- Bitcoin leads the cryptocurrency market in losses less than two days to its 2020 halving.

- BTC/USD quickly bounces off intraday low at $8,105; displaying strength from the buyers.

- The cryptocurrency market is in the red led by major cryptoassets; Bitcoin, Ethereum and Ripple.

The cryptocurrency market has been painted with one big bearish flag led by the major cryptocurrencies. Bitcoin price plunged from highs close to $10,000 on Saturday to intraday lows at $8,105. Ethereum could not hold above $200 due to its correlation with Bitcoin price. Ether touched lows at $180 but is now trading 11.21% lower at $186. The third-largest cryptocurrency has not been spared as it has spiraled to $0.1780 (intraday low) from Saturday levels above $0.22.

Cryptos dump in double-digits just before Bitcoin halving

The selloff in the market is taking place less than two days the 2020 block reward halving. The drop was not expected many traders must have been caught off guard. For instance, data by analytics platform Skew shows that liquidations hit highs $226 million.

Other cryptocurrencies have also recorded double-digit losses include Bitcoin Cash (11.5%), NEO (10.66%), Litecoin (10.81%), IOTA (12.16%), EOS (10.91%) and Ethereum Classis (12.83%).

Bitcoin price technical picture

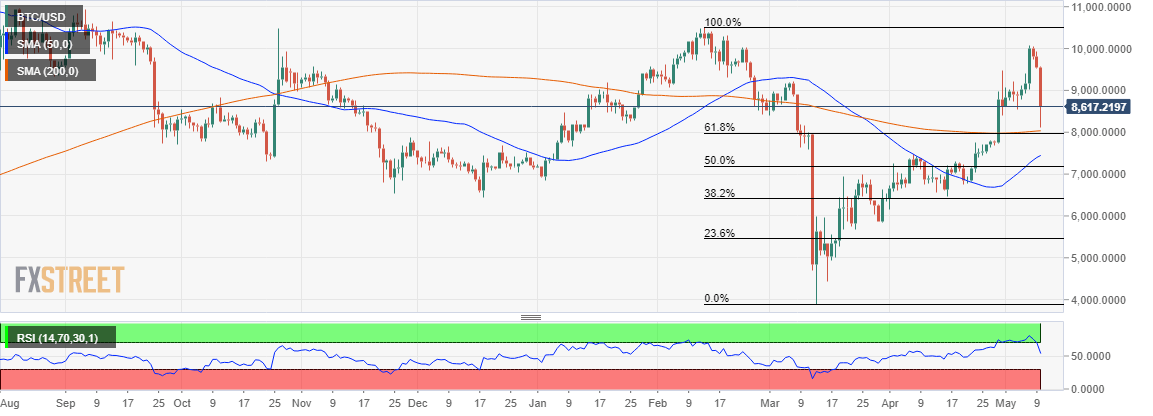

Intriguingly, Bitcoin price bounced off the 61.8% Fibonacci level to exchange hands at $8,611. This shows the willingness of the investors to buy in anticipation of a reversal above $9,000. Also holding the price in place is the 200-day SMA (0$8,053). However, the sharp slope of the RSI suggests that selling pressure is still high in spite of the bounce from the intraday lows. Therefore, other support areas to keep in mind include $8,000, .the 50-day SMA and $7,000.