Image Source – Bitcoin or Gold, which would you prefer?

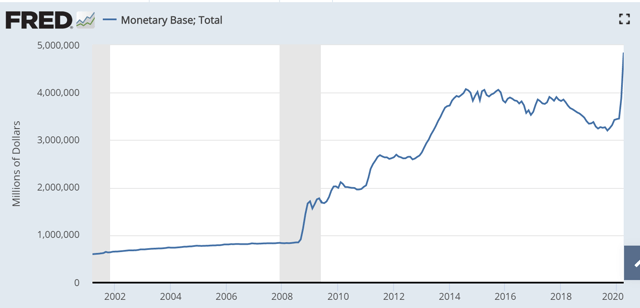

With trillions upon trillions of coronavirus stimulus pilling up, the Fed’s balance sheet, along with the U.S.’s monetary base, is exploding like never in history.

Source: The Fed – The monetary base could reach $10-$12 Trillion as the Fed goes through with its unprecedented lending program.

Source: The Fed – Numbers are in trillions and illustrate that the Fed’s balance sheet has nearly doubled just since the beginning of this year.

Source: The Fed – Numbers are in trillions and illustrate that the Fed’s balance sheet has nearly doubled just since the beginning of this year.

To complicate matters further, U.S. Federal spending budget is about $3.4 trillion in the red, and national debt to GDP ratio is approaching 120%. Furthermore, it is not just the U.S., as fiat currency debasement has essentially become the norm all over the globe. Due to the continuous debasement of global fiat currencies, Bitcoin (BTC-USD) and other inflation-resistant digital assets should continue to experience increased demand and further price appreciation.

The Fed Connection

As the Fed perpetually increases the supply of dollars around the world, assets such as Bitcoin and other promising digital currencies should go a lot higher.

This is effectively the same phenomenon that gold and GSMs have benefited from. Ultimately, the trillions of dollars created by the Fed will filter through to the real economy, which will very likely lead to inflation, loss of purchasing power, and possibly even a loss of confidence at some point. QE unlimited is not going unnoticed, and market participants are beginning to understand that there is no returning to the old normal. There is only the new normal now, and it is filled with incredibly easy credit, rock bottom interest rates, and essentially limitless amounts of capital provided by the fed.

Even Goldman Sachs (NYSE:GS.PK) is hosting a conference on inflation, crisis, and Bitcoin, which is a positive development for the crypto industry in itself. This is telling that major organizations and the “smartest guys in the room” are starting to recognize potential in the digital asset industry due to massive fiat devaluation.

Additionally, the current fiat financial system is filled with faults, redundant charges, and inadequacies. Therefore, banks, large institutions, as well as retail consumers/investors could start to utilize digital assets on a mass scale within the next several years.

So, what is a Digital Asset?

I want to clarify what a “digital asset” means to me. Whether it is Bitcoin, Ethereum, Litecoin, etc., a digital asset is a unit of value. Moreover, this unit of exchange represents your share on a given blockchain network. You see, every cryptocurrency/digital asset has its own protocol and its own blockchain. Additionally, each blockchain project/network has a specific role to play in the ever-evolving digital payment and services industry. Every project essentially consists of a form of a medium of exchange, its own blockchain system, and a very extensive infrastructure to facilitate various business activities. Therefore, a digital asset, coupled with its blockchain, in its essence, is very much like a company, but instead of shares in a startup, market participants own coins in a “project”.

This market segment has a great deal of potential going forward and could potentially integrate and assimilate well with the mainstream financial industry. Even if assimilation is limited, digital assets could represent a growing share of the medium of exchange market and other niche areas in coming years. Digital assets offer market participants advantages such as investing, trading, conducting transitions, implementing various services, and much more. With that said, let us look at some top digital assets to consider.

Top Crypto Positions

Numerous ambitious projects with real-world applications already exist, and many of the best-established enterprises continue to dominate crucial areas of the digital asset market.

