as of 4:00 p.m. on May 15, 2020.

HOPE FOR A U.S. BITCOIN FUND?

The New York Digital Investment Group disclosed that it has sold nearly $140 million in a previously unknown bitcoin fund despite starting sales just last week on May 5. The NYDIG fund’s predecessor was advised by Stone Ridge Asset Management, whose head of regulatory affairs, Ben Lawsky, became known as the “sheriff of Wall Street” for issuing billions in fines to financial institutions while he was New York’s superintendent of financial services from 2011-2015.

JPMORGAN OPEN FOR BUSINESS

JPMorgan Chase has changed its tune on bitcoin and will begin offering bank accounts to the Coinbase and Gemini exchanges. The Wall Street Journal reported that the bank finalized the partnerships in April and will offer deposit, withdrawal and transferring services to both exchanges’ customers. The move comes less than three years after outspoken CEO Jamie Dimon infamously called bitcoin a “fraud.”

Although most coverage revolves around bitcoin’s price fluctuations, this sort of institutional involvement that legitimizes crypto as a mainstream alternative investment class may be the most encouraging sign for crypto and blockchain’s future.

DIGITAL DOLLAR PATENT

The U.S. Patent and Trademark Office revealed Thursday that Visa filed a patent application last November to create digital currencies on a centralized computer using blockchain technology. The patent would let Visa digitize a central bank digital currency anywhere in the world. Although it withdrew from Facebook’s Libra Association last fall, Visa remains well-versed in the world of crypto—in February, it granted permission to Coinbase to issue a debit card that would allow users to spend their cryptocurrencies through the card.

ELSEWHERE

Cryptocurrency Market Is Becoming Even More Concentrated [Bloomberg]

CoinDesk 50: Why Bitcoin Is Still King [CoinDesk]

Hanko’s Time To Go? Blockchain as a Solution to Japan’s Remote Working Issue [Cointelegraph]