Electric Coin Company CEO Zooko Wilcox grew up in what is known as the second wave of cypherpunks, … [+]

Electric Coin Company

The day before Zooko Wilcox formally joined with a band of cryptographers to build a new anonymous cryptocurrency, he asked his then wife to leave her cell-phone behind—lest anyone listen in—and join him at a rocky outcropping overlooking Boulder, Colorado, where they lived. There, he shared his plans to help build a cryptocurrency that would be truly anonymous; unlike bitcoin, it would shield not only the names of users, but also the amounts spent, and other information that might later be used to identify them.

Wilcox believed this new cryptocurrency, which came to be known as zcash, would be a boon to citizens of oppressive and intrusive regimes such as those in China, North Korea and Syria. But he understood it might also prove attractive to hitmen, drug dealers and child pornographers looking to evade detection. The cost of making anonymity available to upstanding members of the public was making it available to the less savory as well, he figured.

“I told her, ‘I’ve decided to do this,’” recalls Wilcox, now 45. “‘It’s scary. I might end up in jail. I might get murdered or extorted. I might go broke. I might be sort of crushed by it somehow. But it’s way too important not to do.’”

Three years later, on October 28, 2016, Wilcox and a team of cryptographers, followed a series of steps to mine the genesis block and bring zcash to life. Several hand-selected participants were trusted to hold a separate part of the creation key. Afterwards, to obscure the origins of the cryptocurrency and prevent counterfeits, each obliterated their part of the key. One even donned a gas mask and set fire to his computer.

While destroying their keys, the founders retained something valuable: every time zcash was mined a residual was paid to for-profit Electric Coin Company, with Wilcox as its well-paid CEO. For a time, their crypto-creation thrived. By January 2018 zcash was valued as high as $750, with an average of $50 million worth of the crypto trading a day.

That month however, zcash took a double hit. A bubble in the global cryptocurrency market started to pop and Japanese cryptocurrency exchange CoinCheck was hacked, losing $500 million of a cryptocurrency called XEM. No, zcash didn’t have anything to do directly with the hack. But earlier that month, cryptocurrency investigation firm Chainalysis had identified a rise in zcash use for criminal activity, and rumors began to spread that if the CoinCheck thieves wanted to spend their booty, they’d have to launder it using zcash or another privacy-protecting cryptocurrency. By June, citing regulatory pressure, CoinCheck delisted zcash (ZEC) monero (XMR), augur (REP), and dash (DASH), prompting other big Japanese and South Korean cryptocurrency exchanges to delist the currencies.

Unable to shake the rumors, last year Wilcox did something that might seem out of character for a self-described cypherpunk: he hired the Rand Corporation, the storied non-profit consulting firm and think tank that last year did $374 million of work for state and federal agencies, most prominently the Department of Defense. Wilcox asked Rand to investigate how widely cryptocurrencies generally, and zcash specifically, were being used for criminal activities.

As part of the deal, Electric Coin stipulated that Rand’s full report would be made public, no matter what it turned up. Today, Rand published all 65 pages of its unredacted findings, concluding that “while privacy coins may intuitively appear likely to be preferred by malicious actors due to their purported anonymity-preserving features, there is little evidence to substantiate this claim.”

