Bitcoin may have had a tumultuous year so far in terms of volatility

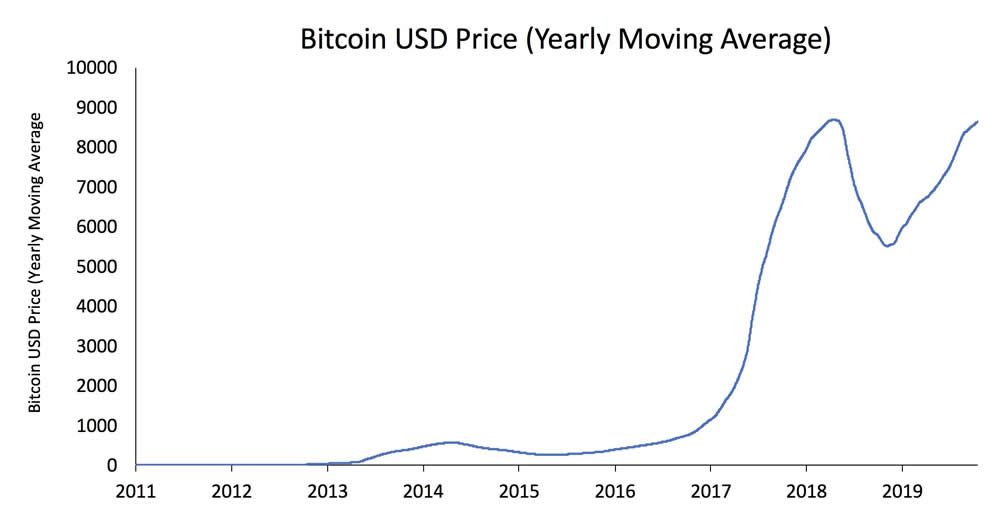

We can describe volatility as how much the value of an asset changes over a given time. A volatility index… More, but longer-term trends are still very healthy. The yearly moving average price for BTC is closing in on its all-time high.

We can describe volatility as how much the value of an asset changes over a given time. A volatility index… More, but longer-term trends are still very healthy. The yearly moving average price for BTC is closing in on its all-time high.

This week has been one of the best so far this year for BTC prices. Since the same time last weekend, it has surged by 17%, outperforming traditional stocks and commodities yet again.

Yearly Moving Average High

Observers and analysts have noted that Bitcoin’s yearly moving average is back up from its 2018 slump, and is approaching its previous all-time high.

This does not mean that prices are approaching ATH, but the accumulation of the averages over the year is.

Speaking of moving averages, this week’s rally has resulted in BTC crossing the long-term 200-day moving average. The last time this happened with such a large daily candle was in mid-January when BTC surged from $8,900 to top out at $10,400.

The 200 and 50-day moving averages have served as support and resistance levels throughout Bitcoin’s life cycle, and trading above both is generally very bullish.

The weekly chart is also looking positive at the moment with seven green candles in a row. The last time this happened was in March 2019, just before the big rally to $14,000. BTC is also trading above both the 200 and 50-week moving averages which is extremely healthy.

The next major resistance zone is around $9,700, but Bitcoin really needs to top its previous high of $10,500 for a real bull run to be registered. Forming a lower-high at the moment could result in further downsides and the resumption of the downtrend.

Bitcoin Dominance Surges

This week’s rally has also had the effect of increasing Bitcoin’s dominance as it outperforms its altcoin brethren.

BTC dominance has been on a downward trend since September 2019, and it has remained below 70% for most of this year.

BTC dominance has increased two percent this week to 66.5% according to the charts. This means that it has gained at the expense of altcoins which have all lost long-term ground, despite enjoying gains in price this week.

Altcoin traders have been looking at the charts noting that a climb in BTC market share is bad for altcoins as they have weakened in terms of satoshi values. ‘Altcoin Sherpa’ [@AltcoinSherpa] has correlated these BTC dominance gains with the seasons, adding;

“BTC.D has risen hard in the summers the last few years, crippling altcoins during this time. June is a good time to exit all altcoins IMO.”

Bitcoin’s halving appears to be driving momentum at the moment and is only ten days away now.

Do you want to Be In Crypto?Join our Telegram Trading Group for FREE Trading Signals,a FREE Trading Course for Beginners and Advanced Tradersand a lot of fun!

Images courtesy of Shutterstock, Trading View and Twitter.

Disclaimer. Read MoreRead Less

As a leading organization in blockchain and fintech news, BeInCrypto always makes every effort to adhere to a strict set of editorial policies and practice the highest level of journalistic standards. That being said, we always encourage and urge readers to conduct their own research in relation to any claims made in this article.

This article is intended as news or presented for informational purposes only. The topic of the article and information provided could potentially impact the value of a digital asset or cryptocurrency but is never intended to do so. Likewise, the content of the article and information provided within is not intended to, and does not, present sufficient information for the purposes of making a financial decision or investment. This article is explicitly not intended to be financial advice, is not financial advice, and should not be construed as financial advice. The content and information provided in this article were not prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making any investment decisions.

The author of this article may, at the time of its writing, hold any amount of Bitcoin, cryptocurrency, other digital currency, or financial instruments — including but not limited to any that appear in the contents of this article.