- Arthur Cheong, an investor and Ethereum enthusiast, predicts a shift away from traditional banking services towards the DeFi sector.

- Cheong argues that emerging markets will have greater access to the financial system and a more reliable method of storing value.

In a publication for Camila Russo’s website, Ethereum and DeFi investor and enthusiast Arthur Cheong wrote about the future of the DeFi sector. Speaking on the outlook for the next decade, Cheong was very confident about the progress the decentralized finance sector (DeFi) will make and how the traditional financial sector will be “eaten”.

The investor talked about a number of benefits that will enable a massive adoption of decentralized finance. As opposed to the traditional financial system that has remained unchanged in its structure, according to Cheong, decentralized finance will allow the sector to be optimized and improved.

First, DeFi applications built on smart contracts from a public blockchain, such as Ethereum, can replace the system’s intermediaries. Banks, insurance companies and asset management firms will be obsolete and replaced by a system that does not require third-party verification. In that sense, costs in the financial system will be reduced and consumers will be able to access more options with greater innovation and liquidity in financial markets.

Cheong points out that especially emerging markets will benefit greatly by having a more secure way of storing the value of their users. In addition, millions of unbanked people will be able to receive access to the financial system and services that they do not have with the traditional structure. Cheong writes the following:

By abstracting time and cost of financial intermediaries, the promise of DeFi is wide — broader access to financial products, programmable money, real-time risk transfer, and auditability of financial contracts. This represents a new phase of financial services development characterized by its transparency and open nature that will bring forward more financial inclusion.

DeFi is the biggest success since Bitcoin

Since Bitcoin’s creation by Satoshi Nakamoto in 2009, a decade before the emergence of decentralized finance (DeFi), there has not been such a large growth of a product in the crypto industry. At least, this is what Cheong says in order to highlight the universal financial inclusion that decentralized finance will bring.

Cheong believes that by transferring the layer of trust from an intermediary or third party to the DeFi platform software, a “paradigm shift” occurs. In addition, Cheong says DeFi will be able to solve the volatility problem that prevents many people from entering the crypto market. By using stablecoins, consumers will be able to have a secure way to protect their investment.

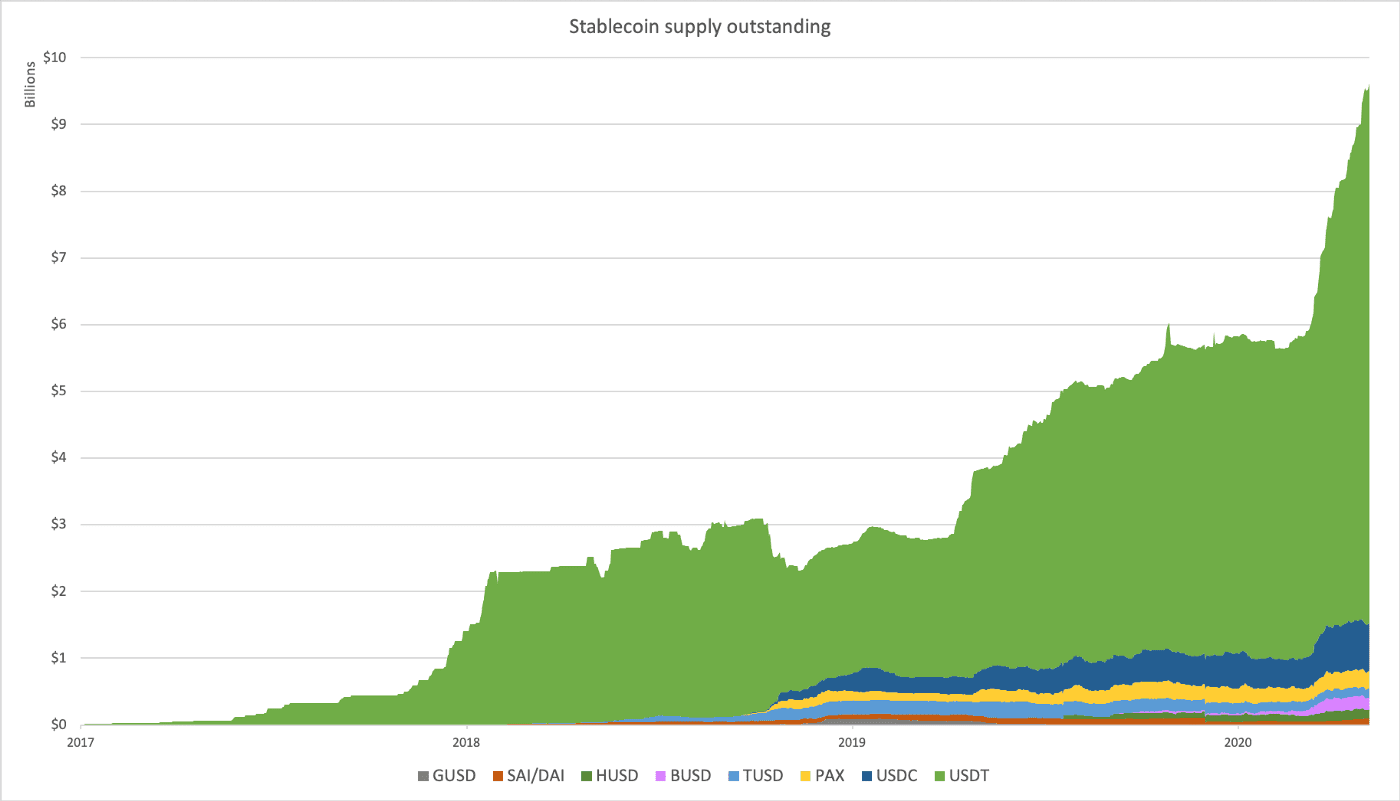

According to Cheong, the use of stablecoins on the Ethereum network already shows how the former have displaced even Ether, in terms of the value of transactions. As can be seen in the graph below, the supply of Tether and other stablecoins has grown significantly during 2020.

Source: https://thedefiant.substack.com/p/defi-will-eat-traditional-finance-d8e

This increase, according to Cheong, occurs because stablecoins fill a significant gap in demand for dollars that cannot be met by other means. The analyst predicts that the increase in the supply of stablecoins will continue. This will be driven by consumers who can make a profit from their stablecoins despite the coronavirus pandemic:

(…) stablecoins form a majority of value locked in various DeFi protocols be it lending and borrowing platforms like Aave or automated market maker liquidity pools such as Uniswap or Curve Finance. This enables users to generate yield on their stablecoins which is increasingly hard to attain in the post-COVID-19 zero interest rate environment.

Last updated on