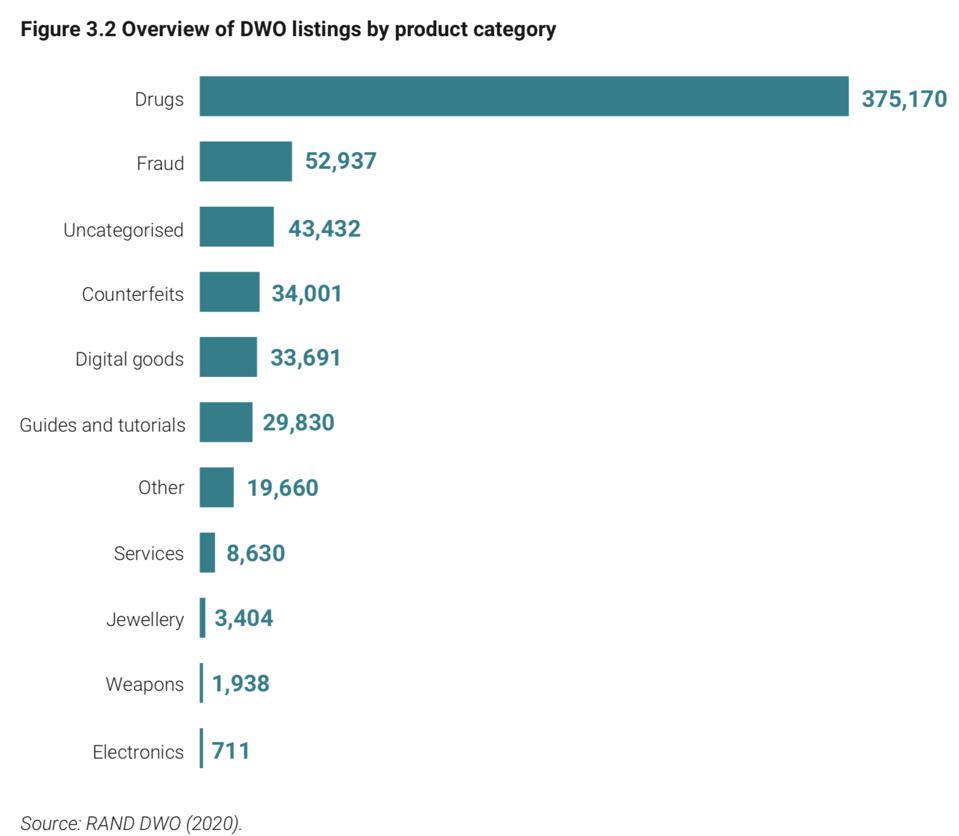

The research firm started by consulting what the report calls “informant interviewees,” including Antoine Martin, senior vice-president of the Federal Reserve Bank of New York and David Jeans, CEO of CipherTrace to get a high level understanding of where to look and what to look for. Guided in part by those interviews, it then used proprietary software called the Rand Dark Web Observatory (DWO) to scan the eight largest dark markets and through a process known as scraping, gathered information on the kinds of goods being sold, the currencies being accepted and the kinds of conversations taking place in public chat rooms.

The DWO found less than 1% of the illegal and illicit offerings that mentioned cryptocurrency even accepted zcash. By contrast, 59% accepted bitcoin, 27% accepted monero, 12% accepted ether, and 1% accepted litecoin. Moreover, nearly half of all dark market zcash mentions were from a single vendor called The Shop, which mentioned the cryptocurrency 161 times.

“We didn’t find any significant evidence that the zcash was used for illicit activities, but also as we know, that doesn’t mean that zcash isn’t at all used for illicit activity,” says senior Rand Europe analyst, Erik Silfversten. “We have to look at technology as a neutral, that it could be used for a wide variety of applications, and then we have to look at the actual evidence.”

While privacy coins like monero and zcash are widely believed to be the currencies of choice for … [+]

Rand Corporation

Wilcox believes the Rand report demonstrates anonymous transactions aren’t the same as illicit ones and that ordinary, upstanding people value privacy. “It sets a bad precedent if we fail and everyone takes the lesson that the governments of the world won’t tolerate privacy and freedom and diversity and decentralization,” he says. “That would set a bad precedent that would deter other important innovations that humanity needs to combat all of the threats to our whole civilization.”

How did the zcash co-founder come to believe in both anonymous cryptocurrency and Rand? Born Bryce Wilcox in Phoenix, Arizona in May 1974, he moved to Texas at five when his engineer father was hired by Texas Instruments to help develop the TI 99/4, one of the first home computers. Ron Wilcox brought home one of these rudimentary machines for Bryce and his younger brother, Nathan, to play with, set it up in a closet and turned them loose.

At first, all the brothers did was type nonsense in Beginners All-purpose Symbolic Instruction Code (BASIC), the default language on the computer. Then he started to learn Logo—a program that was part computer language, part painting program and designed specifically for kids. “You could make colorful shapes and then you could script them to fly around the screen and change and animate and bounce off of each other,’’ he recalls. Back then, home computers were rare. Having one, and more importantly, knowing how to use it, became a huge part of Wilcox’ self-image. “To me, it was magic,’’ he says.

Before Wilcox turned nine, his father moved to TI’s defense business in Colorado Springs. With a father in the defense industry, and cold-war tensions between the U.S. and the U.S.S.R in the news, Wilcox grew up believing “we would probably all die in an Armageddon-like nuclear war with the evil empire,’’ he says. Yet he also started exploring a more-hopeful world, as he discovered bulletin board services, which allowed geeks to communicate via their computers before the first web-browser.

So when the Berlin Wall fell in 1989, it made a big impression on the then-teenaged Wilcox. “I thought, like actually a lot of better-informed people also thought during those years, that the fall of the wall heralded the end of history, the end of war, and of national borders serving as walls trapping people,” he says. “And it was with that mindset that when I discovered the internet a couple of years later, I was extremely excited that I thought this was part of the pattern, that the internet was the end of national borders serving as walls preventing people from communicating.”

This naturally led Wilcox into the nascent cypherpunk movement, where, in the spirit of privacy prevalent in the community, he adopted a pseudonym, Zooko, and engaged with people from all over the world who like him, didn’t quite fit in where they came from, but were at home with ones and zeros. “I felt like I was coming home to my people for the first time,” he says. He also learned that pseudonyms like Zooko stick.