Some of my favorite networks include:

Bitcoin – Bitcoin is typically the first option for many people, as it is extremely secure, and is the original, best known digital asset in the world. It is primarily used for storing value, but Bitcoin can also be used as a medium of exchange.

Litecoin (LTC-USD) – They call it the silver to Bitcoin gold’s, yet Litecoin is simply just a much more efficient digital currency. When it comes to mass transactions, Litecoin is cheaper, faster, can handle scale much better than Bitcoin.

Zcash (ZEC-USD) – Litecoin is not alone in the efficient medium of exchange market. In fact, Litecoin has several worthy adversaries in this space. A factor to consider is that this market is expanding, could grow dramatically as fiat currencies continue to debase, and could represent a significant share of the global store of value and worldwide medium of exchange markets within the next 3-5 years. Zcash is a great transactional coin, which is fast, efficient, and offers an added layer of anonymity to your transactions.

Dash (DASH-USD) – Another very efficient and promising transactional coin. Dash is very safe, efficient, cheap, and has an added layer of cryptography to provide more anonymity to users of its blockchain.

Monero (XMR-USD) – If you want untraceable, there is only one coin that can handle this task. Monero is a truly anonymous coin. Whereas Zcash and Dash transactions are extremely difficult to monitor, Monero’s are essentially impossible to trace.

We just went over my favorite transactional coins that have enormous market share potential going forward, in my view. However, it is not all about transactional coins. Functional coins like Ethereum (ETH-USD), Tron (TRX-USDT), Tezos (XTZ-USD), EOS (EOS-USD), Cardano (ADA-USD), Stellar (XLM-USD), Neo (NEO-USD), Ethereum Classic (ETC-USD) and others represent very promising long-term opportunities in the cryptocurrency market.

Bitcoin: Technical View

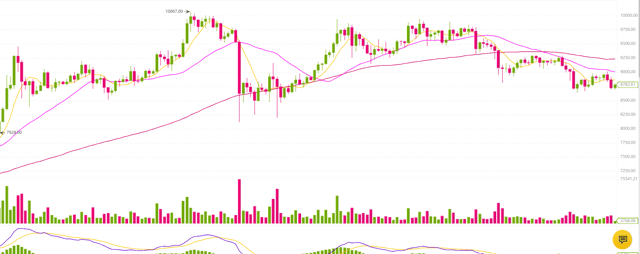

BTC 4-Hour Chart

We see that Bitcoin has staged a very powerful rally since the volatility induced panic bottom of mid-March. In fact, BTC gained as much as 165% from the $3,800 March low to the high around $10,000 in early-May. However, Bitcoin has been in a trading range of around $8,000 to roughly $10,000 for nearly a month now. The price is around $8,700 at the time of writing this article, but BTC appears to be consolidating here and could be setting up for its next leg higher above $10K. Bitcoin has attempted to penetrate this level on several occasions, but the favorable fundamental backdrop should enable Bitcoin to break above the $10,000 soon. For downside protection, I am watching the $8,500 level, and then $8,000, if for whatever reason these support levels begin to breakdown, Bitcoin could fall back as low as $6,500 support next (worst case scenario in my view).

The Takeaway

The bottom line is that tokens, whether it is Bitcoin, Litecoin, Tron, Tezos, etc., are not just coins. These are unique enterprises built upon extremely capable blockchains, coupled with their own digital coins, and deep infrastructure projects. Right now, the industry appears to be notably underappreciated, and its future potential may be drastically underestimated by many.

Moreover, consider the trillions of dollars floating around looking for a place to park to get positive yield in this financial environment. Due to inflation resistance and future potential, I believe a prime place for future investment will likely be the digital asset segment. There is a lot of uncertainty concerning equities going forward, gold/GSMs are doing great, but in the intermediate term, there are not that many bright spots in the market. Furthermore, the Wuhan virus will likely continue to weigh on international confidence and consumption for many months. While it may take some time for inflation to filter through to the real economy, once it does, prices for various assets, including Bitcoin, should go substantially higher.

Digital Asset Price Check

If we look at market caps for some of the most lucrative digital assets, the figures may be undervalued relative to future functionality, capability, and market share potential.

