NEW YORK, NEW YORK – MAY 26: Television journalists and others gather across from the entrance to … [+]

Getty Images

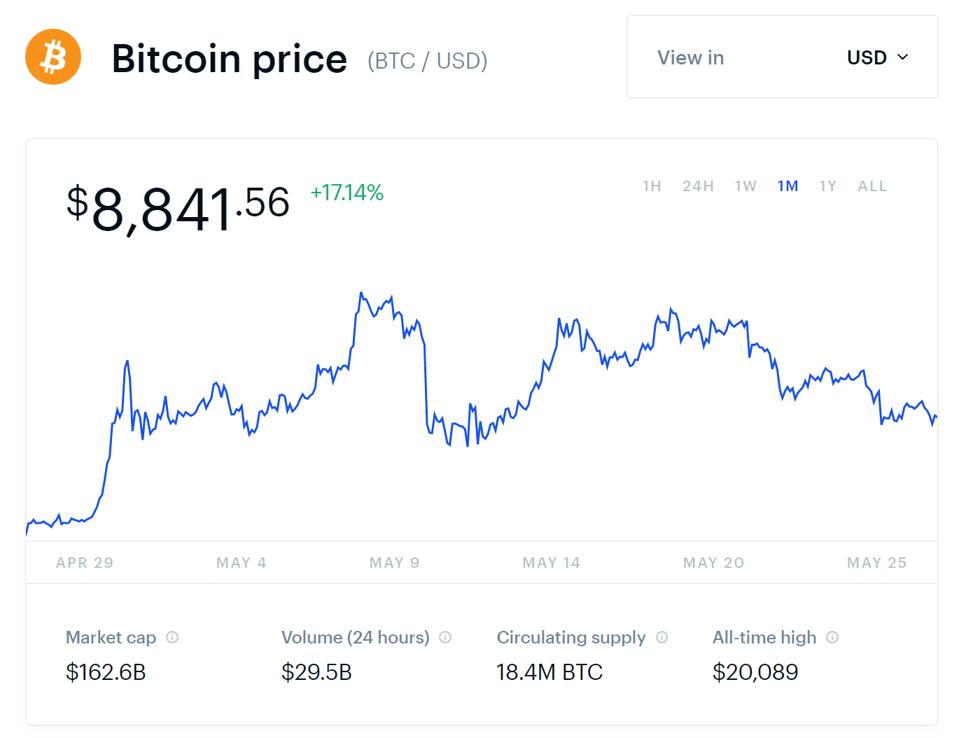

The price of Bitcoin is hovering at $8,800, following three steep rejections in the $9,900 to $10,000 range in the past week. In the short-term, historical data suggests BTC faces a risk of consolidation before a continued rally.

Three key factors raise the probability of a Bitcoin pullback: the tendency of BTC to drop after a halving, repeated failure to rise above a multi-year resistance level, and an increase in open interest of futures exchanges.

After a halving, the price of Bitcoin typically drops as a result of dropping hash rate and miners selling BTC.

A block reward halving immediately decreases the amount of BTC miners generate through mining by half. Before the May 2020 halving, miners were generating 1,800 BTC. Now, miners can mine up to 900 BTC per day.

If the price of Bitcoin does not increase after the halving, for miners, it simply means a 50% decrease in revenue overnight. That causes heightened levels of selling BTC among miners to cover operational costs.

According to data from ByteTree, Bitcoin miners mined about 5,238 BTC in the past week. But, miners sold 5,546 BTC in total, selling all of the BTC they mined and an extra 308 BTC on top of it.

The breakeven price of Bitcoin mining in regions with cheaper electricity like Sichuan, China is around $5,000 to $7,000. Theoretically, BTC could drop 25% and big miners would still be profitable.

The predicted selling of Bitcoin by miners come after the repeated rejection of a historically important resistance level at $10,000.

Since late 2019, the price of Bitcoin rose to above $10,000 a total of three times including the recent upsurge to $10,079 on May 7. The first two occasions in October 2019 and February 2020 each led to a drop to $6,400 and $3,600, respectively.

Given the firm rejection of the $9,900 to $10,000 resistance range earlier this month and the tendency of BTC to see an extended price movement when its macro trend reverses, the probability of a deeper correction is expected to increase.

Bitcoin rejected the $9,900 to $10,000 area steeply in May.

Coinbase

Traders were largely optimistic on the price trend of Bitcoin since late March because retail traders were the primary driver of the uptrend of BTC from $3,600 to $10,000 and not the futures market, as the Coinbase team explained.

When the Bitcoin futures market leads the rally of Bitcoin, as seen in October 2019, it tends to reverse quickly, seeing an abrupt trend reversal.

But, Coinmetrics researcher Jon Geenty said the price drop of BTC from $9,000 to $8,600 on May 24 was led by retail investors selling on Coinbase.

Retail buyers are known to provide Bitcoin a stronger foundation for an extended rally. Still, when the momentum of BTC dwindles, data shows retail investors can also sell off rapidly.

While retail investors and miners sell Bitcoin, the open interest of BTC futures is continuously increasing. The term “open interest” refers to the sum of all long and short contracts open in the futures market.

When the open interest of major futures platforms like BitMEX, Bitfinex, and OKEx expand, BTC often sees large volatility in the near-term.

A confluence of retail investors and miners selling BTC while the open interest of the futures market is increasing may increase the likelihood of a Bitcoin pullback in the near-term.