The cypherpunks’ focus on privacy was growing. In 1992, cryptographer David Chaum shared his ideas for an “untraceable electronic cash” with the Cypherpunk Mailing List—a hodge-podge of thinkers Wilcox compares to a debate club. A year later mathematician Eric Hughes published the Cypherpunk’s Manifesto, connecting privacy to concern over government surveillance, and famously declared that “Cypherpunks write code,” meaning they did more than just think about privacy.

That same year, Wilcox joined the mailing list. There he met Tim May, author of the Crypto-Anarchist Manifesto and Wei Dai, an inventor of an early cryptocurrency called b-money. He also started reading the contributions of WikiLeaks creator Julian Assange. These ideas, combined with the fall of the Berlin Wall made him believe for the first time that technology could further break-down borders. “I was inspired to imagine technological developments having social impact,” he says. “That technology would change how whole human communities interacted with each other.”

By 1996, Wilcox had dropped out of college at the University of Colorado at Boulder and taken his first job in cryptocurrency—as a shopping cart maintainer for DigiCash, Chaum’s early creation. DigiCash was centralized, meaning Chaum’s company had control over the minting process, and it never really took off. Wilcox concluded from that experience that if he could figure out how to make electronic cash that didn’t require a middle-man, he could crack the code to build a private economy without borders. (Wilcox earned his computer science degree in 1998.)

Zooko Wilcox and Amber O’Hearn were married less than a year after they met in what she calls a “mad … [+]

Zooko Wilcox

In 1999, at the Financial Cryptography conference in Anguilla, Wilcox met Amber O’Hearn. The following year, they were married, taking on the “Wilcox-O’Hearn” hyphenate for their last name. “Life and romance were intimately connected to our passions about math and cryptography and engineering and about economics and social influences,” says O’Hearn.

Meanwhile, Wilcox was becoming an entrepreneur. In 2000, he launched Mojo Nation, a progenitor to BitTorrent, which lets users share files without a central authority. While Mojo Nation closed after just a few years, it incorporated features that would later show up in bitcoin, including “tokenization” or the digital representation of unique objects.

Then, on October 31, 2008, someone or some group of people using the pseudonym Satoshi Nakamoto published a paper describing bitcoin as a “peer-to-peer electronic cash system” on the same Cryptography Mailing List Wilcox had joined. “I tried to invent some way to make a decentralized version of DigiCash and I couldn’t figure out how to do it. So I’d almost given up and almost started to think the laws of computer science had, for some reason, made it impossible to have decentralized money. And then I found out that bitcoin was working,” he says.

In those early days, Nakamoto was still working on the code, and Wilcox threw in his two-cents, finding a bug early on that would have let hackers create copies, or forks, of the bitcoin blockchain. Wilcox bought his first bitcoin in early 2011 and by September seemed to be a true believer, tweeting that he’d like some Nobel economics prize winners to tell him why bitcoin, at $4.50, was a bad investment. That same year he founded Least Authority, a security audit firm designed to help clients ensure they aren’t leaking private information into the public.

By then, Wilcox’s reputation in the cryptography community was so strong that Andrew Miller, a grad student studying virtual reality at the University of Central Florida, suspected he might really be Satoshi Nakamoto. Miller joined a chat group for Least Authority intending to surreptitiously prove that Wilcox was bitcoin’s creator and ended up exchanging cryptographic lessons with him instead. Importantly, Wilcox credits Miller for introducing him to zk-snarks, an implementation of zero-knowledge proofs that allow a person to prove they know something without needing to reveal the details about what they know or how they got there.

Now an assistant professor of computer science at the University of Illinois, Urbana-Champaign Miller compares the idea, which is crucial to how zcash operates, to punching a pinhole into a piece of black paper and placing the hole over Waldo in a Where’s Waldo puzzle, proving you know where the beanie-capped character is without revealing anything else about his context.

“I don’t think of myself as a pioneer, like Satoshi,” says Wilcox. “I think of myself as somewhat more of a conduit for other people’s inventions, including Satoshi’s.” Begrudgingly, Miller reached the same conclusion.

Wilcox’s relationship with Miller did, however, prove consequential, setting him on his path to zcash. In 2013, cryptographer Ian Miers presented a paper at the Bitcoin Conference in San Jose with the idea for zerocoin, an upgrade to bitcoin that would erase the trail of publicly available addresses, making the cryptocurrency truly anonymous. But bitcoin core developer Peter Todd stood up from the audience and said, “Zerocoin isn’t coming anytime soon to bitcoin.”