- Bitcoin: $163 billion

- Ethereum: $23 billion

- Litecoin: $2.8 billion

- EOS: $2.4 billion

- Tezos: $1.9 billion

- Cardano: $1.4 billion

- Stellar: $1.3 billion

- Monero: $1 billion

- Tron: $968 million

- Ethereum Classic: $782 million

- Neo: $695 million

- Dash: $695 million

- IOTA (MIOTA-USD): $540 million

- Cosmos: (ATOM-USD): $482 million

- Zcash: $420 million

- VeChain (VET-USD): $267 million

- DigiByte (DGB-USD): $249 million

After reshuffling our cryptocurrency basket holdings, these are all the coins we own interest in right now. I do not look at these as simple coins or tokens, but rather as shares in a company. After all, the more tokens you own, the more market share you have on a given blockchain network. As the worth of the network increases, so do the shares/coins you own in that network.

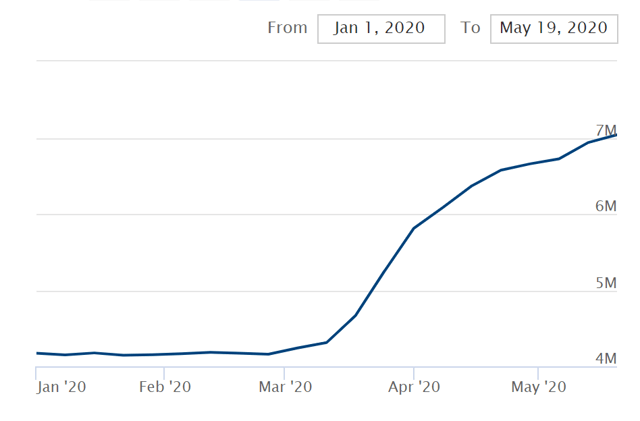

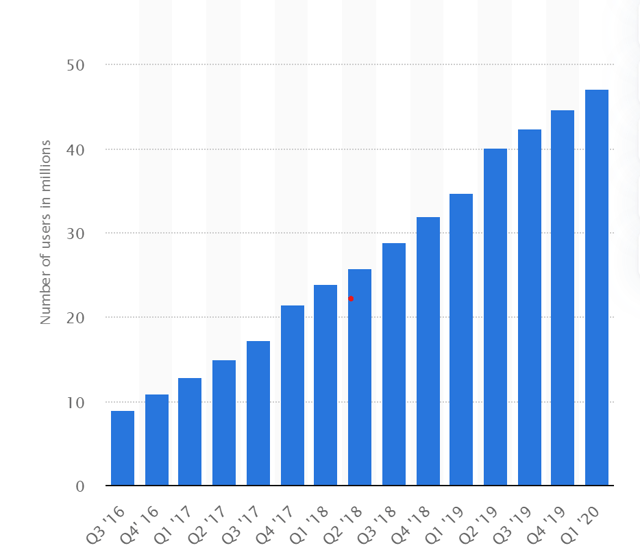

Source: Statista.com – Blockchain wallet growth

Source: Statista.com – Blockchain wallet growth

Thanks to the Fed and other central banks, the world is awash in money now, and there are not that many attractive options for investment out there. The intermediate direction of stocks is questionable, bond rates are incredibly low and likely headed even lower, the growth picture is very murky and anemic right now. Nevertheless, trillions of dollars are being printed, and they are going to have to land somewhere. It is very plausible that investments could continue to enter the gold/GSM and the Bitcoin/digital asset segment. There is enormous growth potential in the cryptocurrency market, and market caps of many projects/enterprises are relatively cheap right now. Thus, future capital inflows could send Bitcoin and other digital assets substantially higher over the next year, as well in the intermediate and long term.

Want the whole picture? If you would like full articles that include technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

Disclosure: I am/we are long ASSETS MENTIONED. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Please always conduct your own research before making any investment decisions.

Disclosure: Our digital asset basket is up by 30% QTD, and up by roughly 80% YTD.