So Miers and his coauthors approached Wilcox to jointly build the anonymous currency. At first, Wilcox turned them down, preferring to focus on building Least Authority. But Miller, who knew about the work of Miers’ team, convinced Wilcox to reconsider, saying he himself would quit his PhD studies to join the project if both Wilcox and Miers’ collaborator Matthew Green got involved. “It was at that moment that I finally made up my mind that I was gonna do it,” says Wilcox.

That’s when Wilcox took O’Hearn, sans cell phone, to that cliff overlooking Boulder, to discuss what he was about to become involved in. “I don’t think he was asking my permission,” says O’Hearn, who has three children with Wilcox. “But he wanted me to know that he was taking on something that could be considered dangerous politically and could have consequences that could take him away from me and the family.” While the pair divorced in 2015, she says she supported, and still supports, that decision.

Matthew Green describes the birth of the zcash team this way: “I remember thinking `Zooko’s the only person I know who’s crazy enough to take this project on.’” Slowly, the zerocoin whitepaper started to evolve into a protocol for minting a new kind of cryptocurrency called the zerocash protocol, then just zcash. While zcash was initially conceived as a more private sidechain to bitcoin, the team, now formally operating as the Electric Coin Company, opted for an entirely separate currency.

At the time it was becoming increasingly popular to do what is called a “pre-mine” where the cryptocurrency is created all at once and either sold (the way Ripple sold its eponymous cryptocurrency) or “air-dropped” with people who already own a cryptocurrency given the same amount of another cryptocurrency (as happened when bitcoin cash was created). But pre-mines run the risk of being branded unlicensed securities offerings and air-drops reward those who are already crypto-rich.

“Why don’t you just give some zcash to all U.S. dollar holders?” Wilcox recalls Miller asking. “And I was like, ‘What? I don’t wanna reward the rich owners of U.S. dollars with more zcash.’” To which Miller replied: “Yeah, and I don’t respect the money of the bitcoiners anymore than I respect the money of the U.S. dollars holders.” Electric Coin opted for a third way, where 20% of the zcash mined went to support the developers of the technology, including Wilcox.

In July 2018 Wilcox disclosed—to some backlash from the crypto community—that he had received 2,033 zcash per month, then worth about $300,000 or $3.6 million annually. (At today’s price of about $45, that would be worth about $1 million.)

The ECC now employs 30 people, not counting the non-profit Zcash Foundation that also helps oversee the development of the code. And in November, a new revenue sharing model kicks in; miners will still receive 80% of zcash mined, but 8% will go to a pool for grants to third parties other than ECC or the Zcash Foundation. ECC will receive 7% and the Zcash Foundation will receive 5%. At today’s zcash price, that’s about $390,000 per month for grants, $345,000 per month to ECC and $246,000 per month to the foundation. The zcash outstanding is now collectively valued at just $400 million.

In spite of being delisted on several of the largest exchanges, zcash is still available on dozens of exchanges, including Coinbase and Gemini, two U.S. exchanges that pride themselves in being compliant with government regulations. Today, while zcash can be used on markets like Toffee.com to buy software that makes it look like a computer is in a different jurisdiction, it can also be used on Andreessen Horowitz-backed Haven, to buy prosaic stuff like clothing, cars, books and computers. Payments apps Flexa and Gemini added zcash last year, allowing users to spend the cryptocurrency at Barnes & Noble, Bed Bath & Beyond and Whole Foods.

Still, the image of zcash as a haven for those concerned with privacy remains. The Human Rights Foundation and the Electronic Frontier Foundation have both received zcash donations. And a Syrian refugee in England tells Forbes he uses zcash to surreptitiously pay an employee in Syria. Over the first quarter of 2020 the zcash market value increased by 27%, according to a CoinMarketCap report, making it the fifth fastest growing cryptocurrency, behind dash, another privacy preserving technology.

And Wilcox hasn’t given up on restoring zcash’s place on the big Japanese exchanges. He says the self-regulatory Japan Virtual Currency Exchange Association agreed in advance that Rand would be considered a suitable third-party investigator. Zcash gave the Rand report to the association in April and an Electric Coin rep characterizes its response as “very positive,” although Forbes has yet to receive confirmation of that from the Japanese association.

A break down of goods available in exchange for cryptocurrencies, including but not limited to … [+]

Rand Corporation

The Rand report raises a big question, however. Why aren’t criminals making more use of zcash given its privacy protecting properties? Rand says it doesn’t know but did offer a number of possible explanations. Perhaps zcash has been successfully branded as a way for law-abiding citizens to transact anonymously online or maybe would-be criminals don’t trust or understand its encryption technology. One possible irony: by drawing increased attention to the use of zcash for anonymous transactions, could the report actually entice more criminals to use it?